Before I get into this weeks letter, I think it’s kind of important to communicate that I personally advocate the use of trailing stops, for the very simple reason they stop me 2nd guessing every 1% or 2% move in the market.

That’s not advice to do the same because we all have a process that suits our own investment philosophy, but I find trailing stops help a lot when the market presents real challenges.

But thinking that you or anyone you listen to knows what definitely comes next, or thinking that you know seasonality is going to kick a correction into gear, is mostly a sure fire way to make bad decisions.

Ok, now we’ve got that out the way, here’s the seasonality headwind data for the NYSE Composite going into August and September.

NYSE Composite Seasonality

It’s not good reading.

Every year, the mainstream media folks say the same thing… we can expect a corrective phase for the markets at some point over the next 2 months.

And it makes sense. No arguments here with anyone calling for a correction, even the perma-bears who seem to get louder this time of year.

Equal Weight S&P500 (RSP)

The equal weight S&P500 isn’t too far away from testing all time highs. We are approaching logical pause levels.

Dow Jones Industrial Average (DIA)

The Dow is 3% away from all time highs and just like RSP, it’s very close to logical pause levels.

As someone who’s been bullish stocks since October last year, a few things concern me at current market levels.

Mike Wilson’s now bullish

Tom Lee is calling for a correction

45 days without a 1% S&P500 decline

Approaching logical pause levels across the market index levels

Bullish FOMO all over my Twitter timeline

The US Dollar is creeping higher

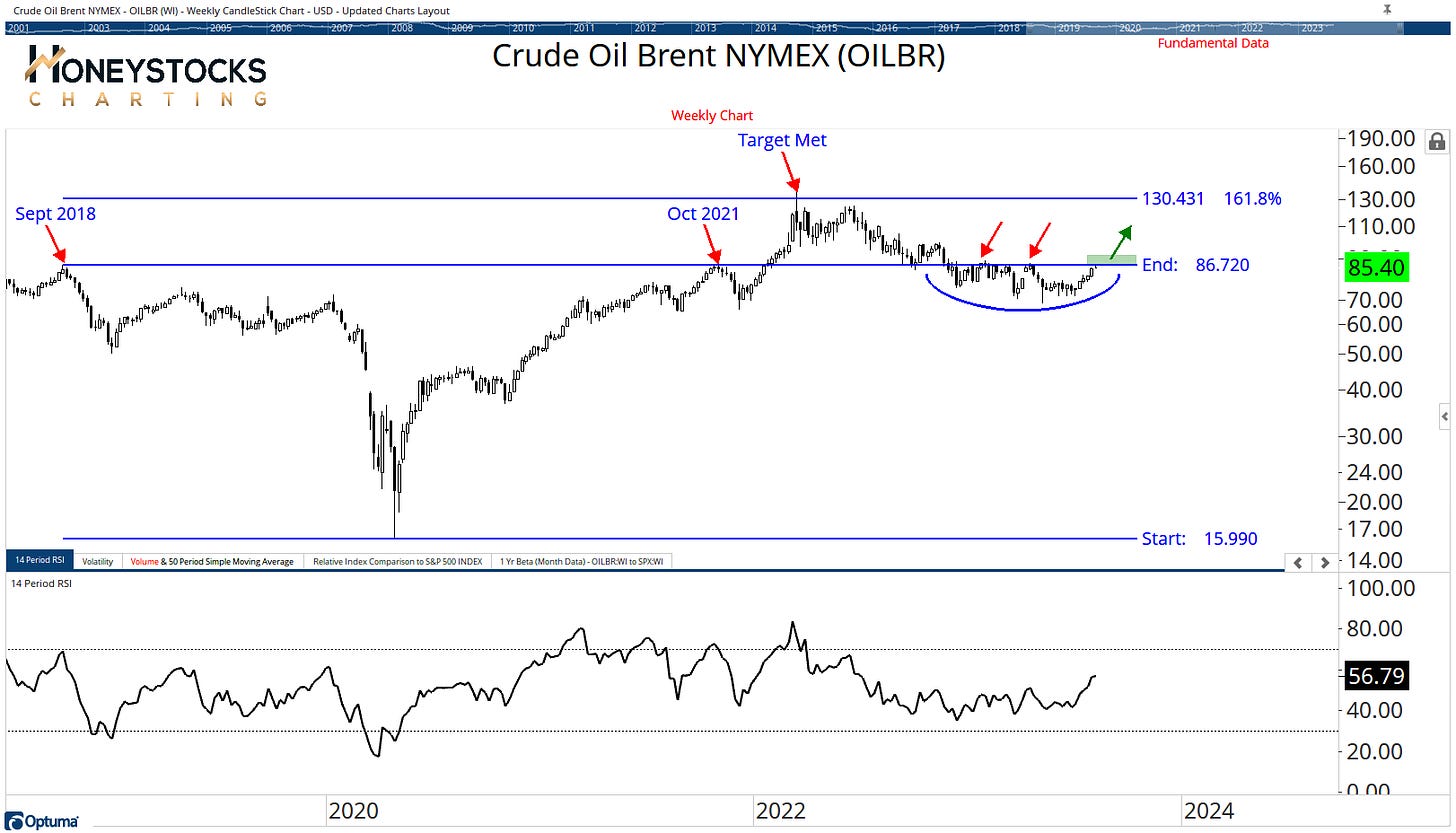

Brent Crude Oil

I’ve been working on a theme of rotation over the last few weeks and focussing on treating areas of the market on their induvial merits.

Energy markets are showing signs of life again. Reclaiming those 2018 levels would be constructive.

Bloomberg Commodity Index (BCOM)

We’re also inching higher in the commodities space, which for new positions, is an area I’m now starting to watch a LOT closer just now.

Many areas of tech are already +100% this year, that’s also a concern, so boring value names might be the place to watch the 2nd half of the year.

I also laid out a bunch of analysis last weekend via our YouTube Channel.

In Conclusion

The news of the last 24hrs is the downgrading of the US Credit Rating, feel free to watch the clown shows on CNBC and Bloomberg if that you enjoy that kind of analysis, I’m sure there will be plenty of hot takes to listen to.

For me, I continue to follow price, it’s just more reliable.

How do you see it play out?

Click below to access all our premium work and charts in real-time.