If you find value from my hard work below, please do consider sharing/subscribing and also following me on Twitter where I also post lots of useful charts and data.

So, we’ve gotten another Fed interest rate decision out the way and the market reacted as it always does.

For the bearish among you, I suspect there’s a high degree of probability you’re experiencing some anger accompanied by a healthy side order of sheer disbelief.

The stock market continues to rip higher, and I get it.

Look at the Yield Curve for crying out loud.

Yield Curve

How can the market continue moving higher in the face of an imminent recession and mass job layoffs?

The curve is lower than it was in 2000, whilst stocks are breaking out all over the place making new 6 month highs.

Unless you focus on the charts, it’s really really complicated and unbelievably confusing.

But as you know, I prefer charts, so here’s a 1 chart snapshot of the stock market.

NYA, IWM, SPX

We’re now seeing some of the big hitting analysts turn bullish on the market 4 months after stocks stopped going down and they’re now throwing around words like “soft landing”.

You can’t make this stuff up.

If you haven’t realised the mainstream media “personalities” throwing around clickbait headlines are after the ad money yet, let me be the 1 to break it to you.

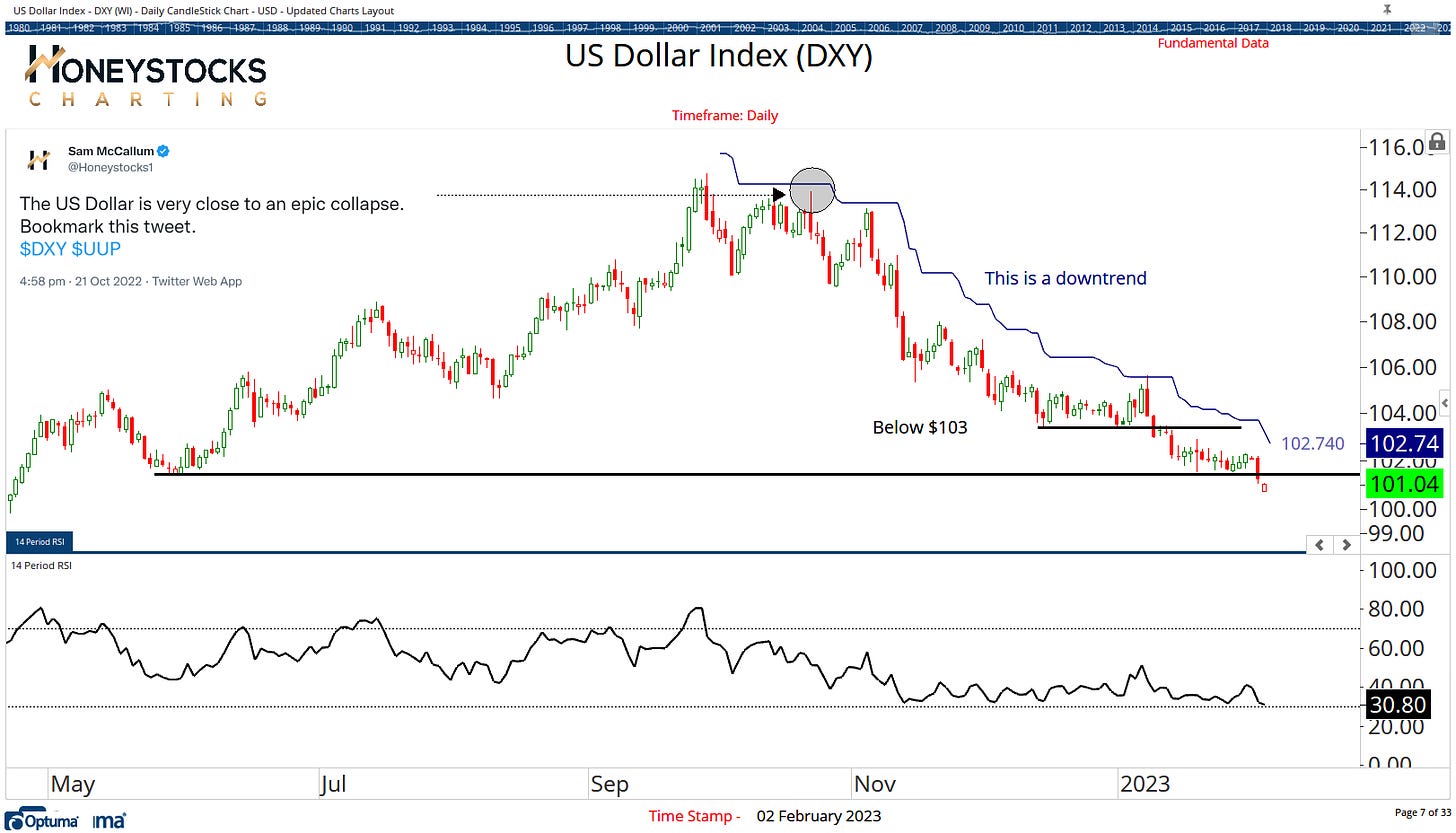

US Dollar Index (DXY)

I keep hearing words like “this won’t end well” or “the market’s a scam”.

It’s the same folks who don’t watch the most important charts in finance.

Once you start viewing it as extreme confirmation bias that isn’t reflected by the reality of price, things become easier.

The US Dollar has nailed every theme of the market over the last couple of years and it’s breaking lower once again. I called it on the 21st October and stocks have been ripping ever since.

SPDR S&P Retail ETF (XRT)

You should whisper this to anyone who’s bearish because telling them retail stocks are breaking out is only going to result in more anger, so it might be better to keep this between you and I.

If these levels hold in XRT, I don’t see what’s wrong with looking at some of the names therein.

Conclusion

Whether you want to acknowledge it or not, stocks (for this phase of the market) bottomed last year.

Could the market collapse at any moment and could it collapse at current levels?

Sure, of course it could.

I’d have to be a complete idiot to not have a plan of action.

Last night I laid out in our premium work for members what would need to happen, so it’s just basic common sense to be open to all outcomes.

In the meantime, we’re over here re-assessing bullish targets on some massive moves our members have been enjoying this year in names like META, TSLA, NEM and AMZN.

I prefer systematic process over headlines.

It’s just easier that way.

Please do consider Subscribing and Sharing with like-minded folks. It’s free.

Alternatively, feel free to check out all our Membership Options below.

Agree with the analysis, but Grammar police take issue with “between you and I.” 😉