If you’ve paid attention to the charts over the last 6 months like we have, congratulations are probably in order.

Go pour yourself a nice cold victory beer.

If you’re new to my work and it’s just dropped onto your radar for whatever reason, this small (free) weekly letter got everything spot on 9 months ago.

The big question I now have after a monumental run up in mega cap tech, are we now setting up for a meaningful pause?

As always, in this weeks letter I’ll communicate some key charts that’ll hopefully give some context to this weeks click bait headline.

We’ve had CPI and the FOMC already this week, and with options quad witching to navigate tomorrow, it promises to be a choppy end to the week.

So lets start with the Q’s.

Invesco QQQ Trust

The way I see it, we’ve basically hit logical upside targets.

Tech has gotten a lot of airtime this year due to the monumental gains in the likes of NVDA, AAPL, TSLA etc etc, and we’ve recently seen the expected FOMO from many of the wall street perma-bears who’ve suddenly turned bullish and they’ve done the inevitable and jumped into the party very late hoping to have a good time.

You can’t make it up, and for me, this is probably a good contrarian signal.

NYSE Composite (NYA)

While we’re all being told the market’s on life support, the NYSE Composite new lows list STOPPED going down in September last year and less than 1% of the NYSE Composite are currently making new 6 month lows.

AND we’re currently seeing an expansion of breadth with 60% of components also within 20% of 52wk highs. (chart above)

We’re seeing rallies and break outs everywhere.

I’d argue my tweet above couldn’t have been any more spot on and it really only took 5 days.

There’s no doubt in my mind the folks who are now climbing the current wall of worry, are very very very late to this phase of the market.

The market has a funny way of knowing when to pull the rug, and I think an exhaustion in Tech would probably signal a digestion of gains across the board, or at the very least another rotation.

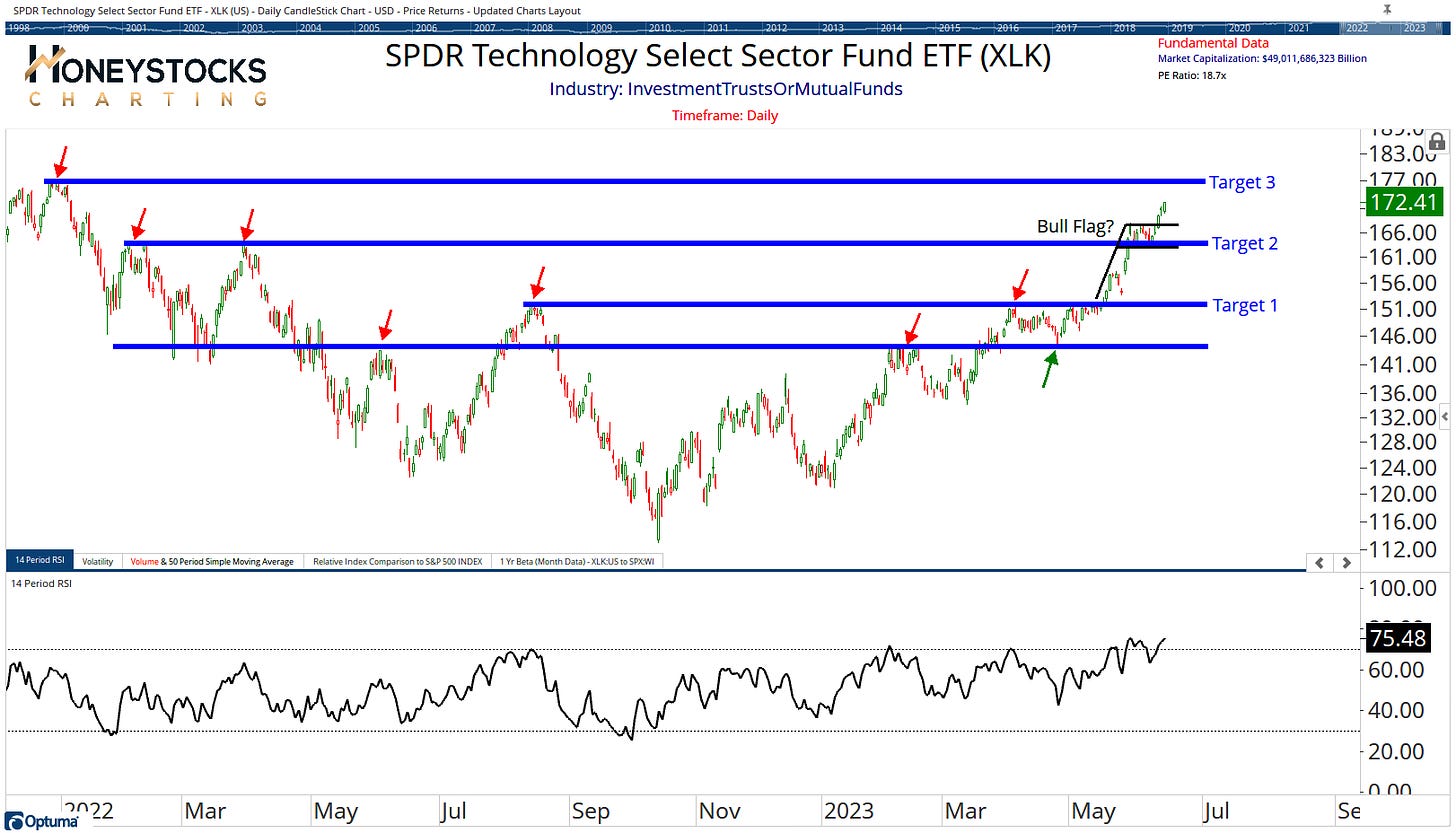

SPDR Technology (XLK)

(Chart taken from our members access ETF Chart Book)

We’re seeing big levels upcoming in the SPDR Tech sector which has just been motoring through our levels and targets, it’s been really great and we’re approaching our big Target 3 (all time highs level) and for me, that’s also a logical pause level.

How about the S&P?

S&P500 Index (SPX)

Fibonacci levels matter.

The chart shows that quite well… at the index level, I think it’s starting to become reasonable to expect a little bit of chop in many of the recent high fliers.

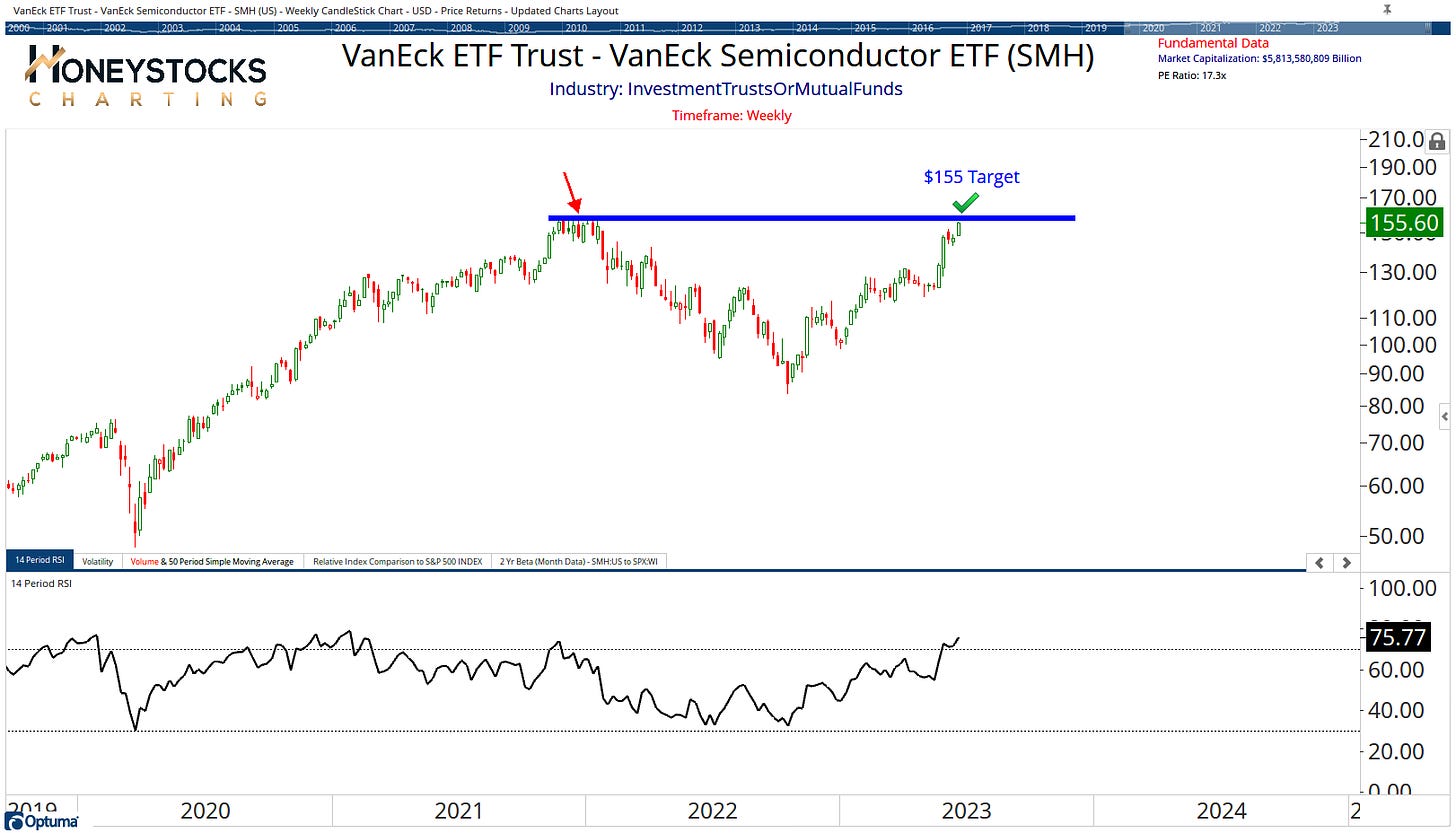

Semiconductors (SMH)

Thanks very much semiconductors, you’ve been great this year.

Another chart hitting upside targets.

In Conclusion

I’ve already started to prep our clients/members for rotation and the next phase of the market.

In our premium weekend analysis and our premium midweek half time analysis over the last week, I’ve laid out a bunch of charts and what I believe is going to catch a meaningful bid moving forward.

Let’s see what the market chucks at us next.

Have a great weekend.

If you find value from my work, please consider forwarding to your friends and subscribing.

Click Below to get all of our best charts and alerts in real-time.