Please consider sharing/subscribing if you find value from my work below.

Please also consider following on Twitter where I post lots of useful charts daily.

Before I get into this weeks letter and charts, let me communicate my thoughts on crypto currencies straight off the bat because nothing I write below should be interpreted as a glowing endorsement on the fundamentals of the assets or stocks I’m going to be talking about.

For a few reasons.

I think they’re a scam.

I think they should be regulated.

I think the pump n dumpers belong in jail.

I’d be just fine with them going away

Now that we’ve got that out the way, lets get on with putting together a game plan for profiting from them because that’s all that really matters in my world.

And if crypto isn’t your thing, I’ve added a few ETF’s at the end of this weeks letter.

They might well be a scam, I might be out my depth like the whale above when it comes to my individual risk tolerance, but I have charts showing me supply and demand and key levels, so I’m in.

Lets start with Bitcoin and Ethereum.

Bitcoin (BTCUSD)

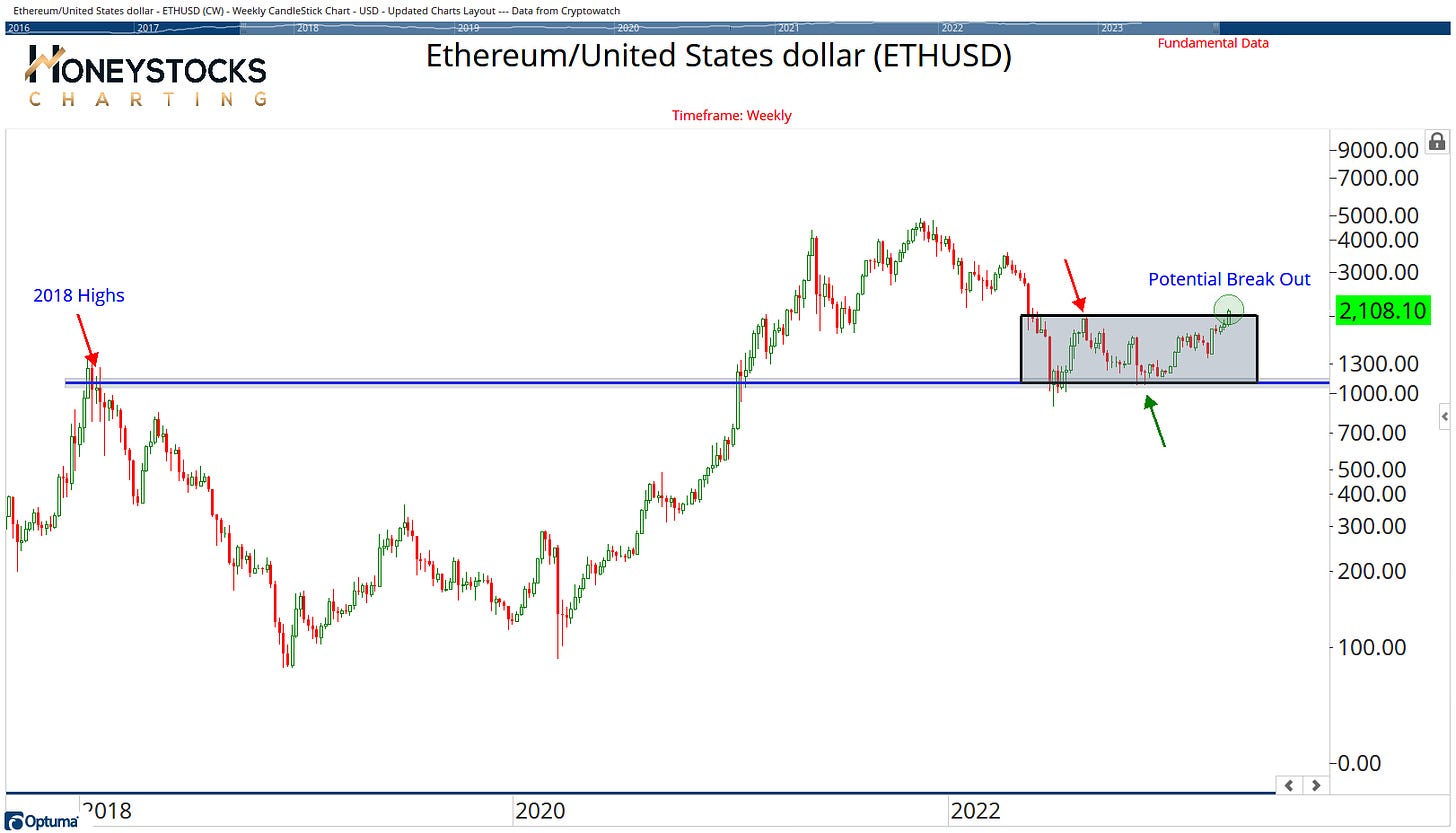

Ethereum (ETHUSD)

As we can see from the charts, both are looking constructive for potential moves above the highlighted levels.

But let me be crystal clear about something because I firmly believe risk management and position sizing is absolutely key for crypto due to the “holy shit” likelihood if they tank, so here are my levels.

Bitcoin - Above $30k

Ethereum - Above $2k

Within the crypto space, we of course have the aligned stocks.

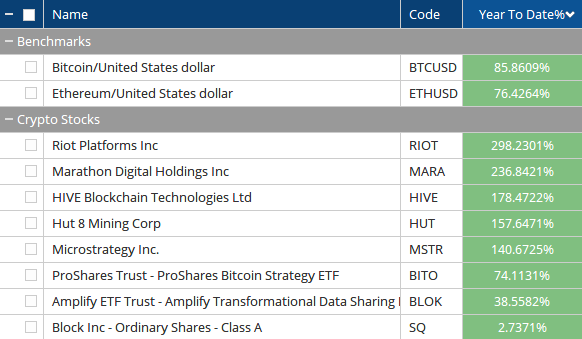

If we’re looking for “out-performance”, it probably makes sense to compare a bunch of stocks against the main crypto benchmarks.

The YTD performance table is very telling, and what I like about data, is the data doesn’t lie to me and it removes all the thoughts and feelings from the equation.

Performance Table

Bitcoin is currently out-performing Ethereum, which is useful to know.

But if you want to express a bullish thesis on crypto, the individual stocks aligned with the space are the places that drive massive out-performance if you have the strong stomach.

The down side risk is of course the “holy shit” move mentioned above that we’ve recently seen with the likes of FTX, Silvergate (SI) etc.

That’s always the risk with this space and it’s also why I’d be just fine with them going away.

I don’t like that risk and I don’t like to see investors lose everything.

That being said, if we can define the risk from the outset using Options, for me personally, that makes more sense.

RIOT Platforms (RIOT)

We put RIOT to our clients on Monday because I prepare for these monster break outs before they happen, I never like “reacting”.

Preparation is everything.

I like big open interest and volume, and I like momentum break outs with blue skies ahead with key levels to trade against.

$10 is that level for me.

The Options Chain with the highlighted contracts were provided to our members intra day on Monday and they’re currently +180%ish and if we can get similar moves to what we’ve seen historically on a break out above $10, it could get interesting.

Marathon Digital Holdings (MARA)

$10 is the level for me again.

But with the 2 names covered above, the risk is off the charts.

That’s why getting those optimal entries into a market like this is absolutely key.

Now, if crypto isn’t your jam, let me put a couple of ETF’s to you from our All Country ETF Chart Book.

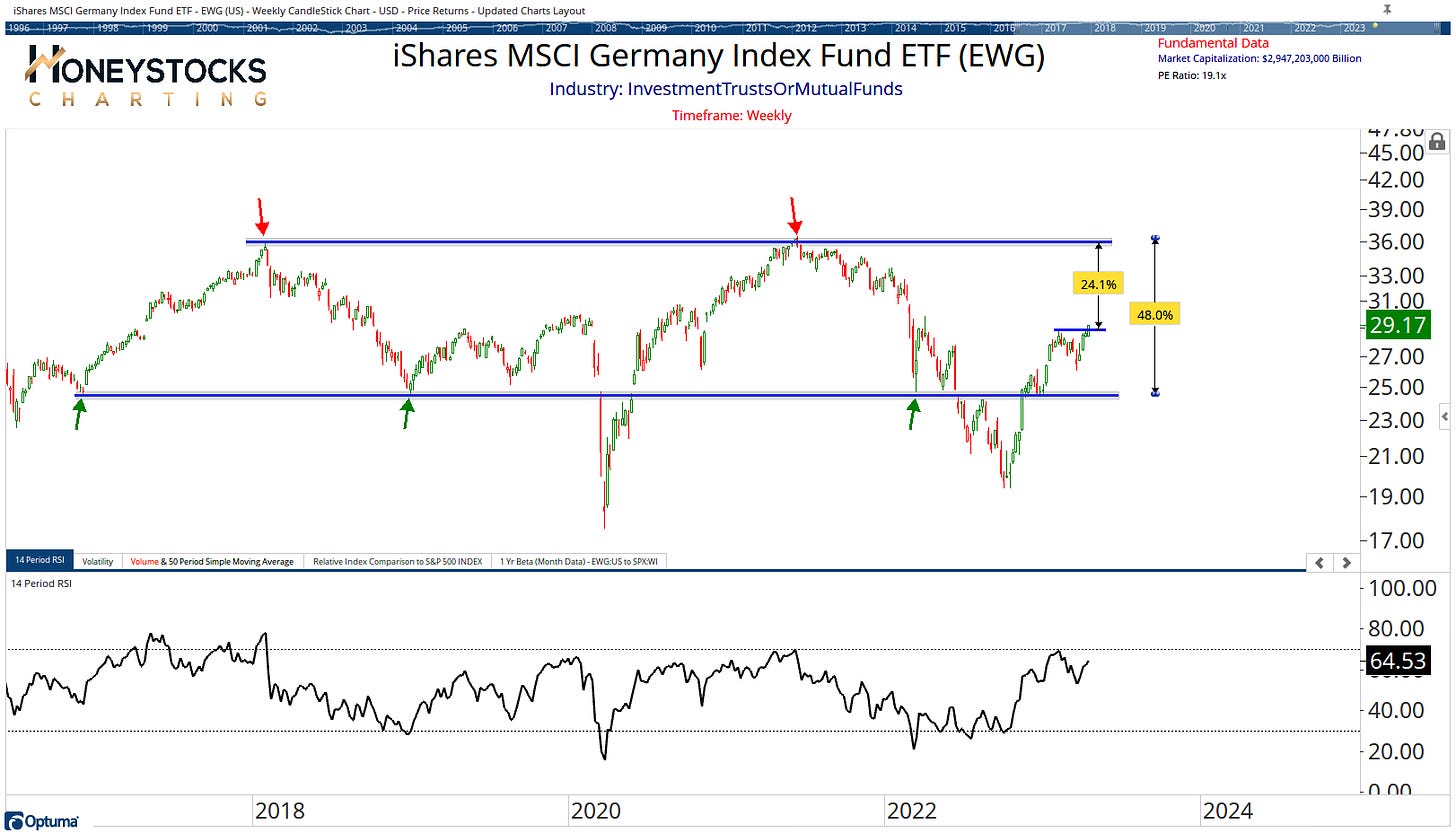

Germany (EWG)

Germany’s been great this year, and the iShares German Index looks to be attempting the next leg higher.

The DAX is also 3% away from ATH’s.

If the world was ending like the media and perma-bears would have you believe, Europe would be on its knees.

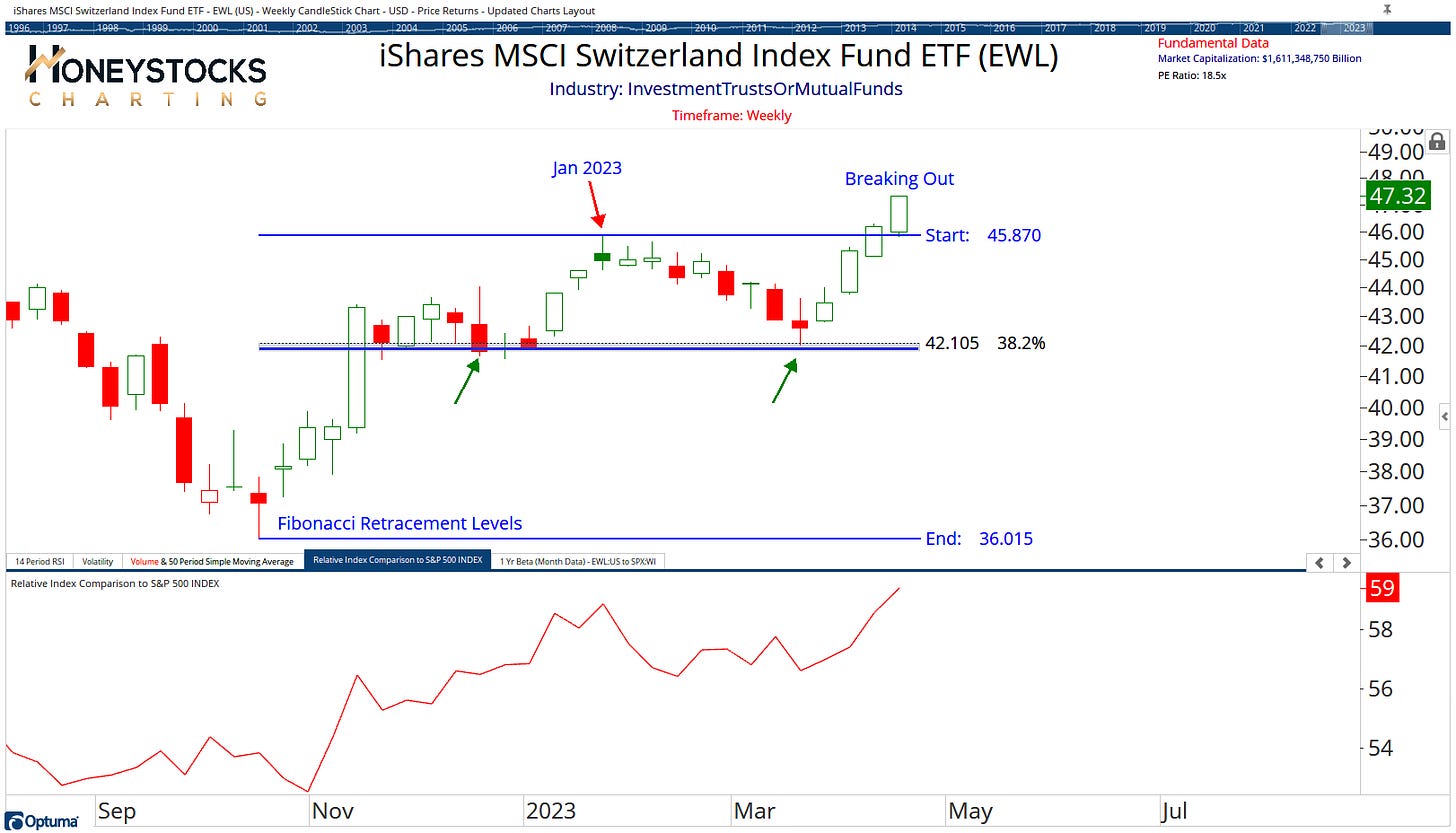

Switzerland (EWL)

Or how about Switzerland breaking out with big out-performance vs the S&P500?

In Conclusion

I get it, not everyone’s into crypto.

The stress, the volatility, and everything that goes with it isn’t for everyone, but when you dig into the market, there truly is something for everyone.

I’m told I’ve done a pretty good job of highlighting stocks to buy since October last year, but for the love of god, if you’re out there and think the S&P500 is a representation of the stock market, I’d urge you to put the hard yards in and look at more charts.

There’s thousands of them and I love looking at every single 1 of them.

Please do consider Subscribing and Sharing with like-minded folks. It’s free.

Alternatively, feel free to check out all our Premium Membership Options below.