If you find value from my hard work below, please do consider sharing/subscribing.

I also post lots more useful charts and data on Twitter most days.

I hear it all the time.

But Sam, it’s just 5 stocks holding up the market and we’re headed for a catastrophic recession that’ll have us face planting back to the stone age.

And I get it.

The Perma bears, the doom-mongers, the message has largely been the same across the board.

Dooms day is just over the horizon and you should have been shorting uptrends since October.

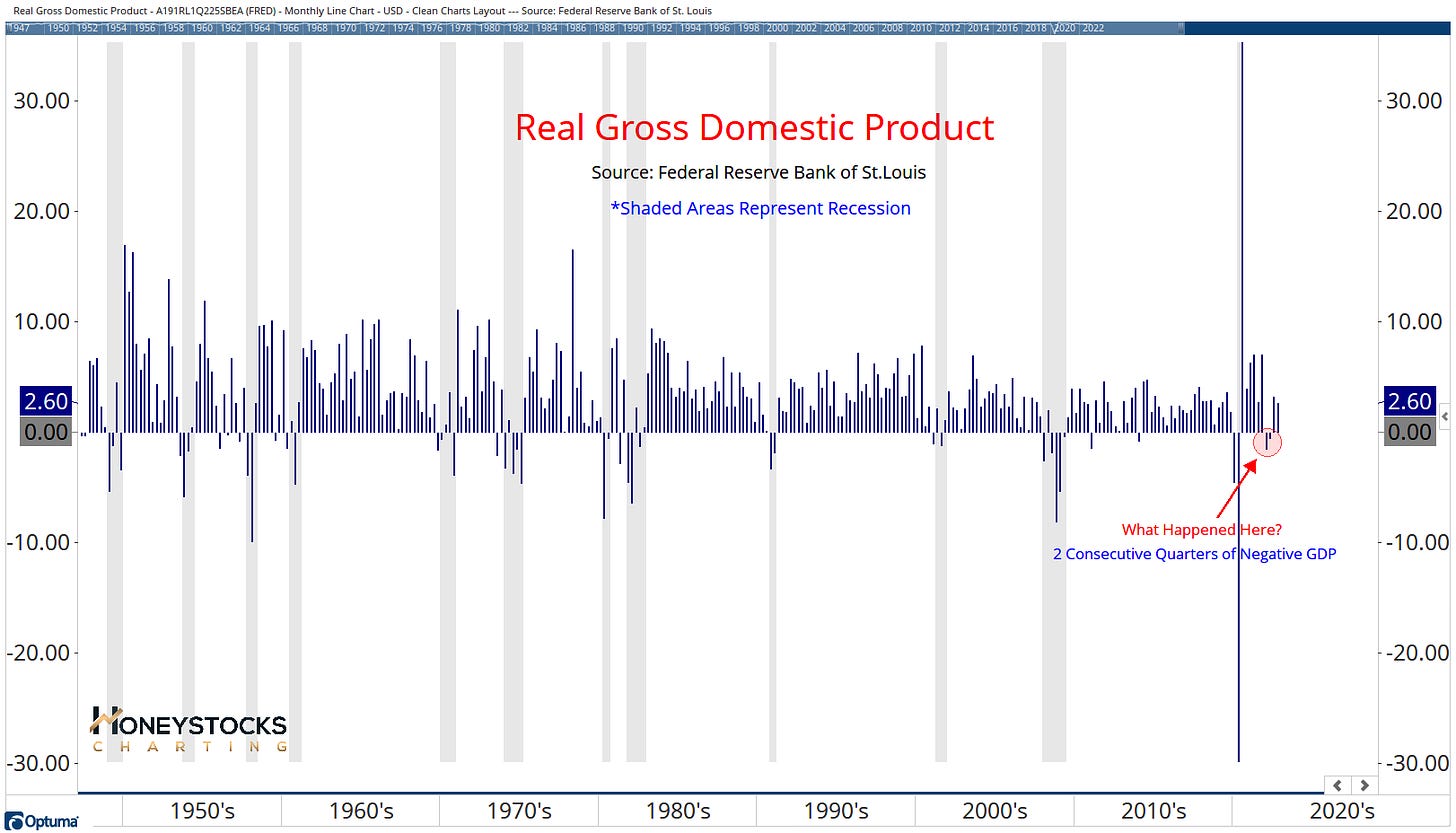

But what if we’re already are in (or already had) a recession and we end up looking back on the shifting of the goal posts shenanigans last year as being the bottom?

We already had 2 negative quarters of GDP, yet everyone seems to have conveniently forgotten about that.

Funny that huh?

When something doesn’t fit a mainstream narrative, it’s funny how things have a habit of being forgotten and re-packaged.

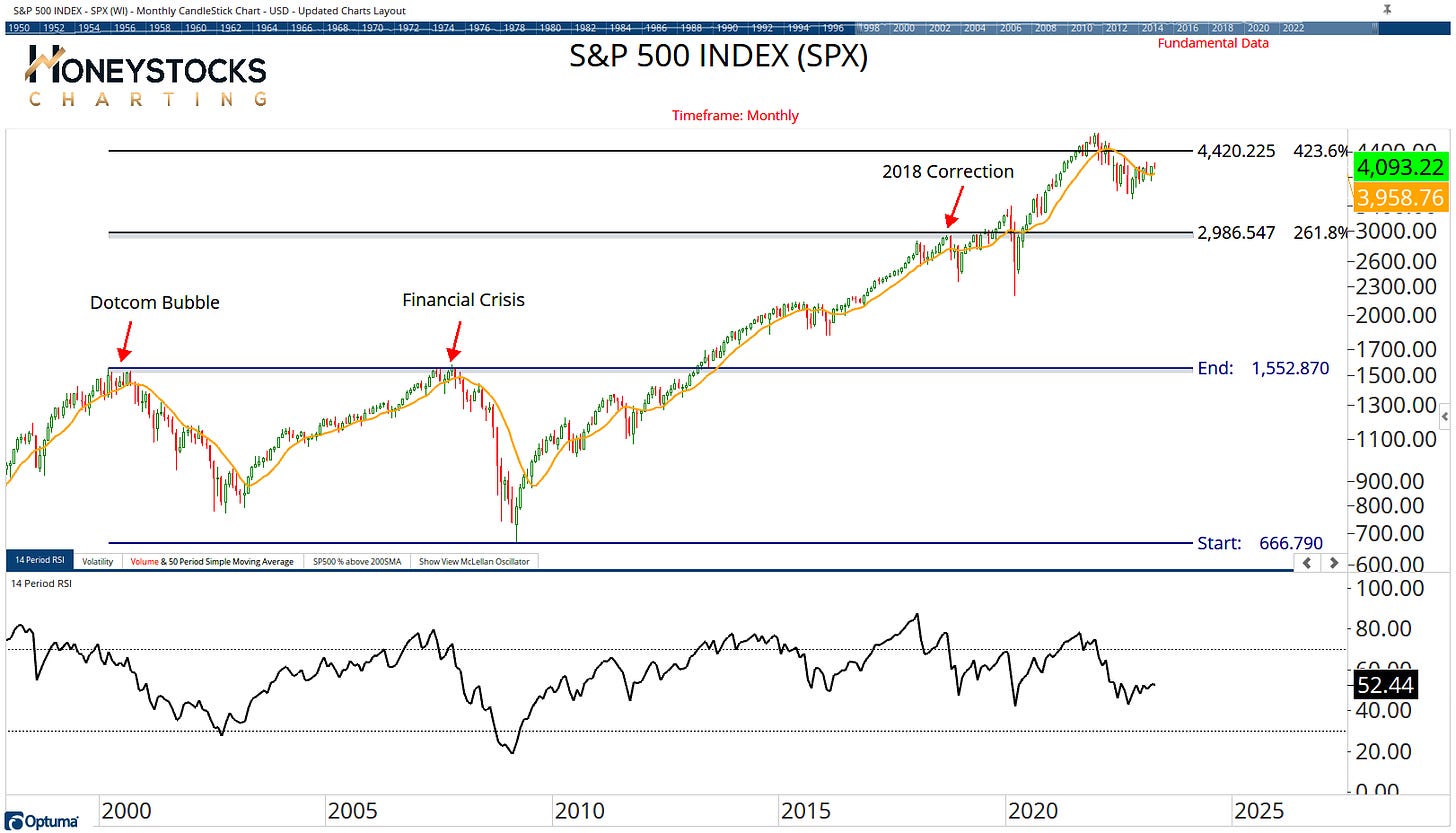

Lets take a quick glance at the current state of play in the S&P500.

I highlighted this chart 2 weeks ago, we’re still ABOVE the 10 Month Moving Average of price.

1 of the main issues I have with the perma bear narrative is that it’s proven to be completely wrong over the last 6 months. Which is kind of important.

Using economic metrics to time the market is (and always has been) a terrible way to make profitable bearish bets unless you’re an institution with deep pockets.

But let me be clear.

I wouldn’t advocate jumping late stage into rallies that’ve been running all year and I don’t advocate risky stocks to own (micro caps / small caps).

Look at the Micro Caps for crying out loud.

Micro Caps (IWC)

My work is largely focussed on good quality stocks, which seems to simple to say, but here’s the thing.

Every single 1 of us KNOWS what the good stocks to own are.

Knowing what the best stocks are, just helps me to understand what stocks I should be looking at from a risk : reward proposition.

Whether you have different opinions or not, price has told us (once again this year) that some of the best stocks to own have been the likes of AAPL, META, NVDA, MSFT, GOOG, MCD, DIS. GS, JPM etc - stocks we all know are good stocks because they’ve proven that over a long period of time.

META Platforms

Look at Zuck over at Facebook (or META as he insists on calling it now) - he’s CRUSHING it this year. Absolutely crushing it.

But you can’t go buying META up here, it’s just wayyyyy too risky after a 4 month 100% face ripper.

Many of the clown show have been telling you for months it’s over valued and about to crash.

I prefer systematic process over anyone else’s thoughts and feelings.

So where can we CURRENTLY look?

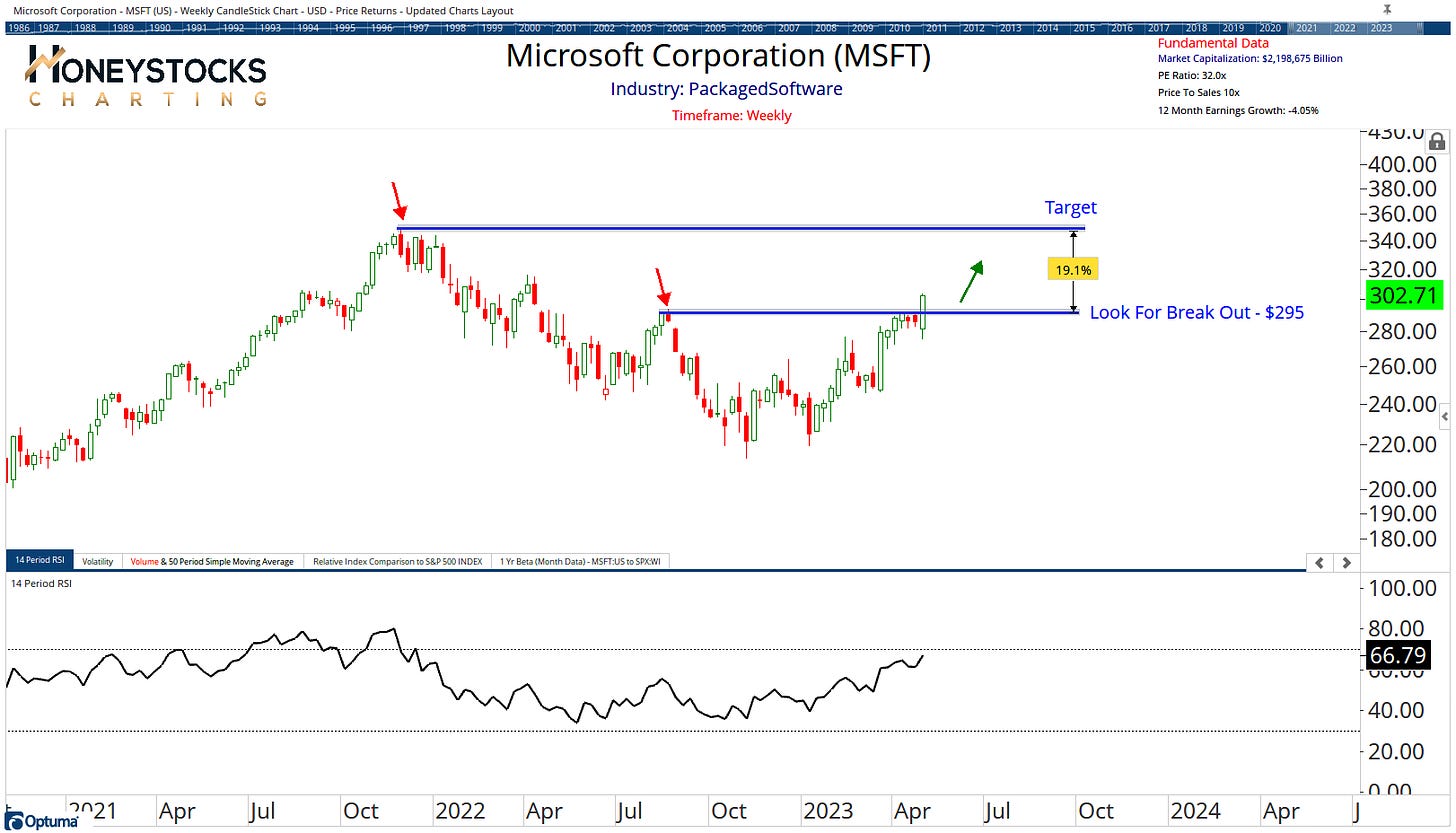

Microsoft (MSFT)

We prepped our members last week for the break out in Microsoft and with blow out earnings providing the catalyst, I’m working with logical upside targets.

If we’re above $295 - no problem.

Clorox (CLX)

Another 1 of our premium charts from 2 weeks ago is working well but with earnings coming up next Tuesday this would be a chart to consider AFTER earnings.

A good earnings rule to consider is to only hold through if you have a 10% profit buffer

I also laid out a BUNCH more via our YouTube Channel at the weekend.

In Conclusion

I’m open to all possibilities.

If the market crashes again tomorrow, next week or next year no problem. I’ll be on top of it.

If the market continues ripping higher for the next 2yrs, no problem, I’ll stay on top of that too.

It is choppy out there, I’m not oblivious to the back and forth nauseating, mundaneness of it all but there are opportunities if you know where to look.

We’ve gotten many of our clients/members 100% rippers in TSLA, NVDA and META already this year and no doubt more opportunity will present itself soon.

Please do check our membership options - it might just make a difference