Before I get into this weeks charts, if you find value from my charts, it would mean the world if you considered forwarding this tiny letter to like-minded friends so I can continue to grow.

Unless you’re living on the moon, you’ve probably noticed the gold bugs are getting excited. Not just a little excited, I mean really REALLY excited.

In this weeks letter I’m going to get into some of the key charts to watch over the coming weeks.

Before I get into the good stuff, I just want to give a late Thanksgiving thank you for following the letter this year and putting up with my sub-standard written English.

If you’re new around here, this FREE weekly letter has nailed every single major turning point in the market over the last couple of years within a week or 2.

I don’t know of any other analyst who’s been able to do that, let alone put the work out for free, so thank you to those who’ve helped spread the word this year.

Link To Our Key Time Stamped Work / Letters

Anyway, Gold.

Is it breaking out and what are the targets I hear you ask?

Gold Futures

As I write this a couple of hours before the market open on Monday, overnight, Gold attempted a break out and has given up around 3%.

That’s obviously a little inconvenient but there’s no doubt we’re on the verge of a break out that’s been a few years in the making.

A confirmed close above $2100 is the level for me.

SPDR Gold ETF (GLD)

I know most of us prefer ETF’s (I certainly do) and 1 of the charts from our ETF Chart Book is also setting up and the level for me here is $193.

For me though, and this is something I’ve been working with our clients / members on over the last couple of weeks is the setups developing over in the gold miners.

They move just as quick as all your momentum growth tech names and they’ve been great for the last couple of weeks for us.

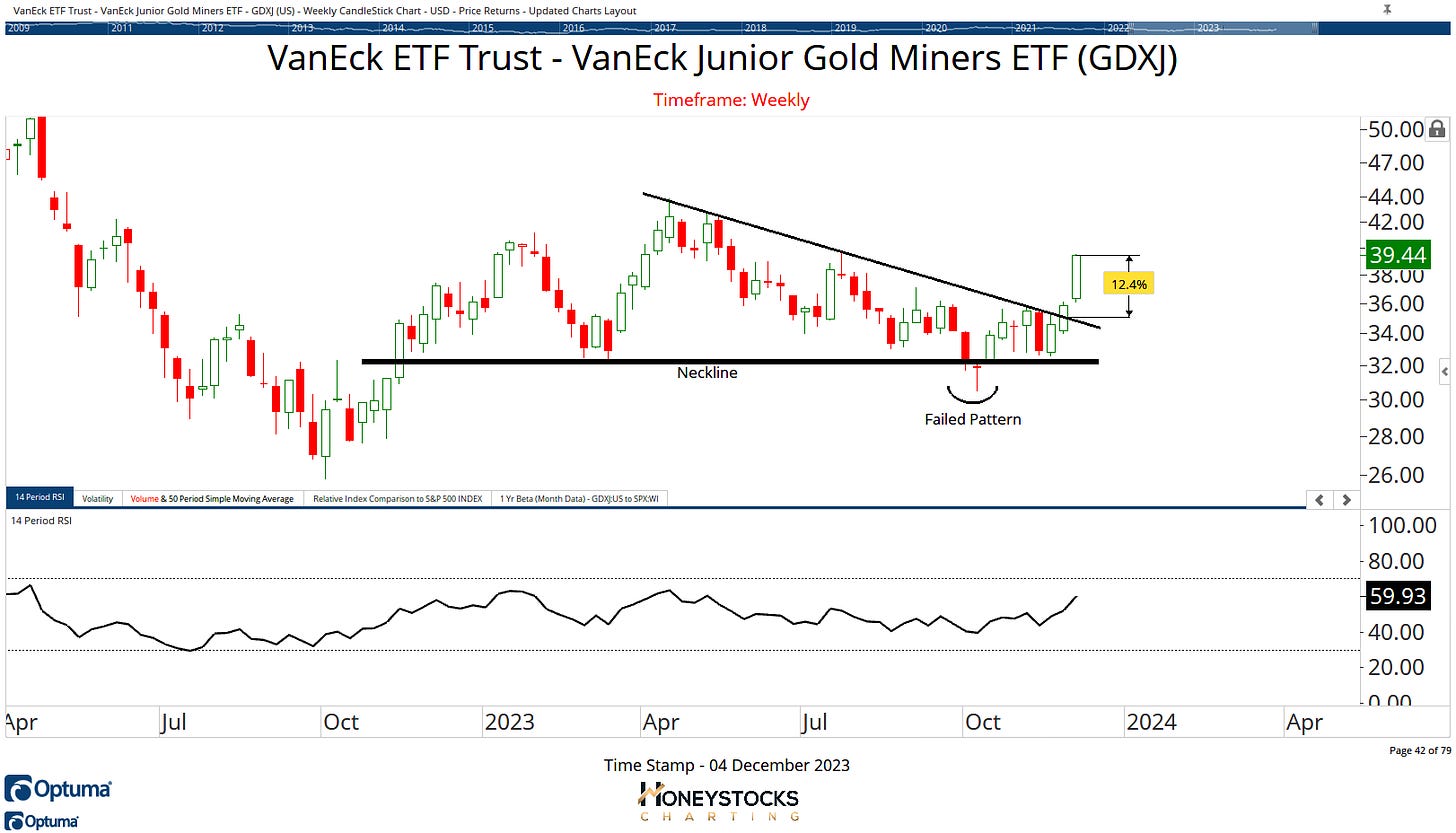

Junior Gold Miners

I’m not big on trend line break outs but when you see the pent up demand and take the time to go through ALL the individual components of the ETF and see everything setting up technically, trend line break outs can often make sense.

For Disclosure: My work’s been covering WPM, AGI, EGO, KGC, BVN, GDXJ and GDX

(Couple Of Those Charts Below)

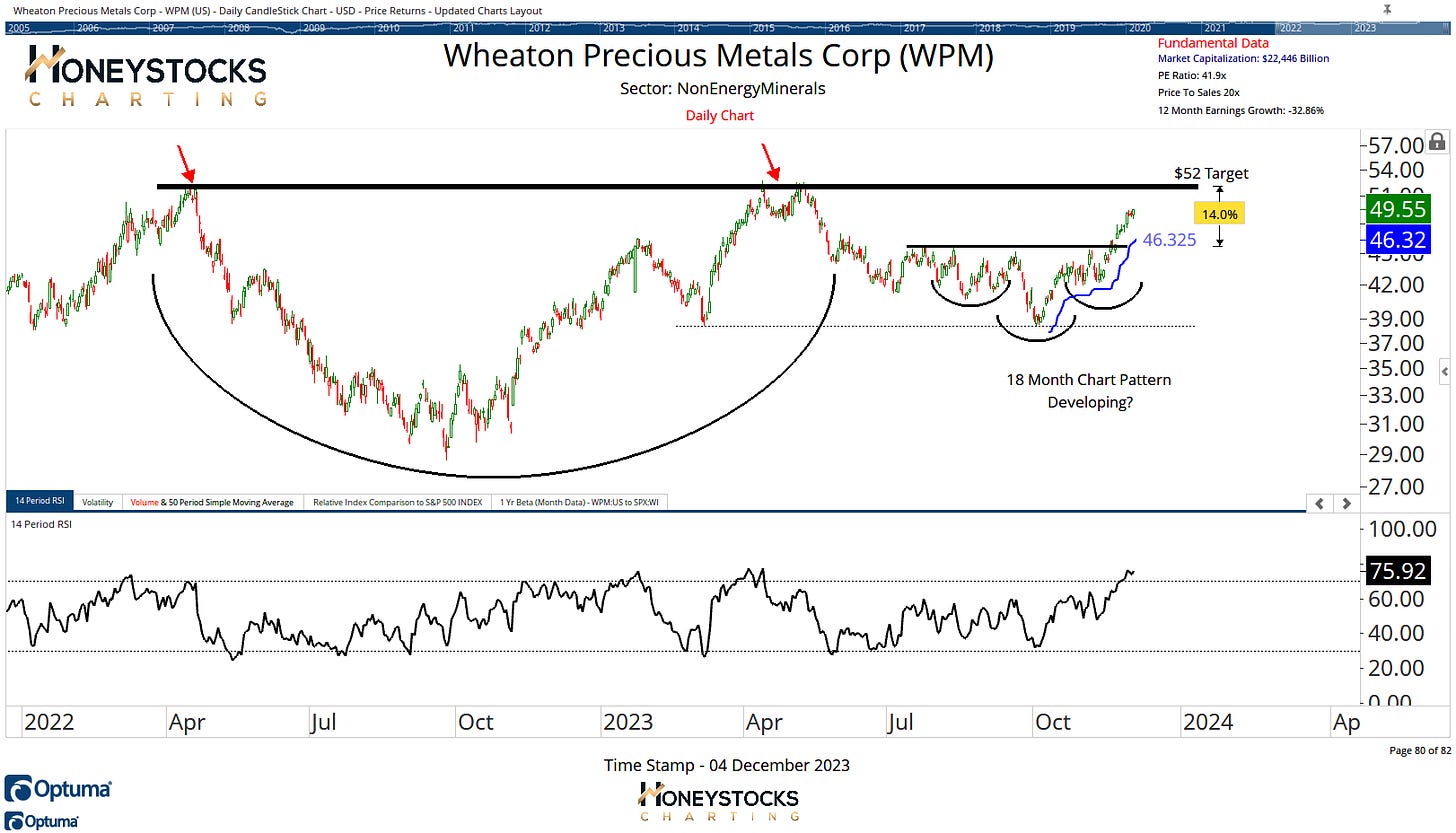

Wheaten Precious Metals (WPM)

Compania de Minas Buenaventura (BVN)

Whether these 2 names continue to rip higher or not will depend on what we see with Gold and whether it breaks out to new highs or if it falls away.

There is the possibility this is as far as gold and the miners go, but if you’ve bought into the miners, I’d always advocate using some kind of systematic process to keep you in the trend for as long as they’re going.

Broader Market Commentary

If you picked up my YouTube work last week, you already know my thoughts and how we’re looking at the markets just now.

If you missed it, you can catch it below.

With the Dow pushing against all time highs and another few % left in the Q’s, the catch up trade over the last couple of weeks has been in the small / micro / mid caps and these names continue to rip higher.

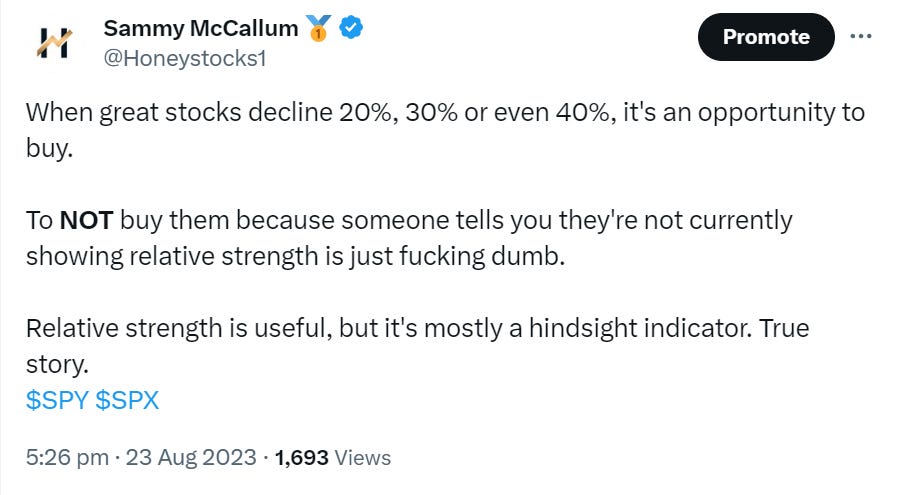

Something we’ve been WELL on top of and if you’re someone who listens to some of the biggest condescending dummies in finance, the relative strength gurus, you might have missed some incredible moves over the last few months.

I get tagged in data tables, I get told O’Neill doesn’t approve of buying low, I get insulted, I get nasty emails….

So here’s a tweet I think encapsulates my views.

In Conclusion

My favourite indicator isn’t even a technical indicator, my favourite indicator’s when I get insulted and folks tell me I’m wrong.

I love it because it tells me the dumb money isn’t paying attention.

I think we can all learn from that.

Have a great week folks. See you next week sometime.

Access All Our Chart Books And Premium Work