It’s been a couple of weeks since our last letter and surprise surprise, the market has kept sprinting toward those former all time highs in the S&P500.

Meanwhile, everyone still keeps telling me it’s still a bear market rally despite being just 6% away from all time highs.

Going into another earnings season (do they ever end), it promises to be another exciting few weeks.

In this weeks letter I’m going to make the case for an area of the market the mainstream media told me was going to collapse everything around the world.

So let’s take a look at the boring old banks and a few ETF’s / stocks that could be poised to move.

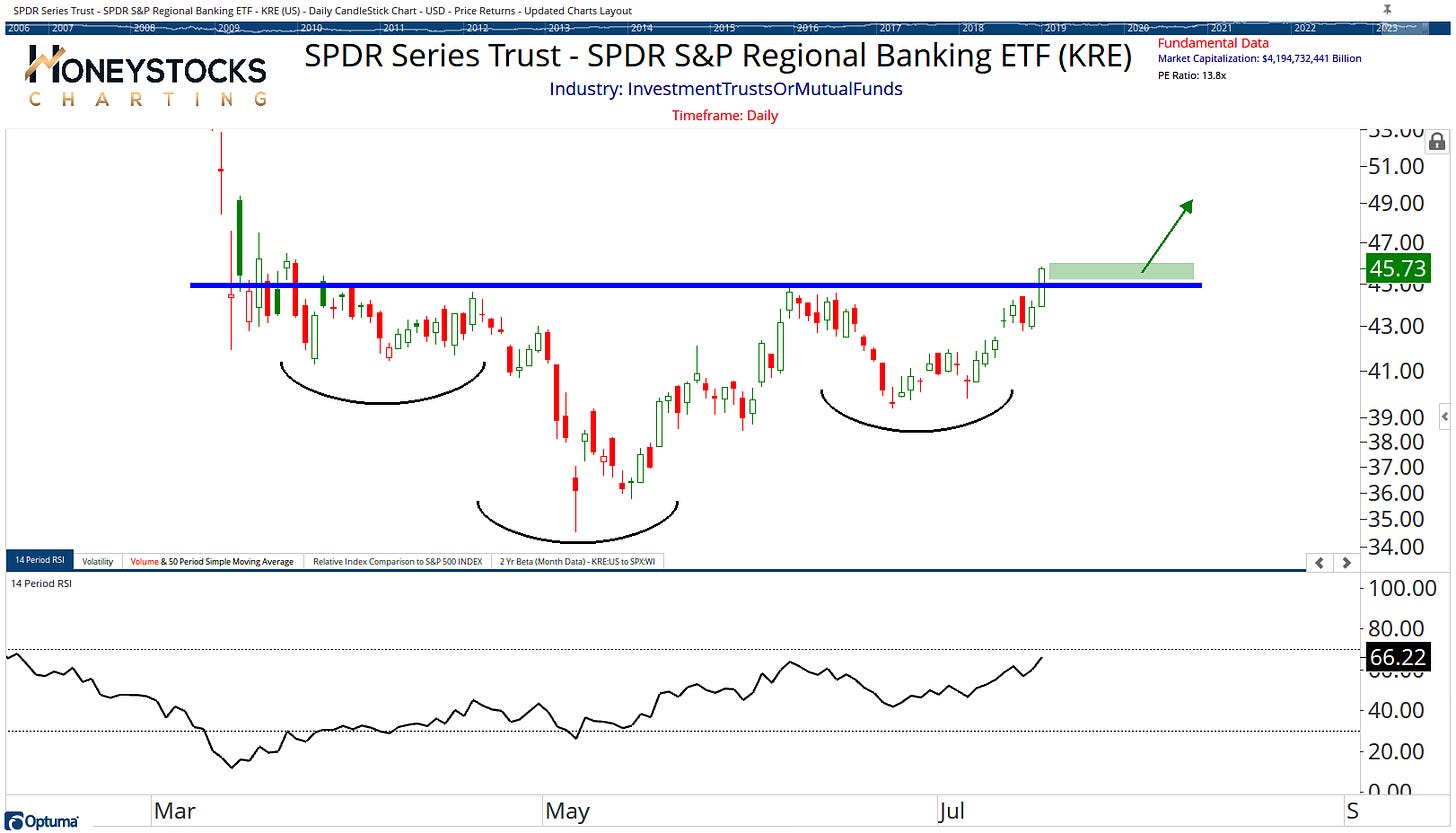

Let’s start with the Regional Banks.

SPDR Regional Bank ETF (KRE)

We’re not going to see headlines telling us regional banks are bottoming, because the reality is, positive headlines don’t generate clicks as much as negative headlines do.

The reality is, mainstream financial media headlines in general don’t help anyone, so if you’re quite new to all of this, I’d encourage you to pay more attention to price.

I’d argue if the regional banks break above that $45 level, it’s quite possible we see a meaningful move across the regional bank board.

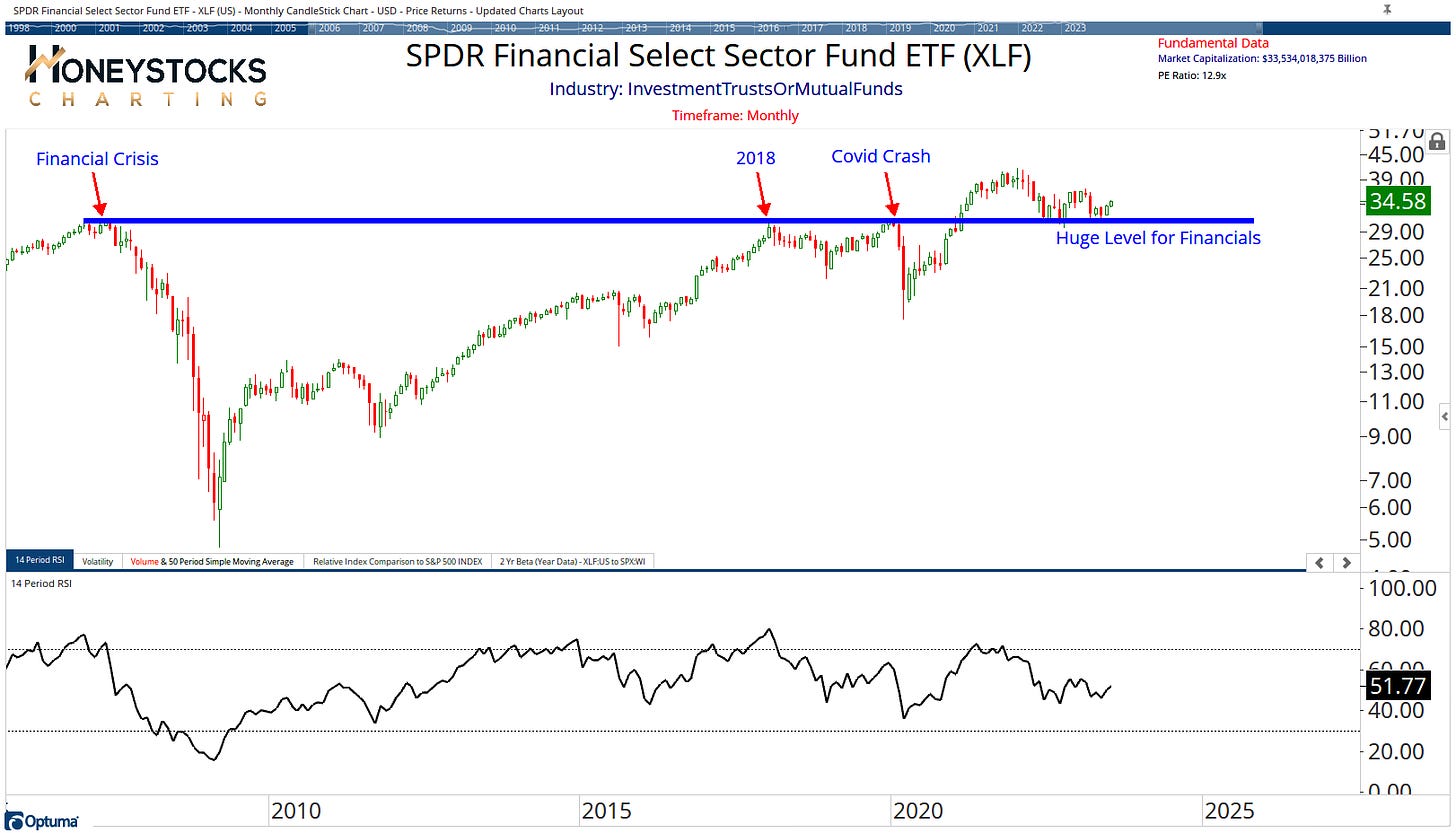

SPDR Financials (XLF)

The wider financial space is continuing to hold above those 2008 Financial Crisis levels, so for me, i think it’s logical to assume the world isn’t ending as much as some might have us believe, so in that environment, I also think it makes sense to identify banks to buy, not sell.

Provided we’re above those 2008 highs, in my little technical world, banks are fine.

So what banks might make some sense?

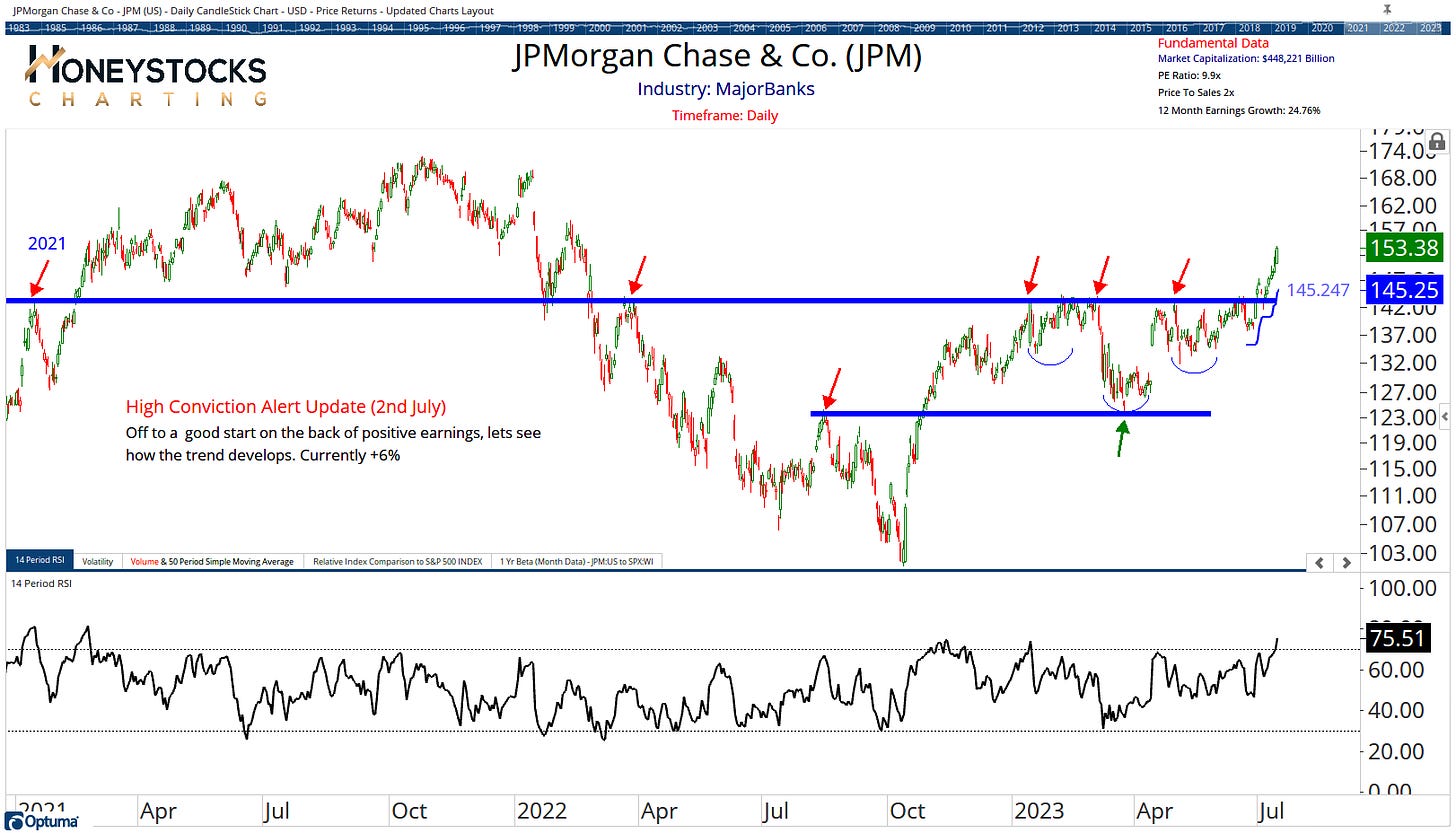

J.P Morgan Chase & Co (JPM)

With many of the banks now through the early stages of earnings, it would make sense to identify the best ones and JP Morgan are front and centre of my work just now.

I put this out to our subscribers as a high conviction idea 2 weeks ago in preparation for a break out and it’s been going to plan and currently +7%.

I believe a pull back / cooling off of RSI may offer opportunity to get in provided we hold above that $143 level.

HSBC Holdings (HSBC)

Another 1 of the too big to fail banks is also breaking above big levels.

Very similar look to JP Morgan and with earnings in a couple of weeks, if we’re above that $40 blue line, again, I think you have to be bullish HSBC with a very easy out if it breaks below.

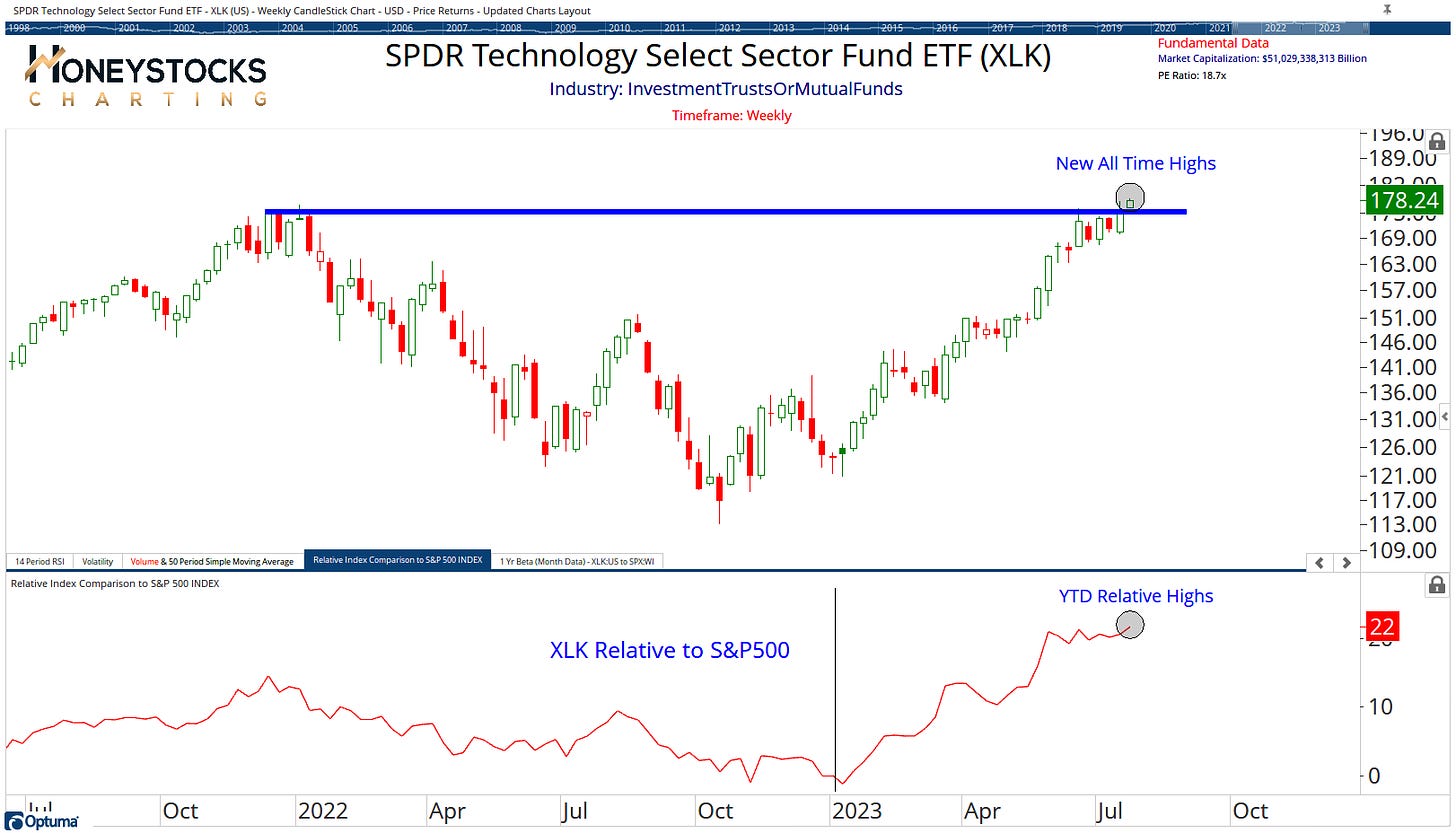

SPDR Technology ETF (XLK)

How about Technology stocks though?

New all time highs posted yesterday for Tech with YTD rising relative strength.

What I like about break outs in major areas of the market is that price also tells us when it’s bullishness is called into question.

You probably don’t want to see this break out fail if you’re bullish Tech (like we have been for 9 months)

We did also lay out a bunch more charts via our YouTube Channel at the weekend, so I’d encourage you to check that deep dive out if you missed it.

In Conclusion

There are rotations going on everywhere.

Small Caps, Micro Caps, Metals/Mining, Financials… Tech, there truly is something for everyone just now.

Could the market cool off soon?

Of course it could.

You’d have to be silly to buy into stocks after 100% moves without managing risk in a responsible manner.

Despite that, there are many opportunities presenting themselves in areas where I like to utilise my buy low : sell high charts.

There are many examples of that in the video analysis above.

Have a great week everyone and please forward to like minded folks if you find value from the letter. (it’s free)

Click below to access all our best charts and alerts in real-time.