There’s a lot of pressure on my 1st letter of 2023.

Exactly 1 year ago, I made a bearish call with the letter - The Great Valuation Reset, hindsight now tells us that’s exactly what we got, but rather that continually dine out on past market calls, I prefer to look forward and you probably should too.

The lessons of 2022 will absolutely last a lifetime for many, but it’s a new year, which means more new data and “potentially” a new approach.

This week, I’m going to dig into some new/updated charts and hopefully I can give you some golden nuggets and food for thought going into 2023.

Disclaimer: I don’t care where the trends are - I just find them

Europe 600

When everyone was busy losing their minds in October, my memo to our members and clients was to start looking at buying stocks.

Not just any old stock, but value stocks in particular, because its been that way all year.

The less Tech exposure the better, that’s what price has been communicating for 12 months, and given Europe is HEAVILY weighted to anything BUT tech, Europe continues to make a lot of sense, especially if the top 600 Stocks are breaking out.

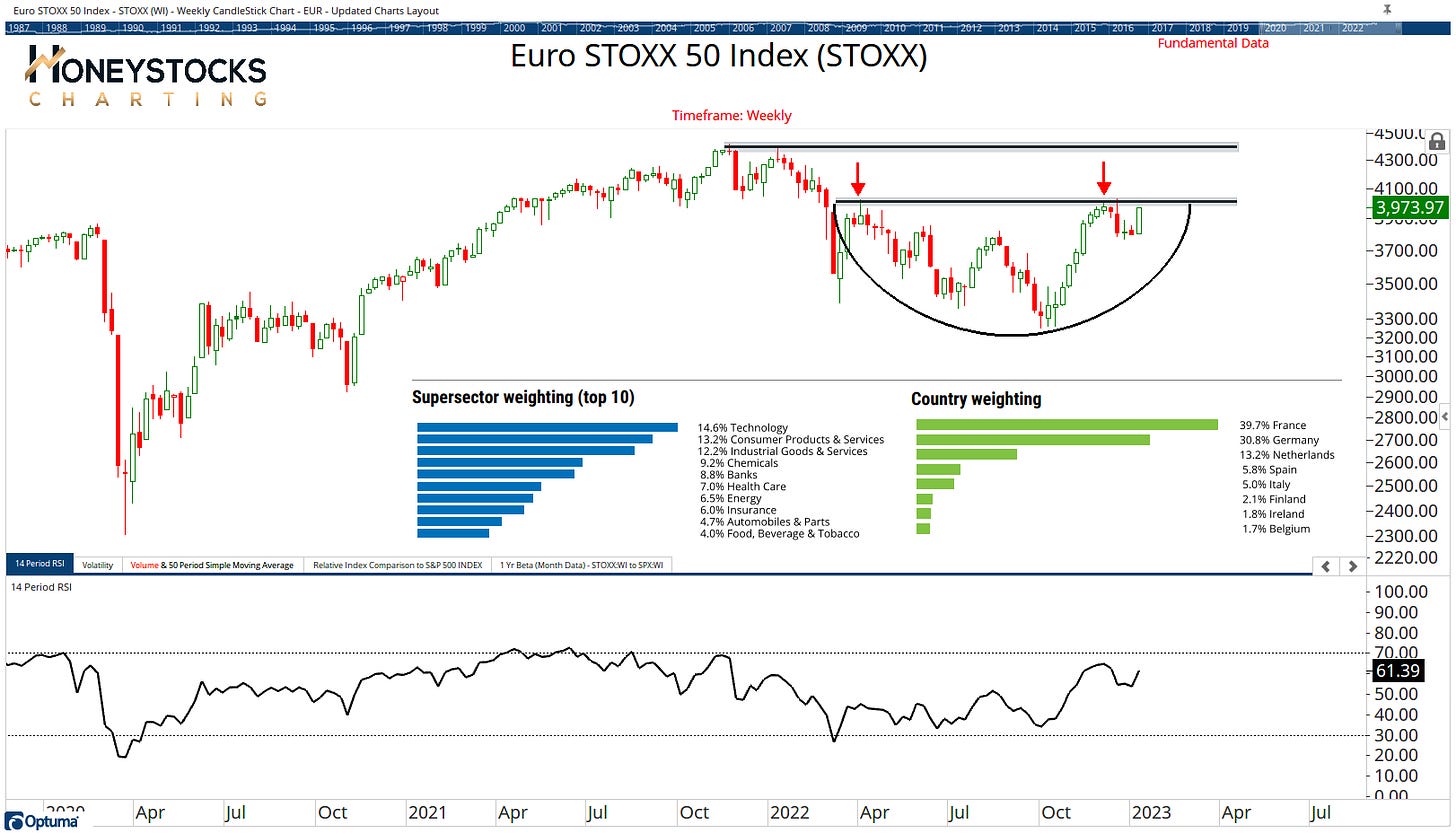

Europe 50

Same story with the top 50 stocks in Europe.

I think we’re basing and potentially gearing up for a break out.

I know what some of you are thinking… what about a nuclear war… what about inflation… what about this, what about that.

Price and charts take away ALL emotion and the thoughts and feelings… because thoughts and feelings help nobody. Price is the only things that pays, so I prefer to pay attention to that.

UK - FTSE Index

I made a bottom call on the UK back in October, same story, we’re approaching a logical target level for the FTSE… but if it breaks out, what do we think happens with the Europe 600 Index given the 25% UK weighting?

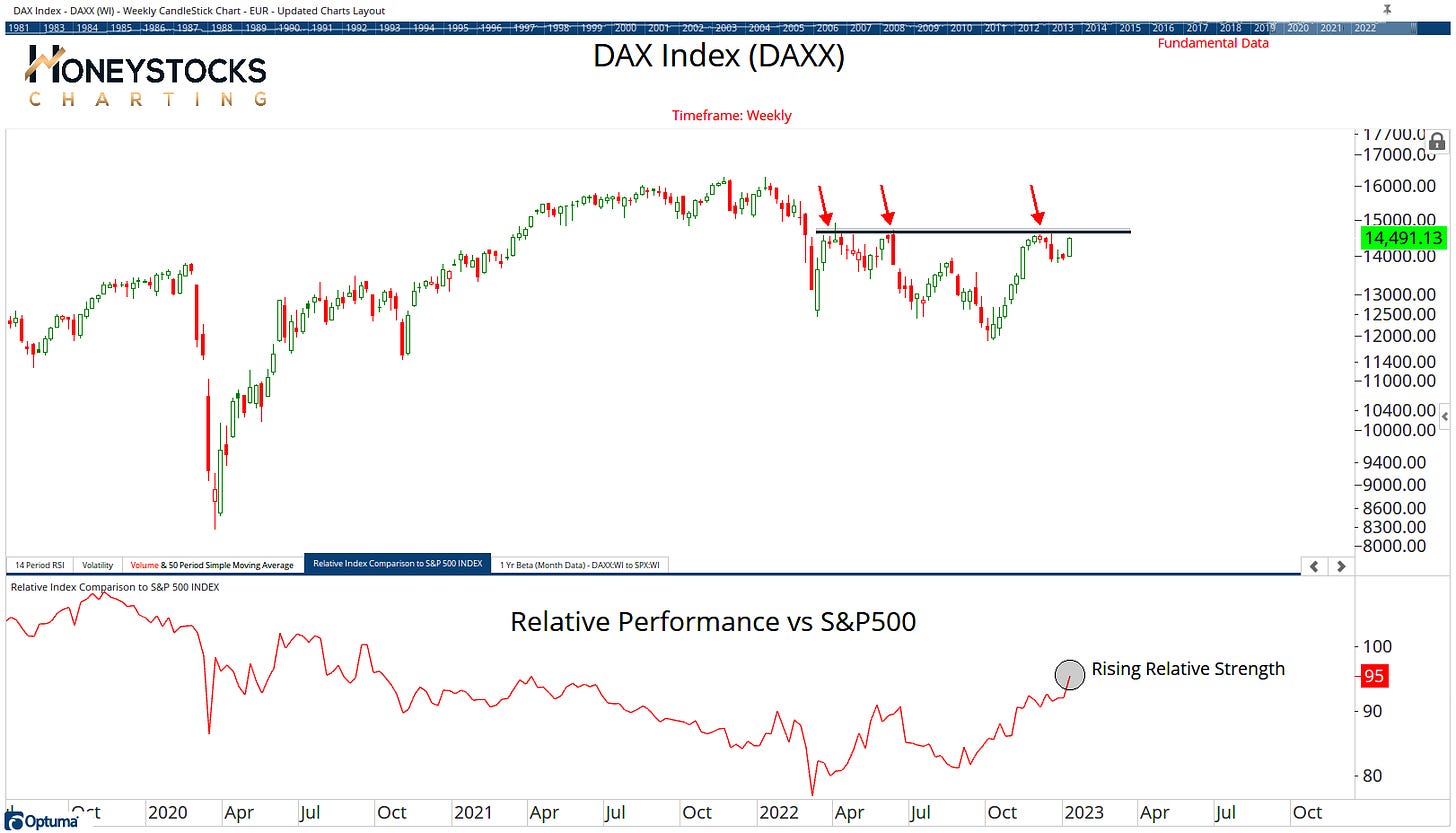

Germany - DAXX index

Same story. We’re approaching big technical levels in Germany.

But please let me be clear about something because I think it’s an incredibly important point to make.

There are opportunities everywhere, and I do mean everywhere.

Europe, US, Technology, Industrials, Energy… I promise, there are opportunities absolutely everywhere.

To find them, you need to look BEYOND the market cap weighted averages which are wayyyy too heavily weighted to big tech.

You need to put in the hard yards and look at hundreds (and for us professionals) it means thousands of stocks are filtered and analysed.

Junior Gold Miners - GDXJ

Look at Gold Miners.

We’ve been bullish on names like Barrick Gold (GOLD), Wheaton Precious Metals (WPM) and Newmont Corp (NEM) for the past month- most of these names are already +10 to 15% over the period, but hopefully they’re only just getting started.

The break outs in both GDXJ and GDX are constructive for those who missed the initial moves in the individual names.

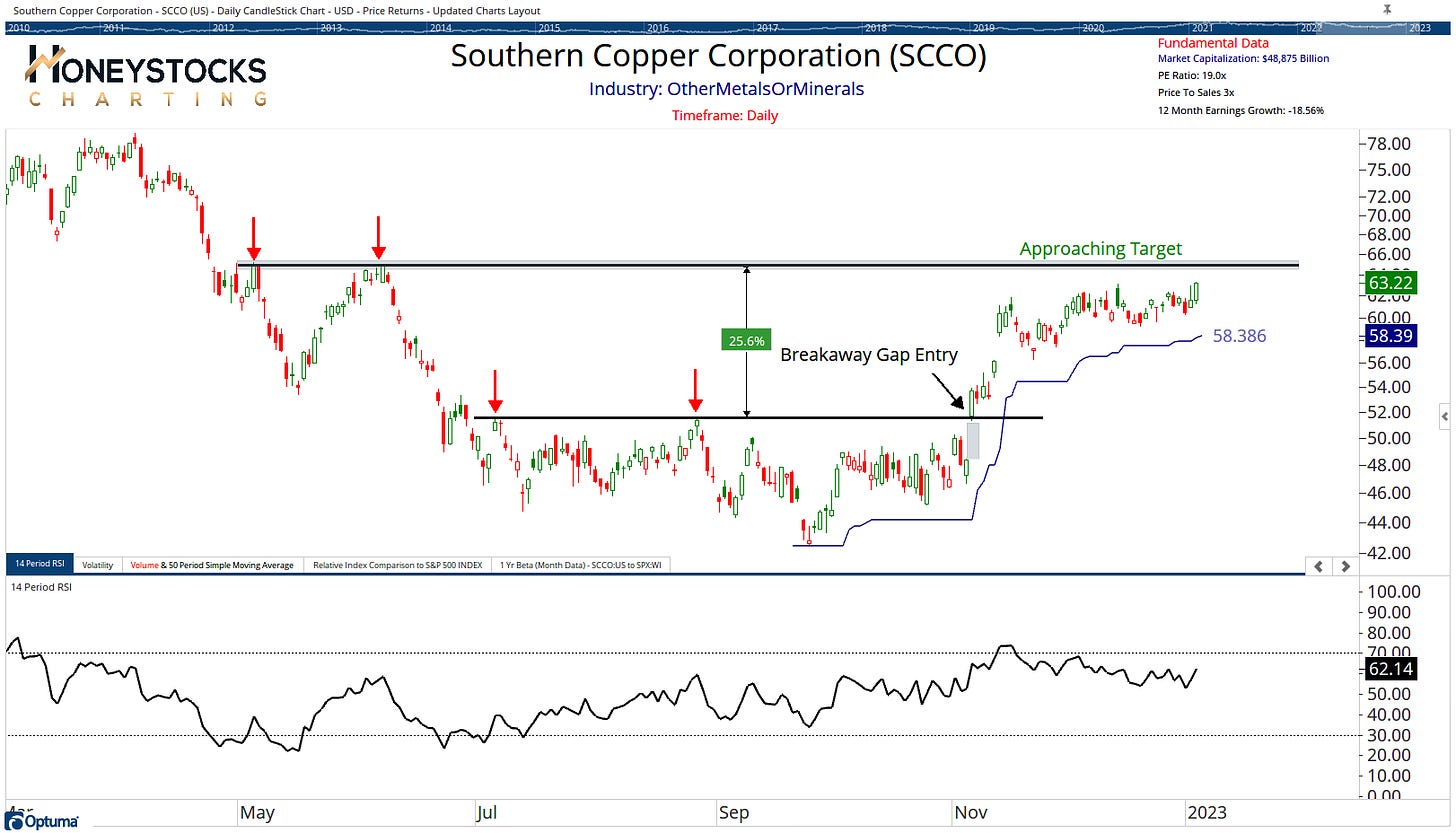

Southern Copper - SCCO

We’re also mindful of upside objectives being met in some of our recent recommendations.

The way I see it, I much prefer identifying uptrends in areas of the market going up, rather than buy blindly stocks / areas of the market going down.

In Conclusion

What worked 2yrs ago during the growth tech glory days, is not working today.

I think the market is being pretty clear about that and it’s been clear for 18 months now.

When the market is screaming something from the rooftops, I think it makes sense to listen.

If all those European charts break out at once, hold onto your hats.

I’ll be watching price, what will you be watching?