Ok, hear me out this week. It might be important.

If you’ve followed my work for more than 5mins you’ll already know I’m not 1 of those hindsight Harry’s and I’ve got a pretty decent record of pinpointing important market turning points and laying things out in advance.

In this weeks letter I’m going to put out what I think are some of the more important charts to consider over the Christmas period, just in case worst case scenario plays out.

Let me be clear about something before we get started though.

For this phase of the market, we’re currently in a super bullish environment, which is full of rotations but we’re also seeing a lot of exuberance and arrogance out there, especially in the professional world, and that’s information I also pay attention to.

I don’t see many folks presenting well educated, well thought out analysis to help folks prepare for a possible down turn, especially with the Fed moving markets this week so here’s a few charts I think are worth considering.

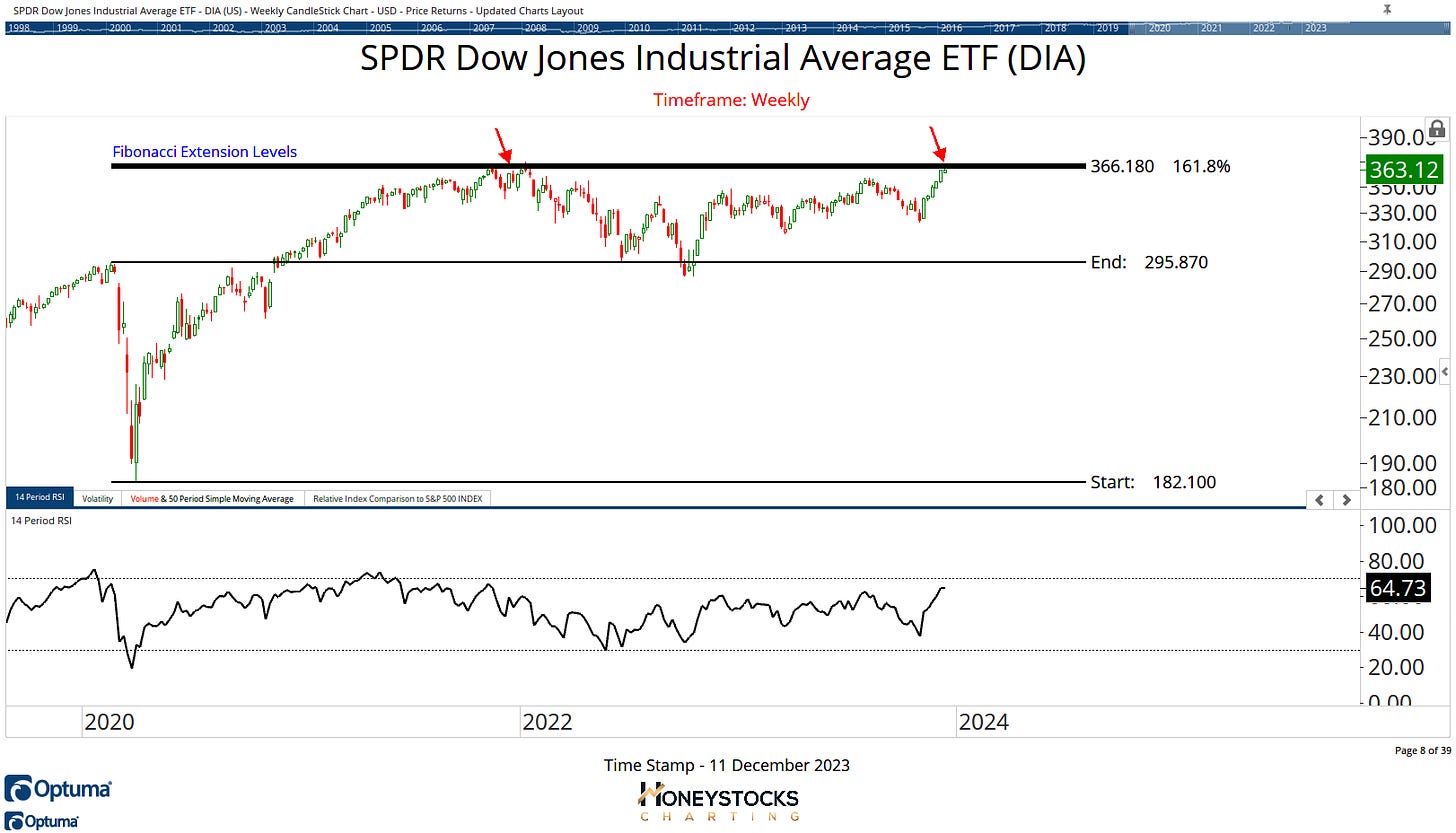

Lets kick things off with the major averages and good ole Papa Dow.

Dow Jones Industrial Average (DIA)

For us, we’ve now hit our upside targets in what some argue is the most important index in the world.

Call me crazy, but in my technical world, I think it would be perfectly healthy and reasonable for the market to chop and digest some of the recent gains it’s made over the last few months at these levels.

I think we’d all prefer an immediate break out to new highs because it’s easier to make money when stocks are going up, but as it stands, I probably lean more towards some chop at the index level for the Dow.

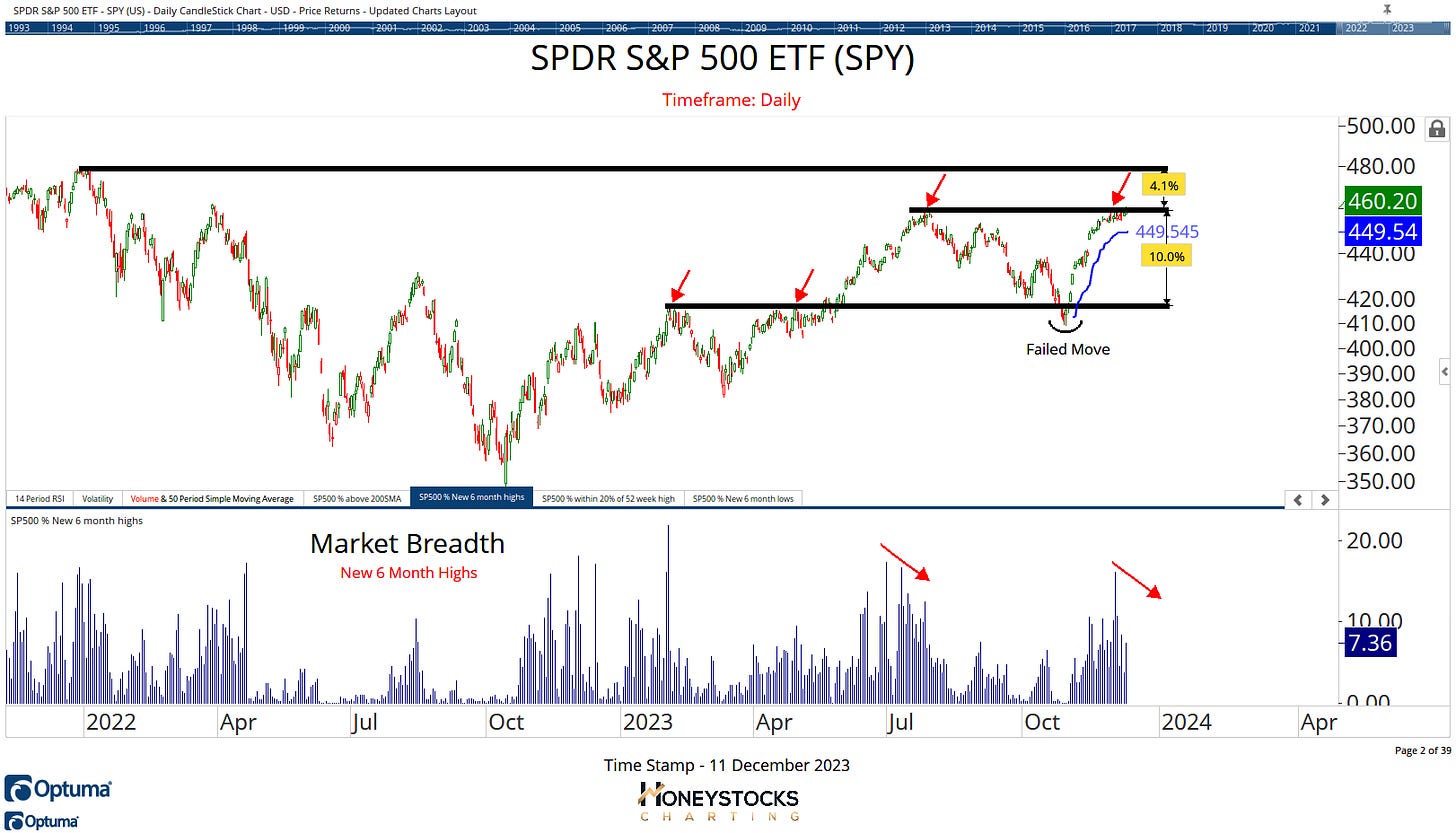

S&P500 ETF (SPY)

The S&P has a very similar kinda look and while there’s probably another 4% left to squeeze out of it going into year end, I can’t help shake the nagging feeling that perhaps things aren’t as bullish as they might appear.

Market breath is a funny wee indicator because you can pretty much cherry pick the narrative you want to present.

There’s a breadth indicator for everything, but I like to pay attention to % of new highs / lows.

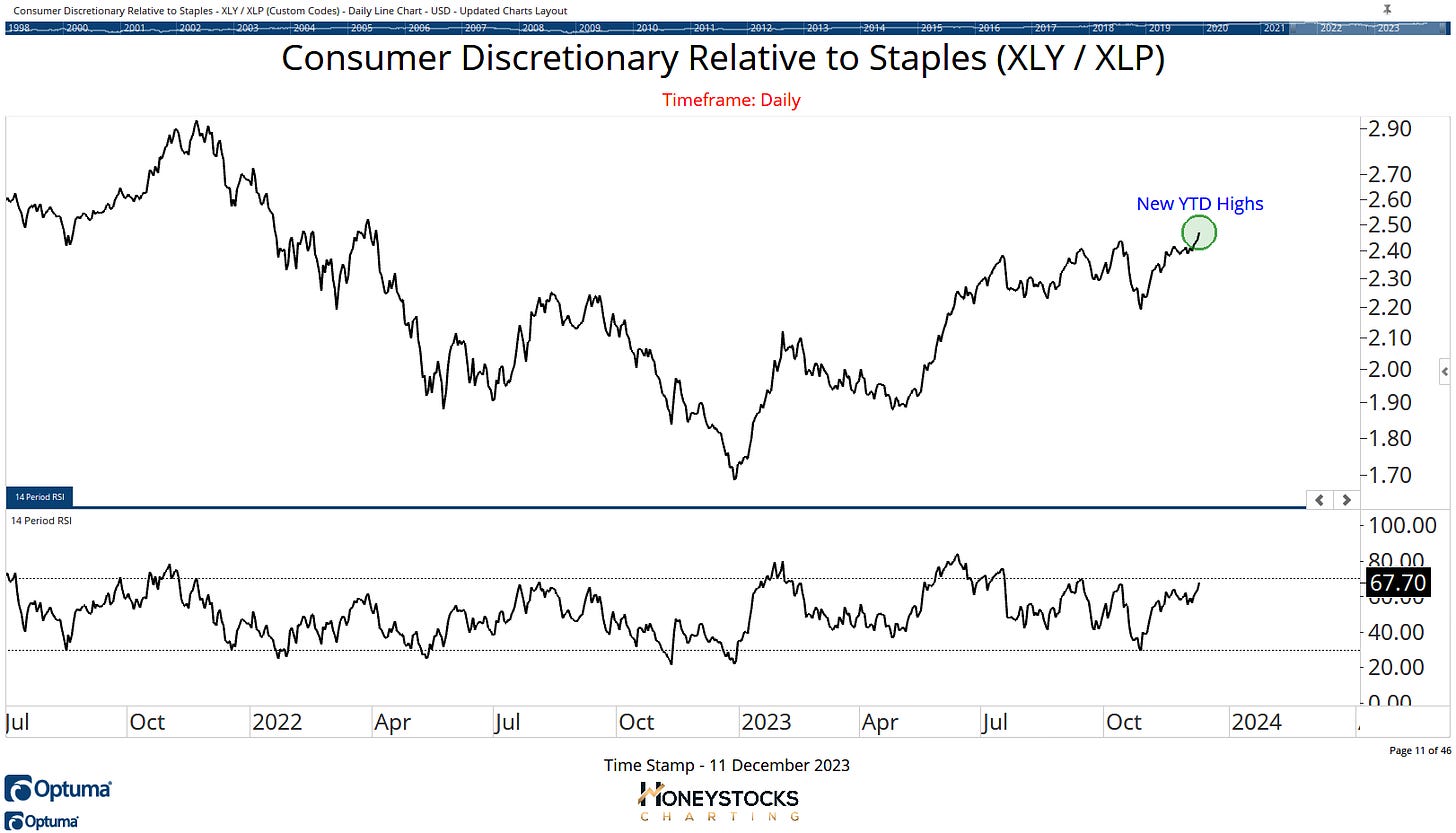

Consumer Discretionary v Staples (XLY / XLP)

Professionals / Bulls are also looking closely at the ratio between Discretionary v Staples because of the strong correlation with the US Markets.

If this continues to resolve higher, it’s hard to imagine stocks struggling in that environment, and it’s worth pointing out that despite the potential chop at the index level, it MIGHT be giving the clue to whether the Dow / S&P500 break out over the coming weeks.

But, for me, the next chart is the absolute key to everything.

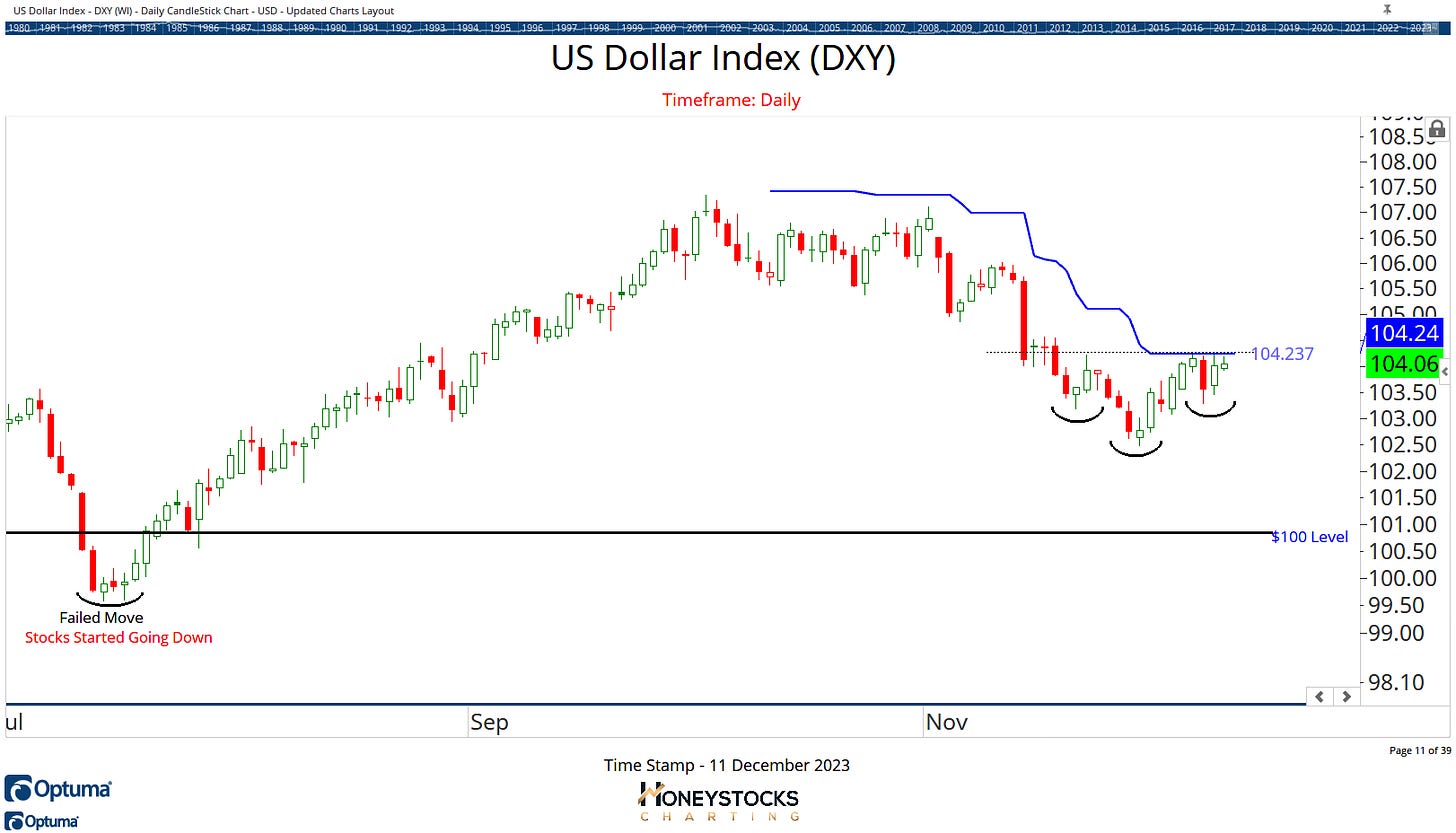

US Dollar Index (DXY)

What the US Dollar does at these levels is going to dictate what comes next for the markets.

Does the recent downtrend continue (this is currently the bet my work has been making over the last 2 months), or are things not quite as bullish as what they seem?

I like to ask these questions and prepare in advance “just in case”.

If the Dollar reverses trend, I think that’s information worth paying attention to because that inverse correlation with US stocks is still very much intact and you’ll likely see the discretionary / staples ratio roll over too.

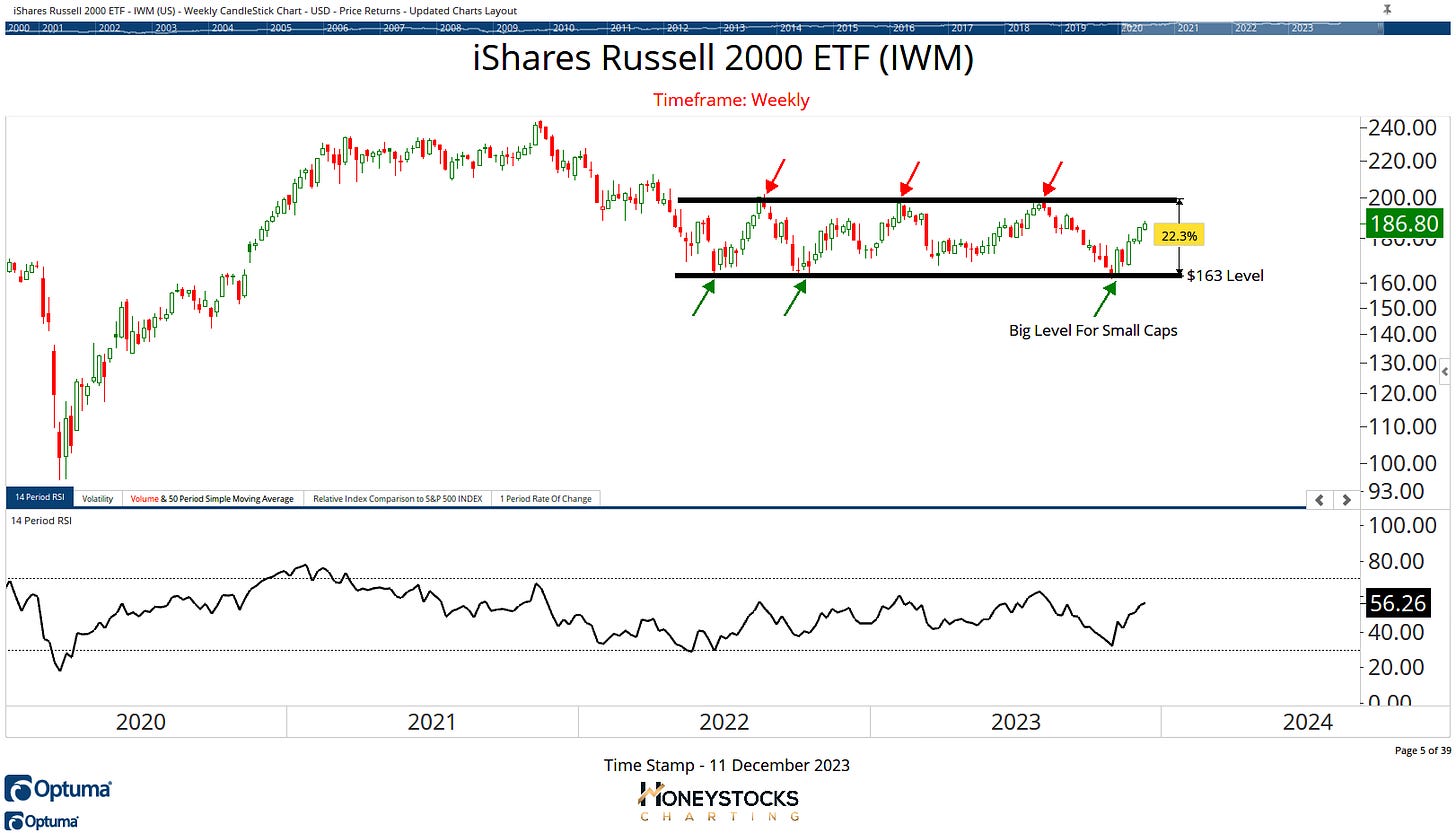

Russell 2000 (IWM)

Over the last few weeks, our premium work has had a heavy focus on the rotation into small / mid / micro caps and crypto, and that thesis has played out pretty much as expected.

We do still have a few % points left in our targets but I’ll stress again, that the US Dollar will dictate whether these upside objectives are ultimately met.

Coinbase (COIN)

Coinbase has been 1 of our high conviction crypto plays over the last month and it’s worked VERY well with 75% upside targets met in a matter of weeks but the message to our clients / members over the weekend was to keep an eye on the chart for a possible break out above $150 for a further 35% potential upside.

It’s a big ask because those crypto names are due a breather, but the chart might be worth keeping an eye on for a significant pull back also.

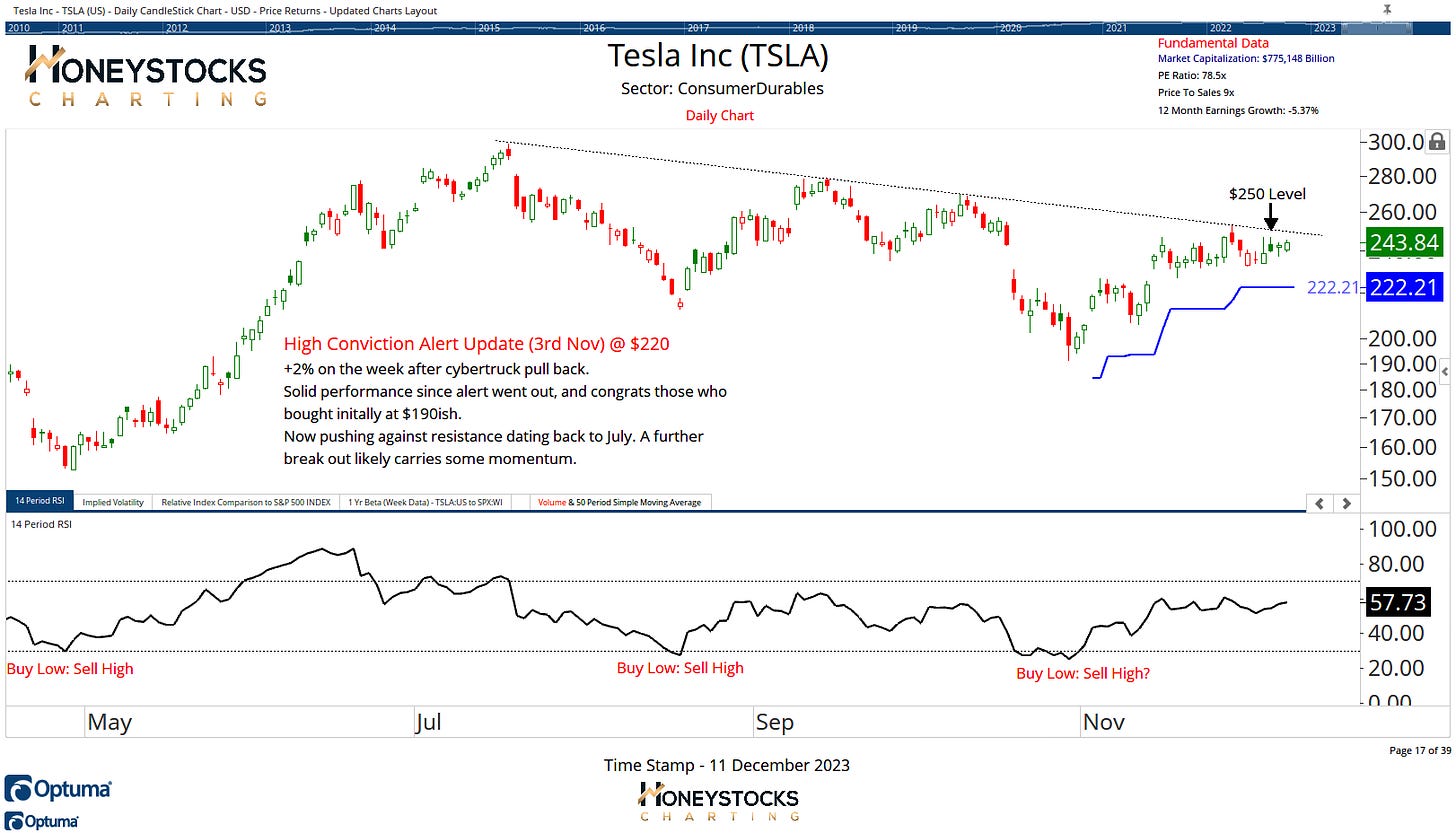

Tesla Inc (TSLA)

Tesla’s been another of our high conviction ideas over the last few weeks because I like these buy low : sell high opportunities on mega caps, it continues to work well (albeit it’s been flat for the last couple of weeks).

I think it’s coiling up for a potential monster break out (provided the dollar doesn’t rip higher).

In Conclusion

To be clear again, we’re bullish and we remain bullish and we just put another 12 bullish stocks to our members at the weekend.

But I learned a long time ago to prepare in advance for every possible outcome and while we’ve been wildly bullish for a few months now, and nailed pretty much every theme in the market (bonds, dollar, stocks, rotations)… I’m now starting to look at what it would take to get defensive after the recent run.

I don’t see any harm in being prepared.

It’s better than listening to the perma-bear doom mongers, or the overly exuberant bulls gloating their way around social media just now.

If you keep missing the big market turning points and want access to our weekly analysis and best charts every day, you should consider checking out our premium options at the link below. I’m told my work’s the best.

Have a great week, I’ll catch you next week sometime.