Well, September’s started off a little bit shit hasn’t it?

August and September Seasonality for stocks is always a minor headache, no matter the year, but given the ungodly amount of negative bearish sentiment across my FinTwit feed, it’s no wonder the average mom and pop investor is struggling to make sense of it, let alone confidently allocate capital.

In this weeks letter I’ll lay out a few of the charts I’ve been putting to our clients and members over the last couple of weeks.

But lets start with a chart I covered last week.

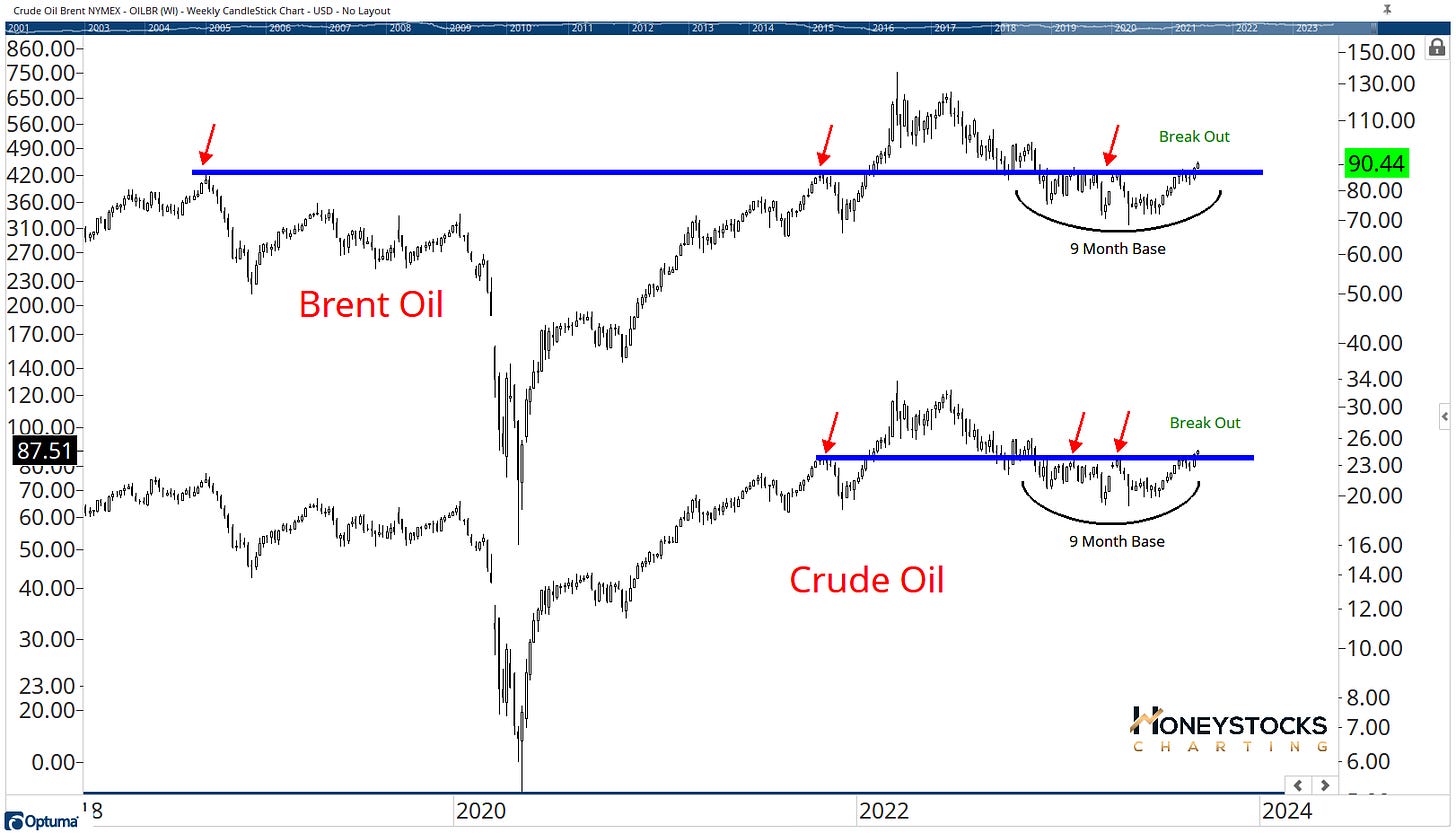

Oil Markets

Not a day goes by that I don’t get random emails or X messages about growth tech stock ABC, XYZ that’s been going down for 3yrs.

If you’re 1 of the folks who keeps going back to stocks that did well for you in the past and can’t move on, you might be missing the elephants walking past in plain sight.

The Oil markets are currently breaking out and while they obviously need to stick the landing on these base break outs, things are looking reasonably constructive going into next week.

10Yr T/Note Yield (TNX)

If you want to see some kind of move in the “growthier” areas of the market, you probably want to see the 10Yr failing at current levels.

The US Markets (at the index level) are a complete mess.

Anyone presenting a bullish or bearish thesis using Technical Analysis just now is flipping a coin… take it from me, someone who has strong track record of getting the big turning point calls correct, they’re guessing.

So if we have an environment where we can’t confidently predict market direction, what do we do?

For me, it’s simple, we judge each chart on its individual merits.

Alphabet Inc (GOOG)

Should we not consider Google for a tactical trade because the market’s a bit choppy?

How about payment processing?

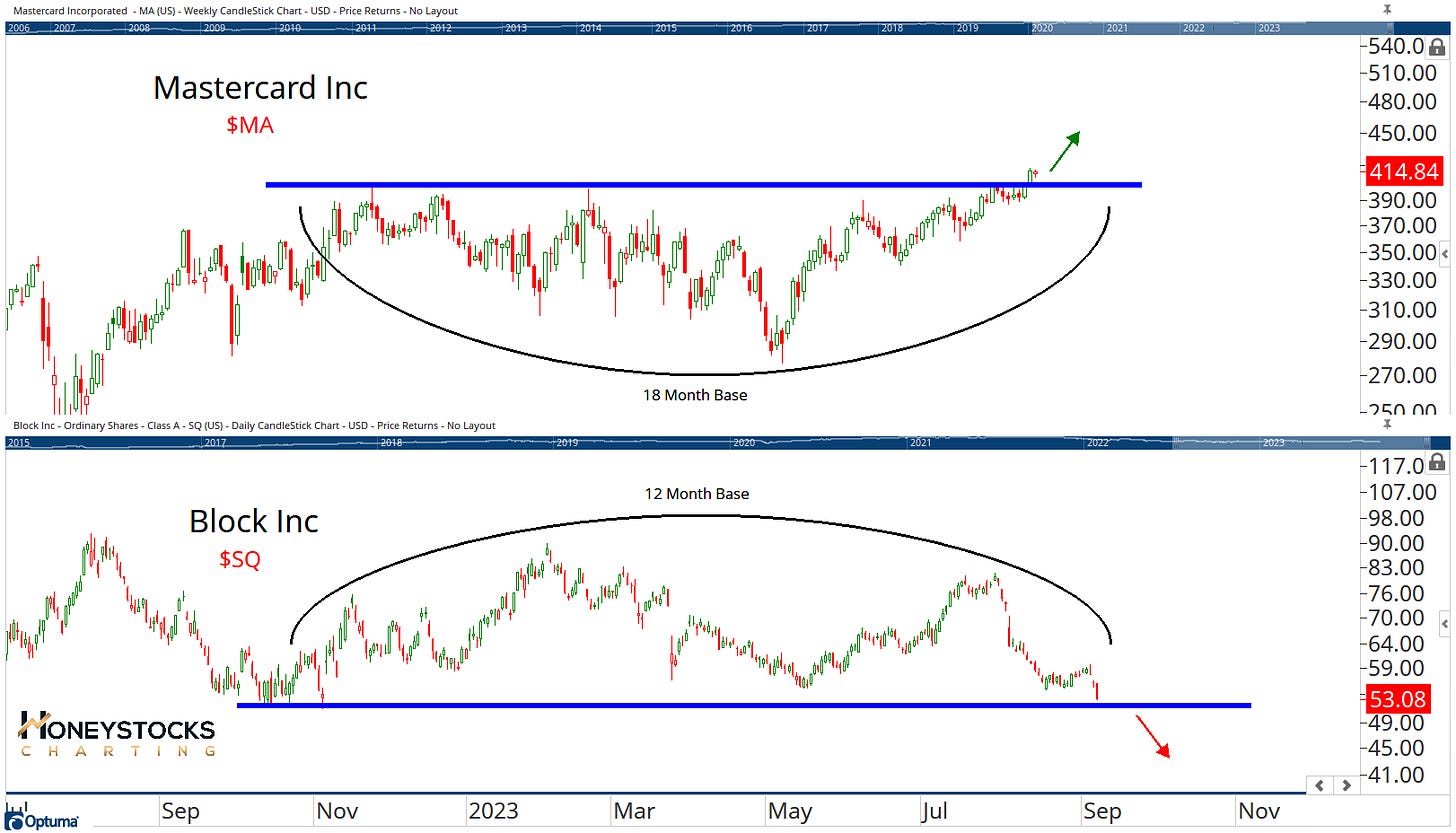

Mastercard (MA) and Block Inc (SQ)

I received a random email from a YouTube follower yesterday asking me for my thoughts on Block Inc and whether it would be a good stock to buy.

It’s probably a good example of a stock that many folks just can’t let go of.

If you’re looking for the stocks people want to own in the payment processing space, Mastercard seems like a better place to hang out.

Eaton Corporation (ETN)

My work is focussed on finding leaders BEFORE they become leaders and $94B Eaton Corp is a good example.

It may not be a name you know, but it’s been really terrific.

It’s been covered in our chart book for a few months and keeps making new all time highs.

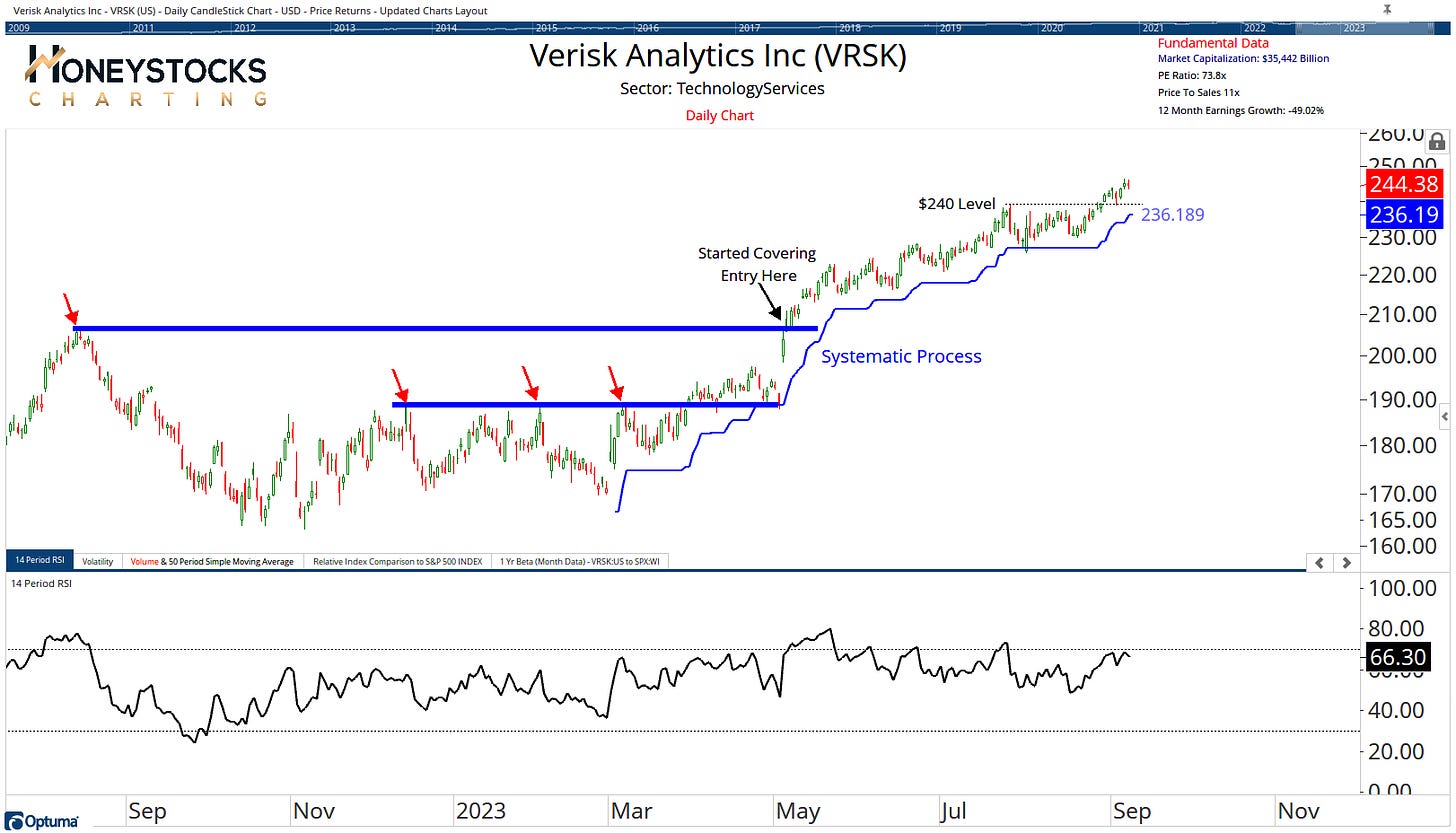

Verisk Analytics (VRSK)

Another $35B Market Cap Uptrend which despite the market chop, it continues going up.

We laid out a bunch more charts via our YouTube Channel last week if you missed it.

In Conclusion

In our weekend work for our clients, we laid out a bunch of bullish AND bearish charts and laid out what I think would be a catalyst for full blown market correction.

If you’d like to access that, there’s a link below, but in the meantime, my best guess is that it will continue to be a stock pickers markets, so I’ll just keep doing that.

Have a great weekend, I’ll mostly be watching the Rugby World Cup.

Access All Our Premium Work And Chart Books