If you picked up last weeks letter and did anything with ARM Holdings (ARM) or Snowflake Inc (SNOW), congratulations, it’s probably been a good week, despite all the doom-mongering negativity surrounding the market hitting all time highs.

Choose your bearish narrative from all manner of perma-bears.

Inflation Data

Declining Market Breadth

Consumer Staples

Economic Armageddon

Too much, too fast

Rather than give the thoughts and opinions of others any kind of weighting, I prefer sticking to my charts, it’s just easier that way and I’ve got a few important charts and stock ideas prepared for your consideration over the next week.

So lets get into it and lets start with 1 of the broader charts from last week that I think is worth communicating again.

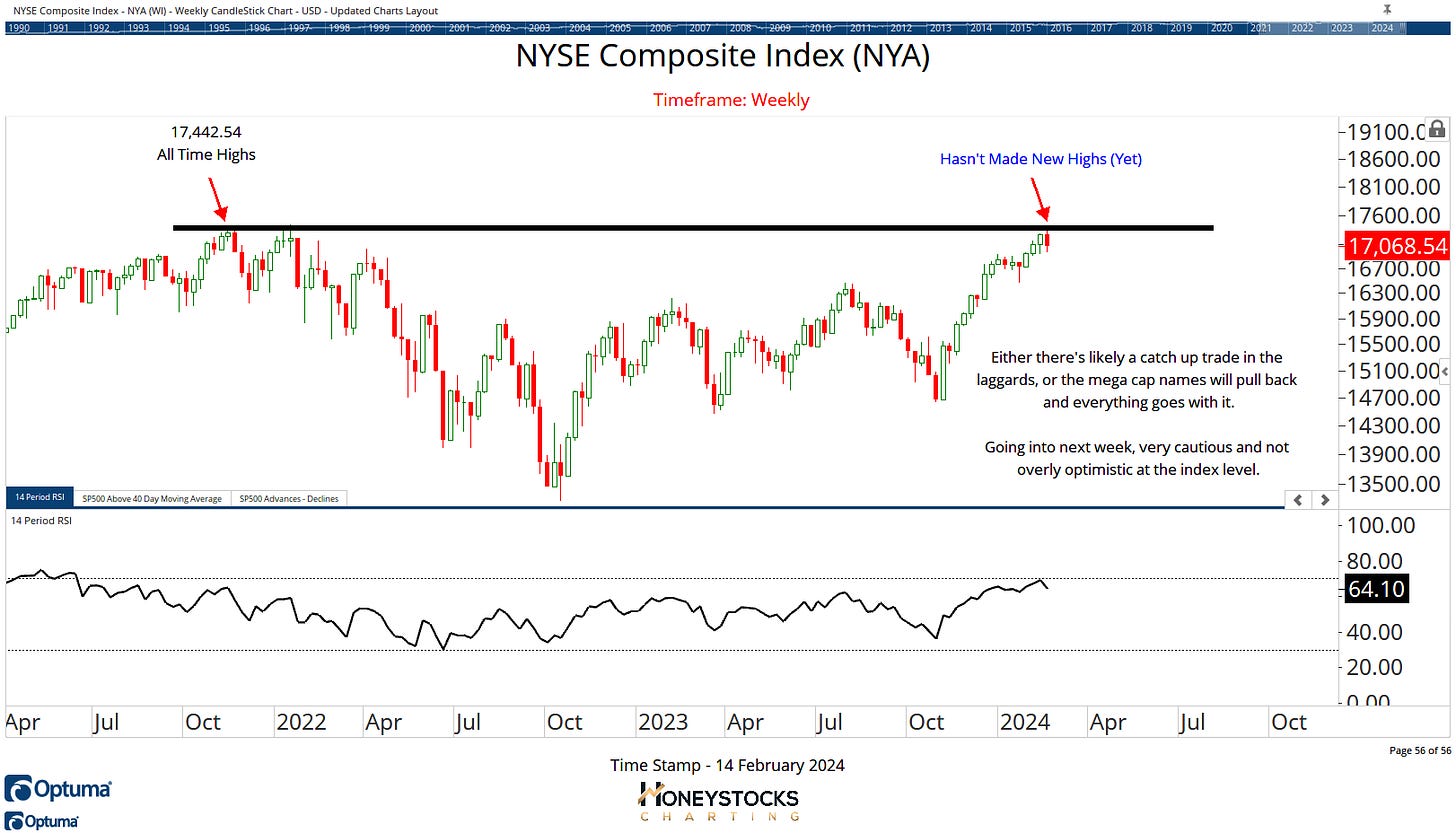

NYSE Composite (NYA)

The NYSE Composite gives us broader scope of the market as it holds a lot more stocks than the S&P500.

As the chart shows, we’re now stalling at key levels, but let me be clear, that doesn’t automatically mean stocks go down from here.

In fact, plenty of stocks / areas are doing just fine and plenty of areas are rebounding well.

So here’s the thesis I’m working with, and I’ve included a few of the charts I’ve put to our clients at the weekend.

If you already subscribe to our premium work, this letter is automatically included in your membership so please drop me a message on Workplace with your email address.

Keep reading with a 7-day free trial

Subscribe to The Weekly Grind to keep reading this post and get 7 days of free access to the full post archives.