Now we have the December CPI print and Fed Interest rate announcement out the way, the market is shifting focus to the much anticipated Santa Clause rally and whether or not he’ll show up this year.

In this weeks letter, I’m going to share some of the charts I’m focusing on, and also some of the charts we’ve been sharing with our clients / members over the last 2 weeks.

Let’s get into it, and lets start with the broader market and a chart I shared last week.

S&P500 (SPX)

If you picked up last weeks letter you’ll know that for the broader market, the 3,900 level is a level I’ve paid attention to.

To clarify, it’s not because I consider 3,900 to be a monumental level for the market.

It’s more of a “guidance” level that’s confirmed the structure of my work, which switched to incorporating bearish charts again 2 weeks ago.

NYSE Composite (NYA)

The NYSE Composite also gave us a clue 2 weeks ago, and if you follow my charts on Twitter - Follow Me Here - you might have been wondering why I’ve been posting bearish charts over the last couple of weeks.

The small caps are a factor in that process.

Russell 2000 (IWM)

The small caps are rangebound and fast approaching downside levels which we like to use as “targets” - I’d be looking for small caps to (hopefully) rebound at that $162-$164 level if the sell off continues for the next few days.

Buying small caps at current levels makes no sense to me.

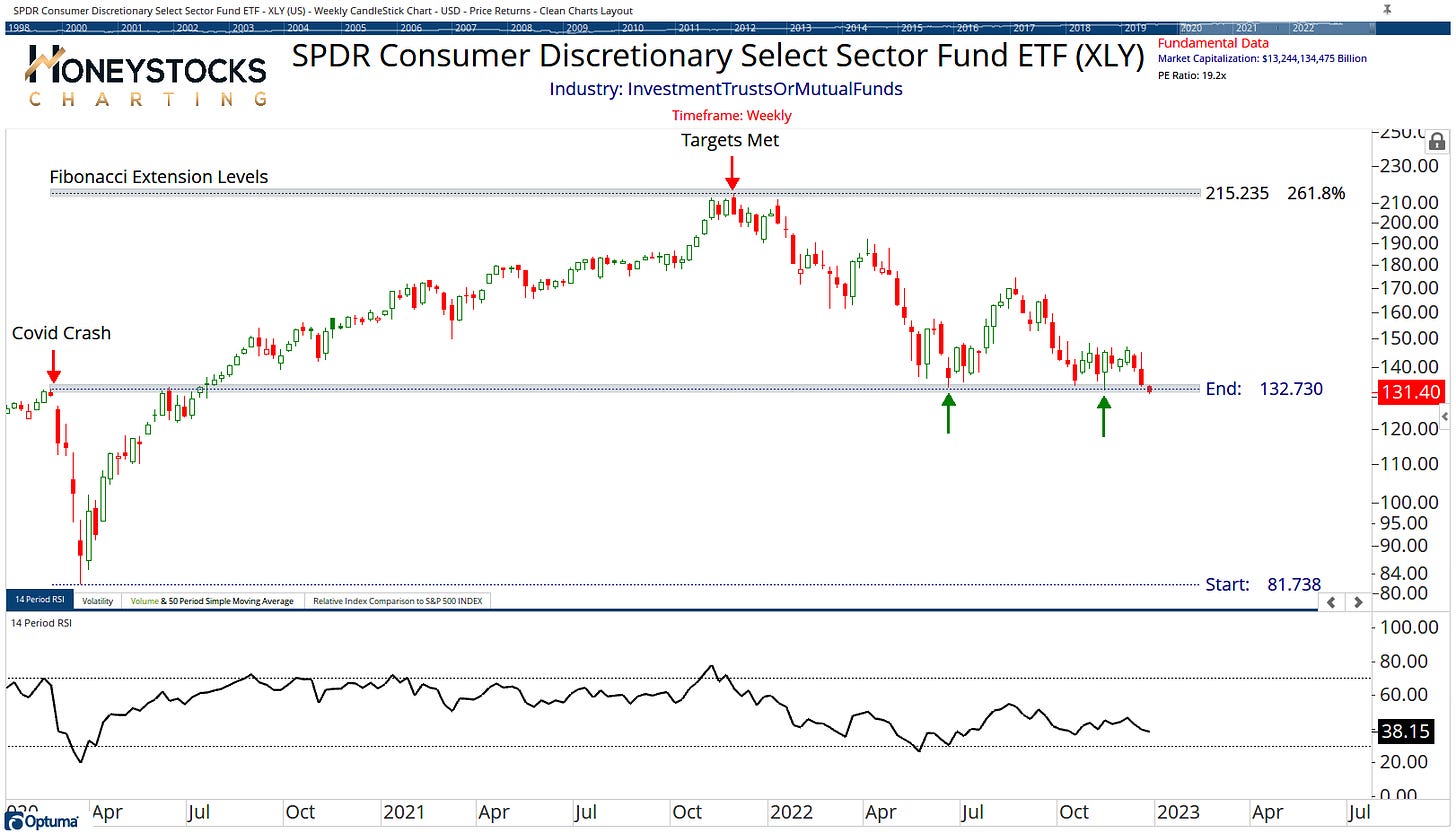

Consumer Discretionary (XLY)

1 of the charts I’m keeping a close eye on is the Consumer Discretionary sector. Our upside targets were met 12 months ago, and now they’re flirting with breaking down below those Covid Crash levels, I don’ think we need to re-write any rules.

If the Economics folks among us are correct, and we ARE heading toward The Great Depression 2.0, it’s hard to imagine discretionary thriving.

I’m not 1 to pay attention to the economics folks, but the chart is interesting me.

I’m looking for confirmed break downs.

Santa Rally

We use the last 5 trading days of December and the first 2 trading days of 2023 for the rally period, which means Friday is the day we want to see a rally kick into gear.

Will he show up?

I’m always optimistic, but I’m very mindful that we’re structurally in a bear market and looking at the charts , it’s very difficult to have confidence in either direction.

After an incredibly lucrative rally over the last 2 months, logical upside targets in the major averages and sector ETF’s have been met, and or me, it’s now a waiting game.

Let me be clear, it’s not all bearish. There ARE areas of the market I’m still bullish on (Gold/Silver/Semis anyone?)… but I think we can all agree it’s now choppy at best.

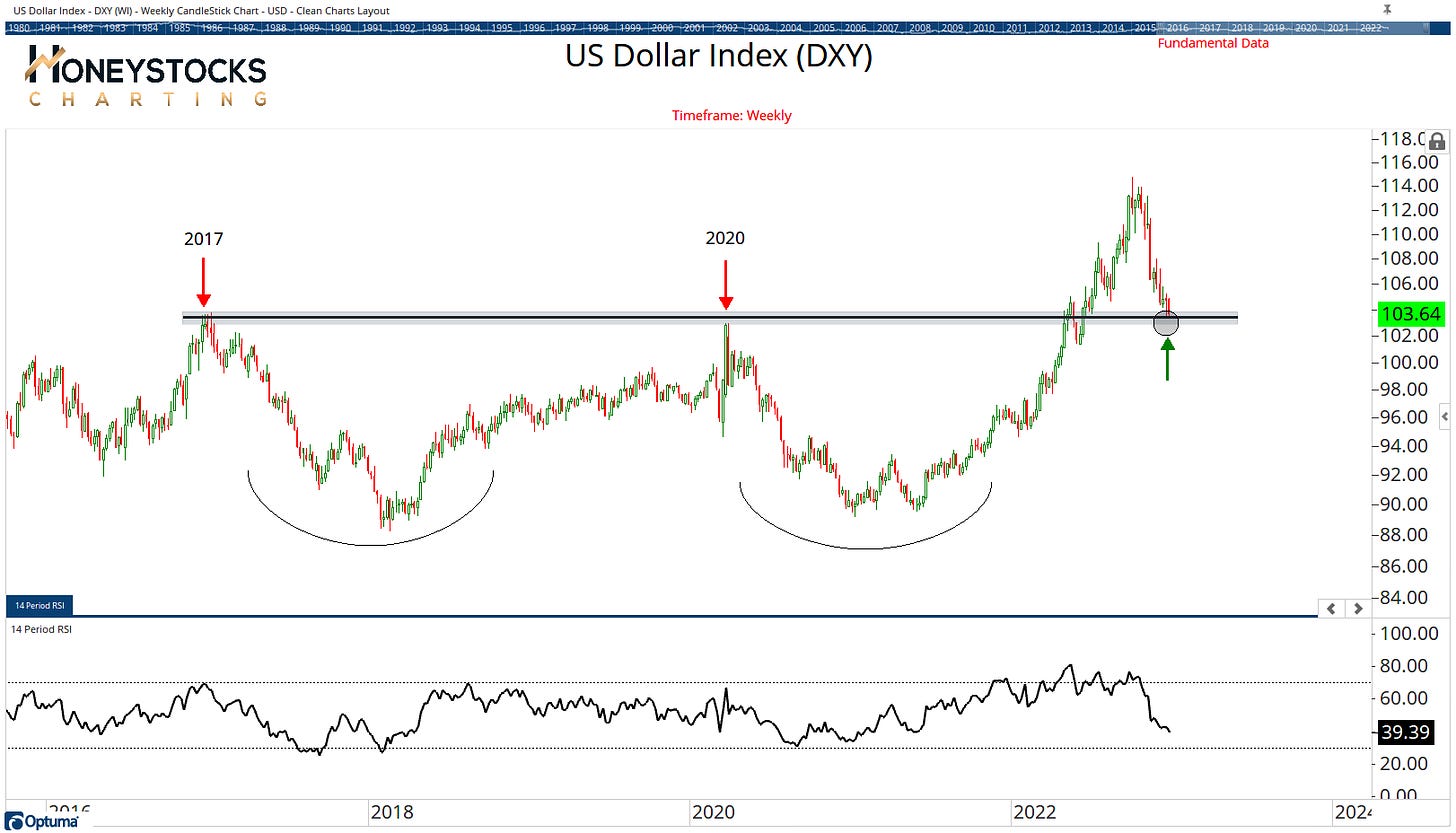

And to wrap things up, the US Dollar is still THE chart to watch.

For stocks to go meaningfully up, the US Dollar needs to go meaningfully down.

If we rally, it all starts there, so please consider watching the chart instead of the news headlines.

That’s just how it is.