Is this the most hated rally of all time?

It’s definitely up there.

On one hand we’ve got the perma-bulls screaming it’s just getting started, and on the other hand we have the perma-bears willing the market lower armed with nothing more than some jedi mind control and some cherry picked economic data.

If you listen to them, you’re probably convinced another market crash is imminent and just around the corner.

I don’t like narratives, I prefer price, so lets continue to focus on that.

Here’s the state of the S&P500.

SPDR S&P500 ETF (SPY)

We can see the S&P500 (which I should say I DON’T consider to be a good representation of the market) is trying to break out again above this problematic $420 level with poor underlying market breadth.

But lets take a quick glance at the May numbers.

Invesco QQQ Trust (QQQ) +7.8%

S&P500 (SPX) +0.2%

Dow Jones (DIA) -3.3%

Equal Weighted S&P500 (RSP) -3.8%

NYSE Composite (NYA) -4.2%

It’s definitely not a healthy market just now. I think anybody with half a brain can see that.

Last week I covered the potential for some weakness in Europe and whether it could spill into the US Markets, but you could probably argue the weakness is already there.

What’s causing it?

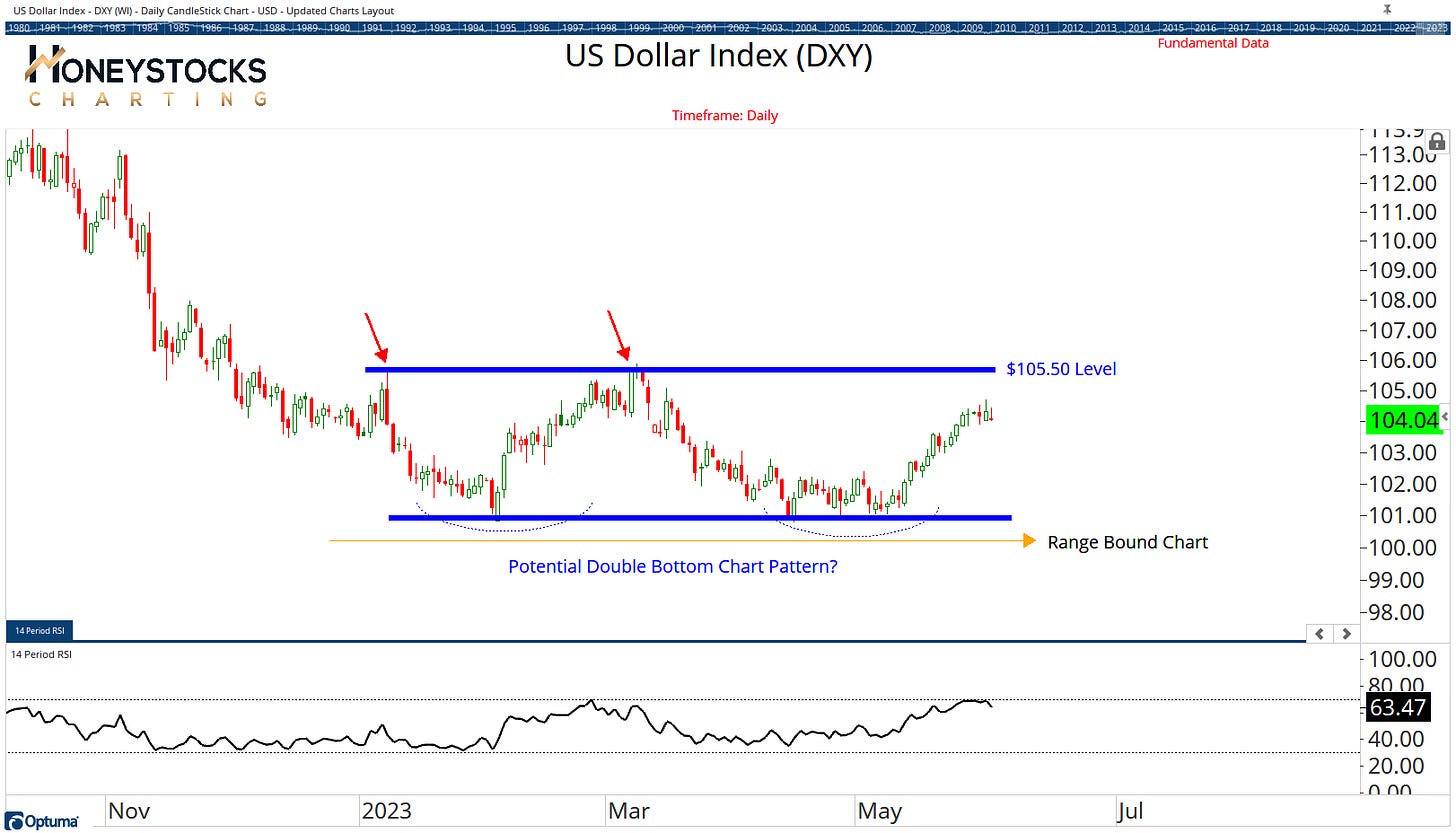

US Dollar Index (DXY)

Notice how the US Dollar started going up the 1st week in May and stocks have suffered the consequences?

For me, the US Dollar is still THE chart to watch.

It’s been a wrecking ball for a couple of years now, and it continues to tell us through price that it’s going to continue to be a wrecking ball and that’s information to pay close attention to.

For me, that $105.50ish level is front and centre.

SPDR Communications Sector (XLC)

I hear it all the time.

Usually the question looks something like,

“But Sam, it’s just 10 stocks holding up the market, how can you possibly have any confidence in putting out ideas and alerts?”

I say, great, if the big, liquid stocks are going higher, and people are buying them, and the market’s telling us they’re being bought, then maybe you should consider buying them too.

Look at XLC for crying out loud, it’s breaking out and making new 11 month highs.

Should I give more weighting to what small regional bank stocks are doing when I’m looking at the components of the Communications Sector?

Or should I consider what price is telling us is happening with the Communications Sector?

How about Amazon?

Amazon.com (AMZN)

We got our clients and members in at $100 and it’s doing incredibly well with both stock and options, but is it breaking out again?

Should I worry about economic data and micro caps with this chart or should I worry about what Amazon is doing and the 1 share Jeff Bezos bought this quarter?

In Conclusion

I look around the world markets and see things well just by using price.

It’s way I’m wired, I like things that make sense and perma-bull or perma-bear narratives don’t make much sense to me.

90% of the time I just see confirmation bias everywhere, whether it’s the rising wedge brigade or the doom-mongers pushing opinions, it’s why I mostly stay off social media nowadays and follow such few folks.

I get mild anger when I see the Fin-Twit “experts” telling 750k followers that “few understand this” while their ETF is down 40% over the last 2yrs, but somehow those of us who read the market well are dumb for buying stocks like Nvidia or Meta at the beginning of the year.

I already know what I would need to see to take defensive action, our clients and members know too, so until we see what we need to see, it’s business as usual.

If the market crashes this week or this year, no problem, that’s where risk management and pre-planned game plans come in.

Prepare for all outcomes is how I learned it.

Have a great weekend.

Check our membership options. We might just make a difference.