If you pay close enough attention, you’ll notice the closer Mr Dow pushes back towards All Time Highs, the louder the bearish media voices sound.

They like to tell everyone willing to listen all about job losses and how the economy is ready to collapse more than it already has, and why you definitely shouldn’t be buying stocks.

They sure do a great job of sounding smart and convincing, so why has my work been focussed on doing the exact opposite for 2 months now?

Some Recent Calls

US Dollar Collapse - 18th OCTOBER LETTER (it collapsed)

The Rip in Copper Miners - 3rd NOVEMBER LETTER (they ripped)

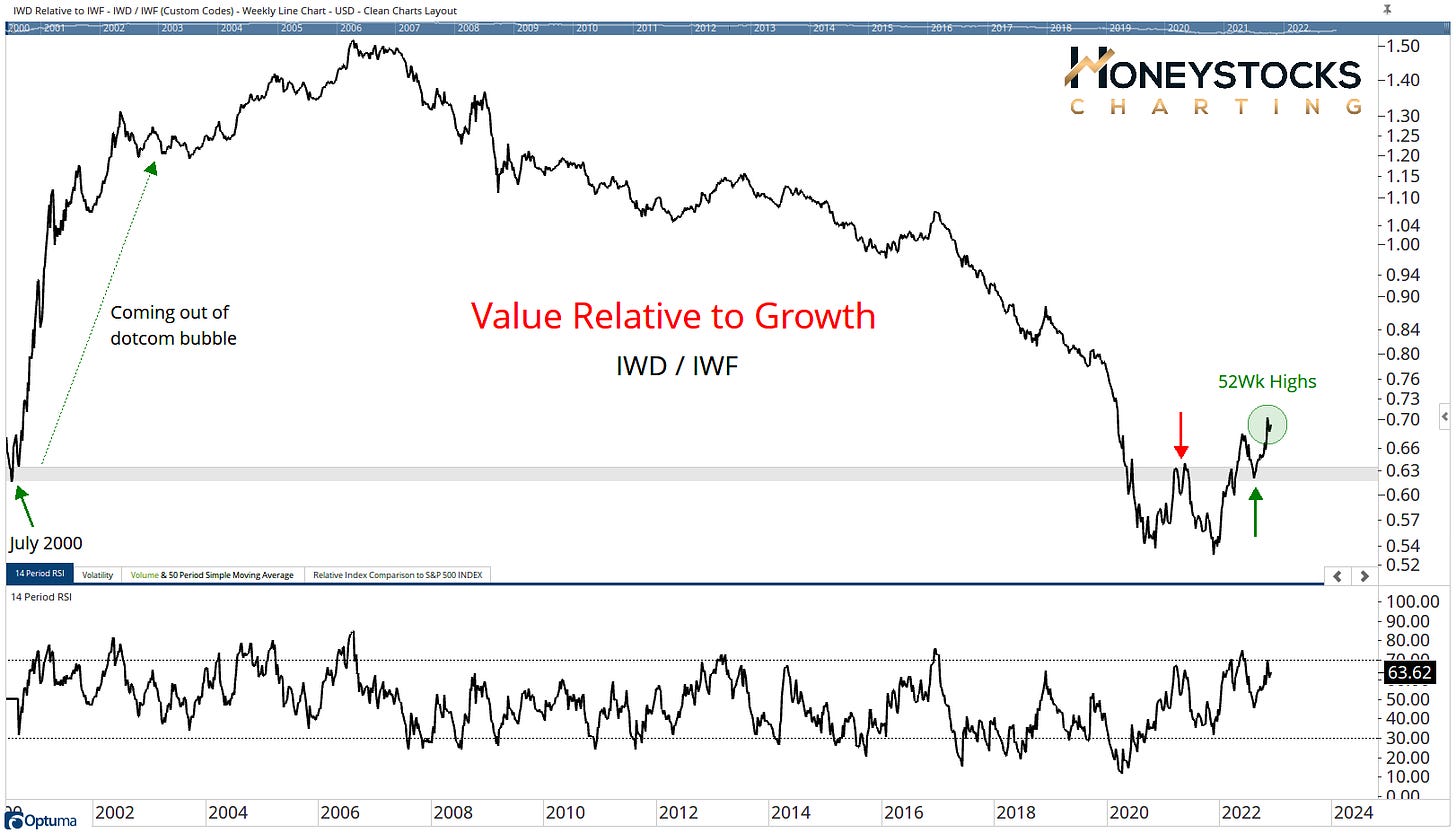

The Value over Growth Debate - 10th NOVEMBER LETTER (the ratio is widening)

The Imminent Break Out in Steel stocks - 16th NOVEMBER LETTER (they broke out)

Lets look at some charts and lets start with the breadth expansion in the S&P500.

S&P500

Looking under the hood of the S&P500 is incredibly useful and I really don’t think we need to debate it, we’re seeing an expansion in breadth which I know is difficult to comprehend for many. Why are stocks going up? Doesn’t the stock market reflect the economy?

But lets not get things twisted.

If you’re bullish, there are plenty of stocks going up.

If you’re bearish, there are plenty of stocks going down.

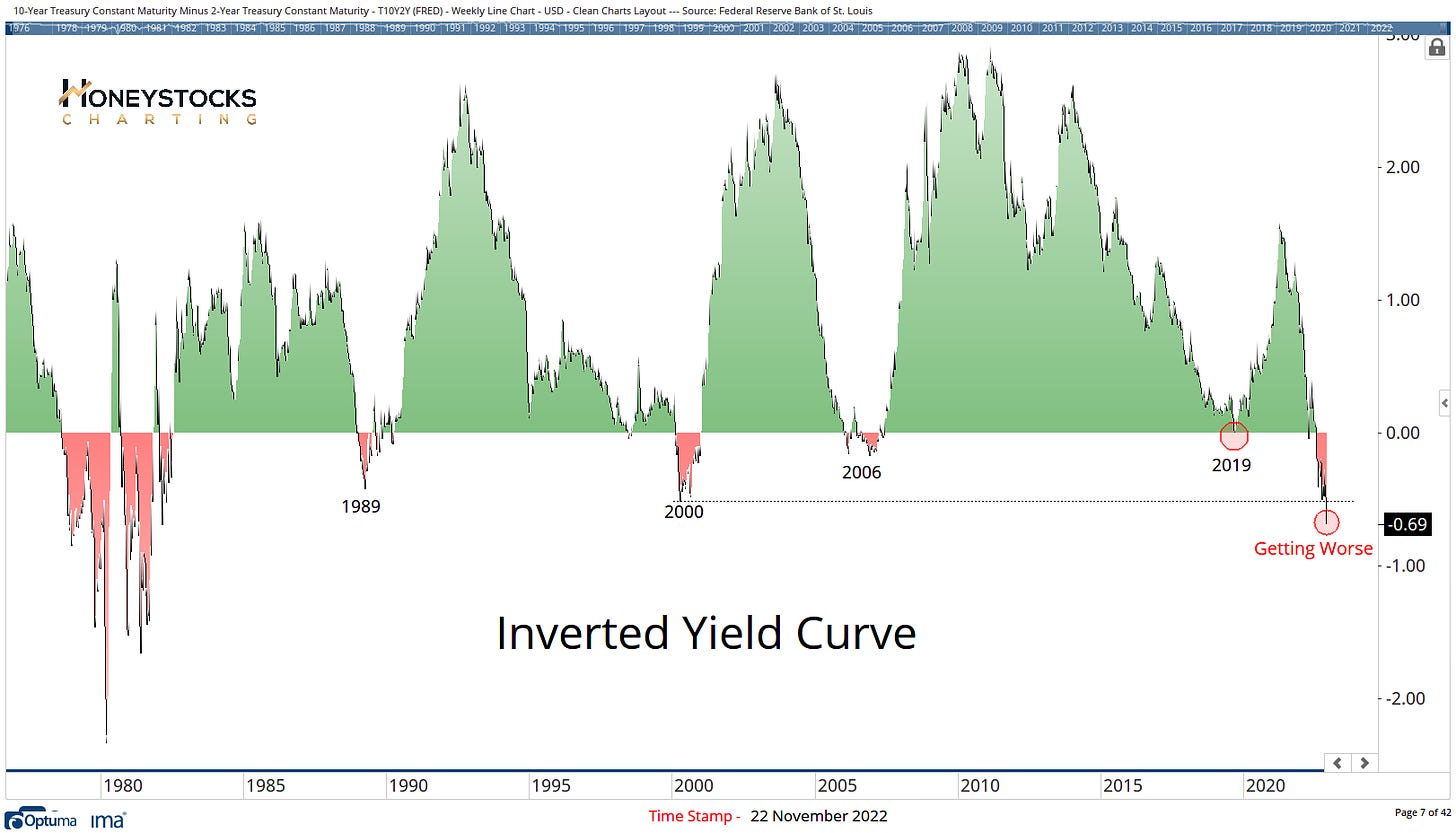

Yield Curve

“The stock market almost always bottoms well before a recession is over, and, sometimes, before we even know that we’re in a recession. It should work like that. Equity markets are publicly-traded 252 days a year. They are the best forward-looking mechanism for economic growth and earnings that we know of. GDP by definition is a backward-looking growth number, measuring the last 12 months or last quarter of economic output. It tells us what has happened, not what is going to happen in the future.”

Source JP Morgan

The Yield Curve has now undercut the lows from 2000. We know the chart is a problem for economists.

Many economists subscribe to my work and I’m constantly battling with them, which is great, I love the other side of the coin, just as much as they love the side of the coin I present.

It’s why the markets are so great.

Look at what this ratio did coming out of the dotcom bubble. Tell me that doesn’t scream Value over Growth in the current climate?

Sure, take the 20-50% rippers in all the crap, beaten up growth tech names when they put in a bear market bounce… but for longer term structural, relatively stress free uptrends, value I think will continue to be the play around my house until price tells gives me another indication.

Where can we look I hear you ask?

Copper Miners (Updated Chart from 3 Weeks Ago)

If that $32 level holds up, I don’t see any reason why the copper miners can’t move considerably higher.

Two names we’ve provided members recently (they have trailing stops already beyond initial entry recommendation)

Freeport McMorran

Southern Copper

In conclusion

There’s truly something for everyone just now.

Once you take your eyes off the Market Cap Weighted Averages and start to hone in on the glaringly obvious uptrends, things become easier.

If the market collapses tomorrow, no problem, I’m prepared for that too.

I’ll be watching price, what will you be watching?