As fate would have it, over the weekend, whether you’re red or blue in your political views, I think it’s fair to say we all got within an inch of something I’ve never experienced in my professional life… the dreaded black swan event.

I’ve heard so much about it and until this weekend, I’ve ignorantly discarded the possibility out of hand and told myself something will show up in the charts before something happens, just like 2008 and the Covid Crash, technical analysis was very useful.

If you pay attention to the doom mongers, they’ll tell you that Gold accumulation is 1 of the possible signs that something big is lurking around the corner.

Others will point to the slow uptrend in risk off assets in the bond market which have steadily been rising off the Octobers lows 9 months ago.

It’s complex, but one thing I know for certain, we could’ve just as easily been looking down the barrel of a 10% gap down yesterday and the beginning of an incredibly dark period in the history of US politics and the country.

NYSE Composite Index (NYA)

That said, I’m a chart guy, so I’m going to do my best to stick to charts.

So from that perspective, nothing’s really changed for me, it’s absolutely a positive for the market that we’re hitting new all time high in the NYSE Composite but the break out NEEDS to stick the landing.

The other side of me likes to look at the past (more out of curiosity than anything else).

I don’t believe past market environments are useful for the current one. That’s just how I learned it.

S&P500 Index 1981 (SPX)

Disclaimer: I wasn’t born during this period so can’t rely on personal experience.

Assassination attempts of US Presidents are few and far between so I went back to the last one in 1981 to see the market reaction.

Reagan obviously went on to recover but it’s worth noting this period also coincided with a severe recessionary period that was borne from a tighter monetary policy in an effort to fight mounting inflation.

So the 25% drawdown in the S&P500 isn’t directly attributed to a bullet, so the chart is slightly misleading in terms of the Reagan assassination causing the crash.

But the similarities with today are there…. inflation… bullets flying… pending recession (yield curve still inverted)… so it’s definitely not all sunshine and rainbows out there.

I fully understand the bear case and have done for the last 2 years.

iShares Russell 2000 (IWM)

But whether it’s 1929, 1981, 2008… for me, the only environment that matters is 2024.

And in this environment, the stock market just keeps moving higher and we’re now potentially seeing the participation from the small caps amidst the storm of a US presidential campaign which will no doubt have some more twists and turns to come.

I’ve been on the record with our clients and members that I expect the 2nd half of the year to be dominated by the riskiest stocks as the “catch up trade” but like the NYSE Composite, this break out NEEDS to stick the landing.

In the meantime, what individual stocks can we look to I hear you ask?

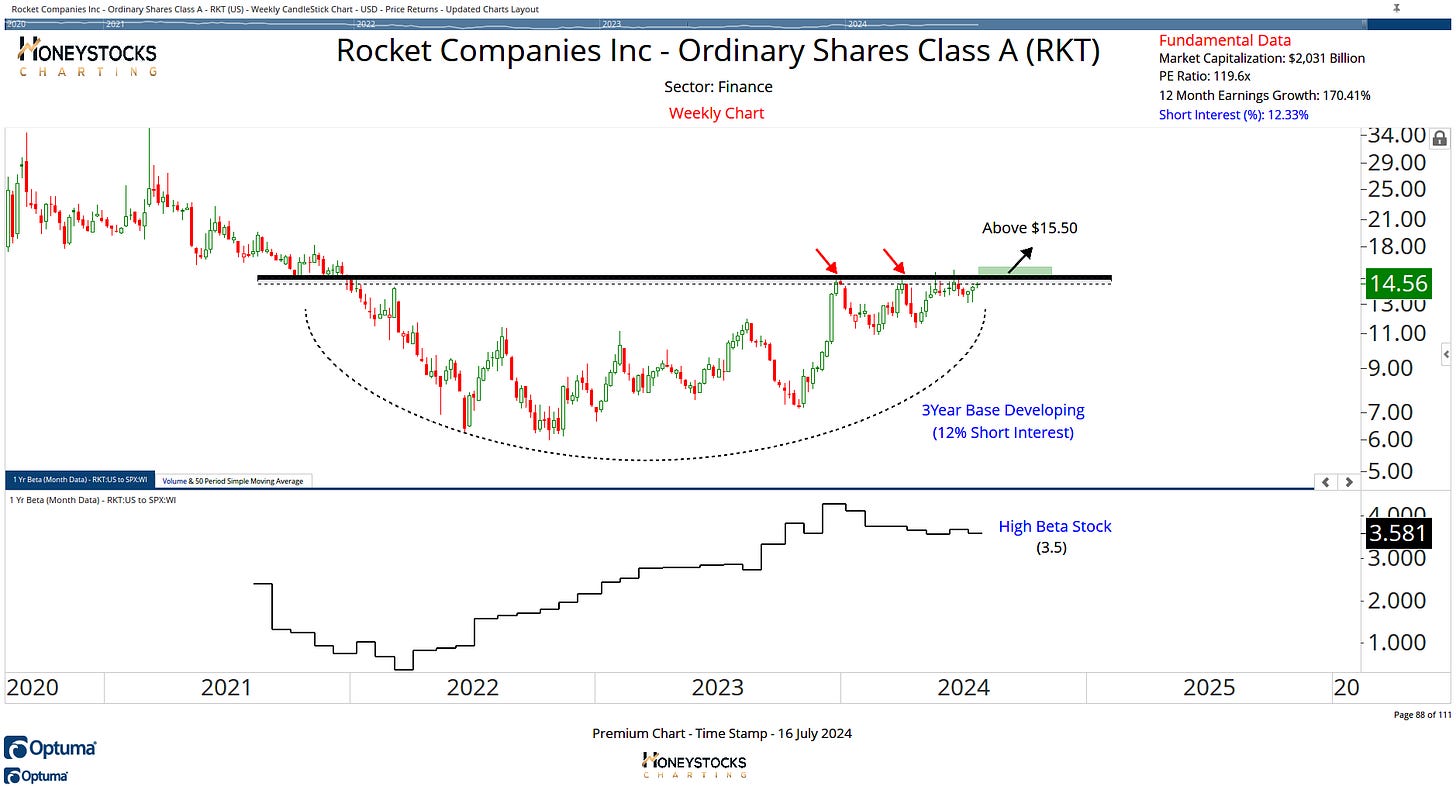

Rocket Companies (RKT)

If you take the view rates topped last October like I do, there are lots of potential ways to express a bullish position if you’re looking for alpha and in an environment where small caps could potentially lead, I’m looking for high short interest stocks that are being accumulated.

Rocket ticks a lot of boxes for me and $15.50 is my level.

Super Micro Computers (SMCI)

I want to be clear, I made a bottom call on this 2 months ago and it’s been 1 of our trade ideas from our chart book.

I’ve also attached that chart, because just like last week with NEM, I hate it when the Hindsight Harry’s of FinTwit don’t back up their claims.

With inclusion to the Nasdaq 100 news hitting the market over the weekend, $975 is the level for me.

Cloud Computing (SKYY)

If you’re looking for a broader sector ETF going into earnings season, perhaps Cloud Computing fits the bill.

It’s 1 of our members 20 ETF picks just now but it does need to get over the hump and break out.

A Note Of Extreme Caution

Lets not get it twisted here… what happened at the weekend wasn’t good.

I mean, REALLY not good, I think we probably all know that whatever side of the fence you sit.

The conspiracy voice lurking inside me just doesn’t think it’s plain sailing from here, I fully expect more shenanigans going forward and I just pray everyone in the US can have a fair election where voters get to choose who they want, rather than someone being eliminated and a default win.

I think that would be very bad for markets and a black swan event so I’d just urge having some kind of plan over the next few weeks and months, just in case something happens.

Have a great week and I’ll see you next week and if you enjoyed the read, feel free to check out my premium work below.

Sam, need some help in the subscription options: Yearly is $149, Founding member is $200/year. What is the difference? Thanks