Well folks, we did it. We got through another year.

Some of you will have high fived everyone over Xmas dinner.

Some of you will have bought risky names in downtrends and had tough calls to make.

Some of you will have paid too much attention to the perma-bear “It’s only 7 stocks” brigade and regretted every minute of sitting in cash all year.

Whatever your jam, 2024 gives you the opportunity to wipe the slate clean, dust yourself off, and go again.

My only hope is that this tiny little letter with it’s poorly written grammar will continue to serve you in some positive way throughout next year.

A good place to kick the year off is my 1 chart snapshot of broader US markets just now, because what happens here will likely set the stage for 2024.

SPY, QQQ, DIA and IWM Charts

Going into the first trading week of the year, all of the major averages are now pushing up against BIG price levels.

Targets have been met and everyone’s wondering if we’re about to collapse or keep ploughing higher.

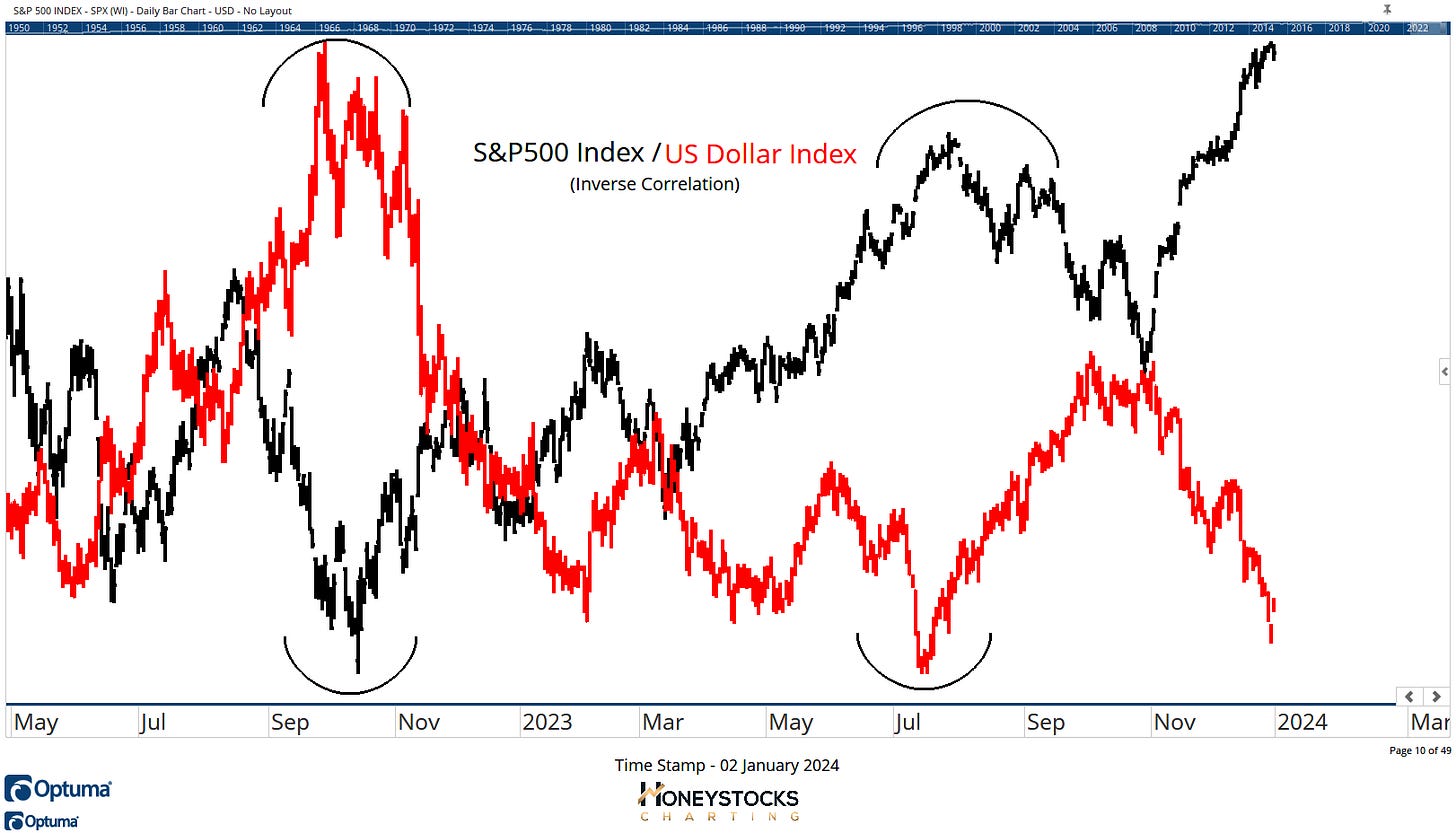

The key for me remains the US Dollar.

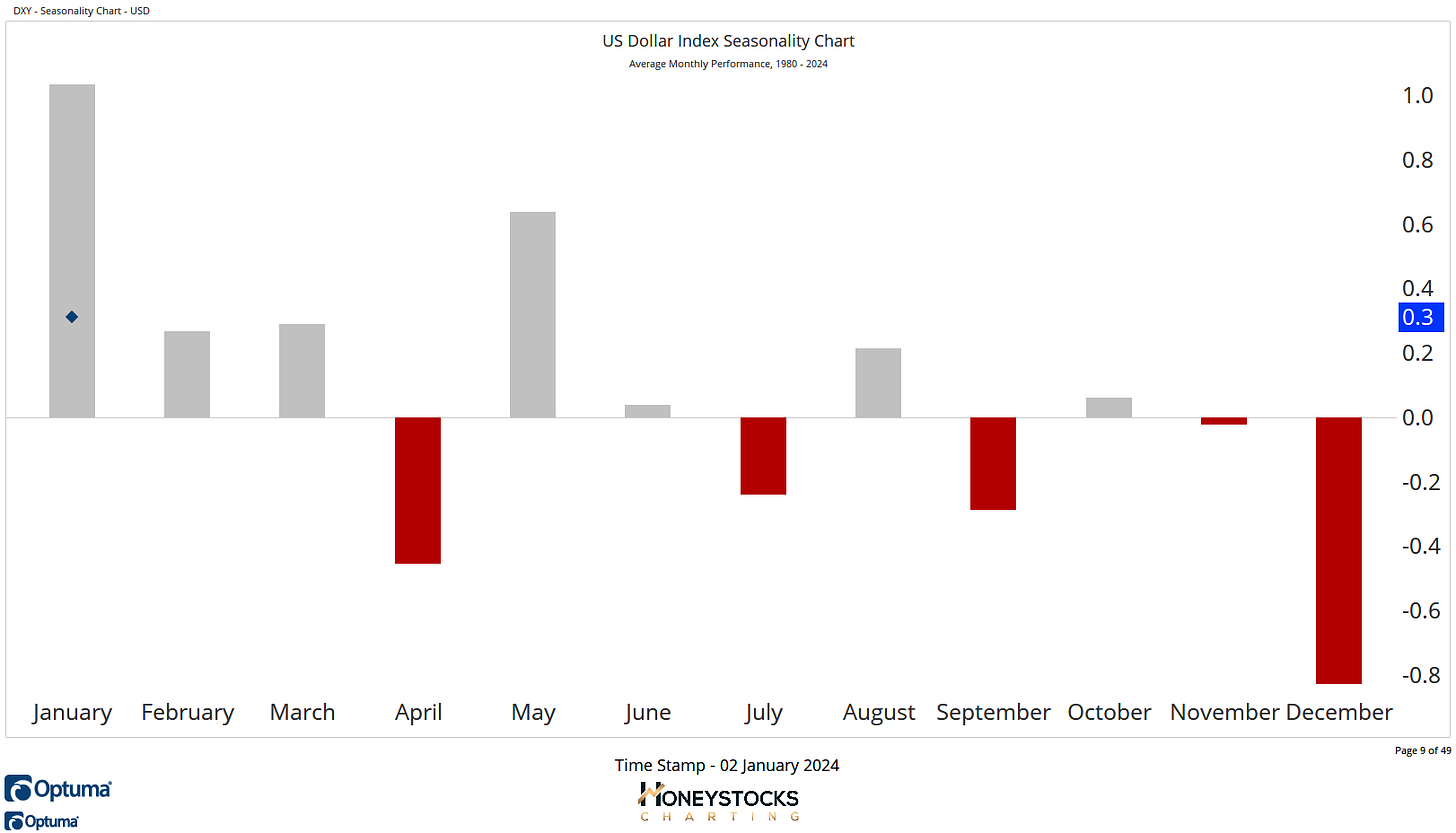

US Dollar Index Seasonality (DXY)

US Dollar Index (DXY)

US Dollar / S&P Inverse Correlation

We’re coming into a strong seasonal period for the US Dollar and with major averages pushing against logical targets across the board, the message I’ve put to out clients/members over the weekend was along the lines of if the dollar catches a bid, then it’s logical to expect some digestion of gains.

Rates - 10Yr Note Yield (TNX)

For anyone who missed my call on the top in rates 2 months ago, what’s happened since?

Bonds have ripped higher.

Risk Assets have ripped higher.

If you bought up some of the small / mid / micro cap names over this period like we’ve been advocating, congrats, you’ve been rewarded through the final quarter of 2023.

But what comes next in 2024 in hear you ask?

Let’s take a zoomed in look at the small caps.

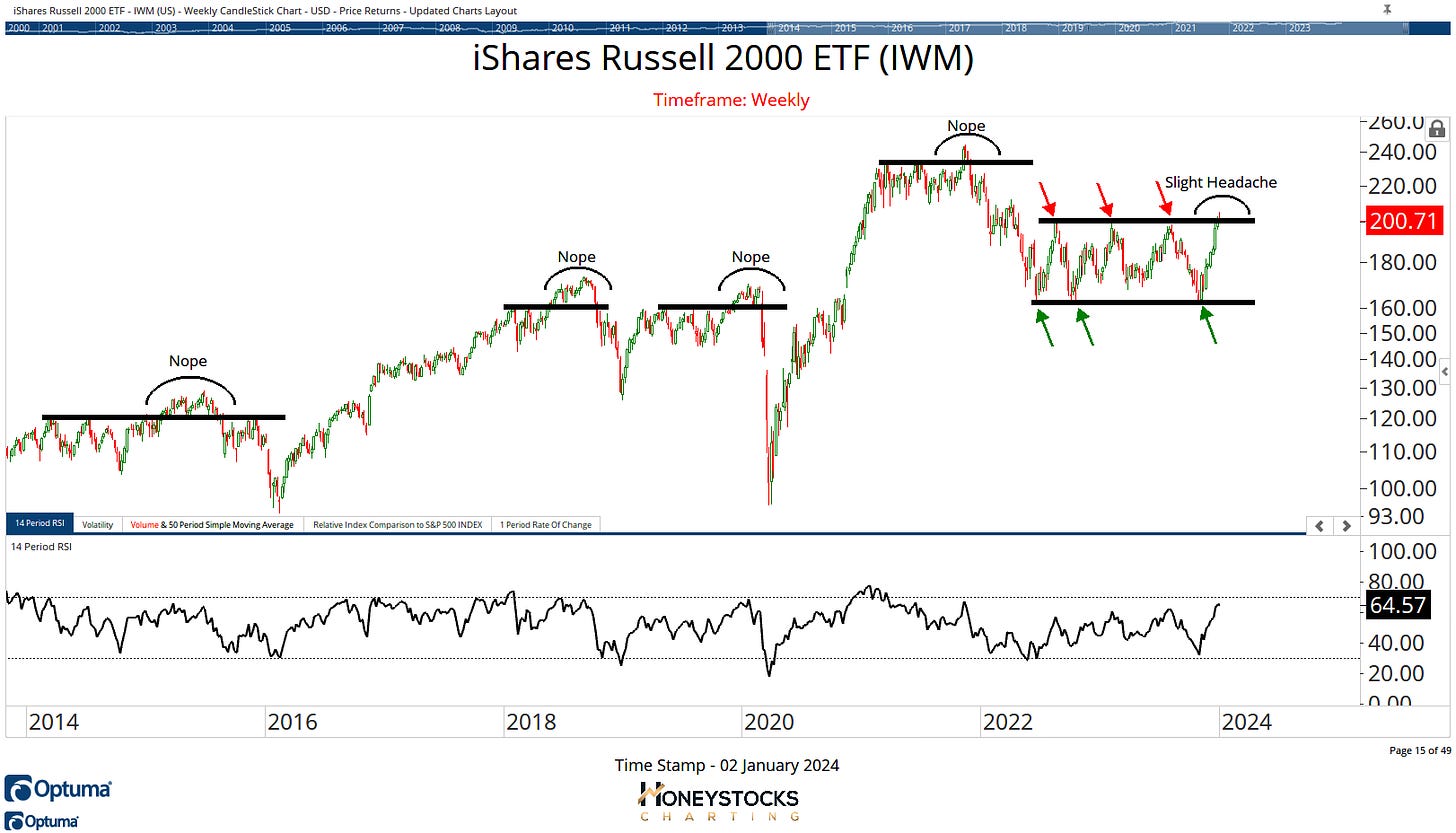

Russell 2000 (IWM)

I see all the Hindsight Harry’s and the mainstream media analysts pushing the narrative a break out in the small caps is highly bullish for the market.

And it could be, if definitely could be, but here’s the thing.

Recent history shows a break out in the small caps can’t really be trusted, especially after the monster +50 to +100% moves many of the names have enjoyed over the last 6 weeks.

I could cite 100 examples but you don’t have the time to read that and I certainly don’t have the time to build out the work, but rest assured, when major averages put in failed break outs, bad things often begin.

Go look for yourself.

In Conclusion

The click bait headline of my 1st letter of the year said I’d give my predictions for 2024…. well that’s easy….

Stocks will go up and down.

There will be rotations

I’m currently (that could change by next week) looking at tactical bullish trade opportunities.

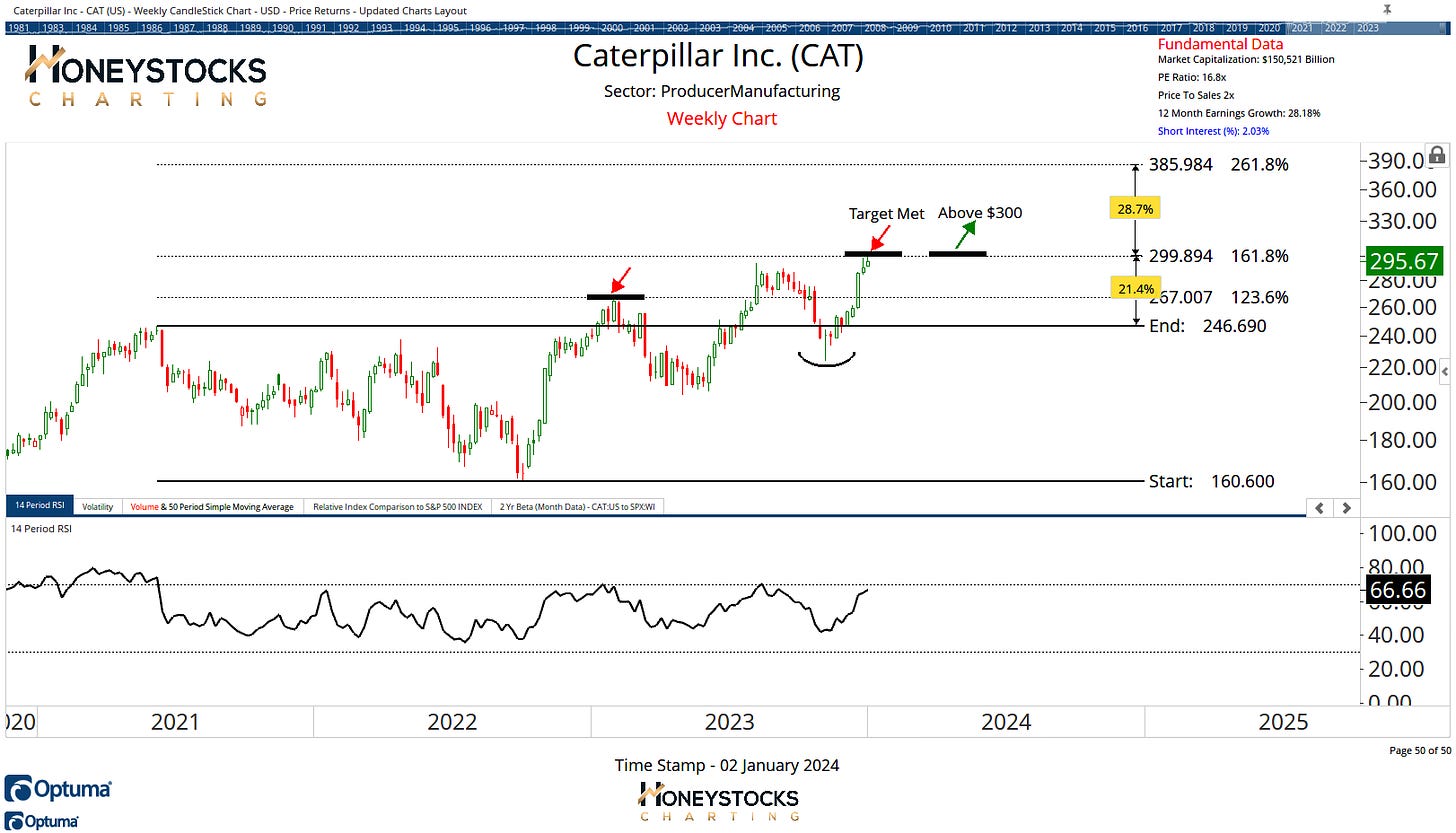

CAT is a good example and has been 1 of our buy low : sell high charts over the last couple of months and it’s recently met our upside targets but a break above $300 (that holds) could bring in another 28% upside provided the market doesn’t sell off.

Caterpillar Inc (CAT)

Disclaimer: If the Dow fails at all time highs, and the small caps roll over, for me, that would be a logical place for a defensive phase to begin.

We’re not there yet, but in a world that likes to panic, I think it makes more sense to prepare with a laid out plan, with systematic process and stop losses in place (just in case).

These are just 6 of the 40 charts I’ve presented this weekend in our premium work in addition to the 100’s of stocks, ETF’s and Commodities we’re covering in our chart books.

I’d recommend checking that out below.