With September continuing to run true to form at the index level, after yesterdays Fed induced market down-turn, the focus now switches to what comes next.

If you picked up last weeks letter which included some of the key charts to watch for a more broad based market sell off, those charts could now be starting to play out.

If you missed it last week, you can catch it here - The Mild(ish) Bear Case For US Stocks.

Despite all the perma-bear doom-mongering these last 2 months, loads of stocks have been doing incredibly well in the value space.

This has been where the bulk of my work has been focused, but the big question I’m now asking is, are these trends now about to come to a shuddering end?

This week, I have a few charts I think are worth some consideration.

Russell 2000 (IWM)

I presented this chart last week, and yesterdays price action is incredibly problematic from a risk management perspective.

At a minimum, the chart is communicating… be careful.

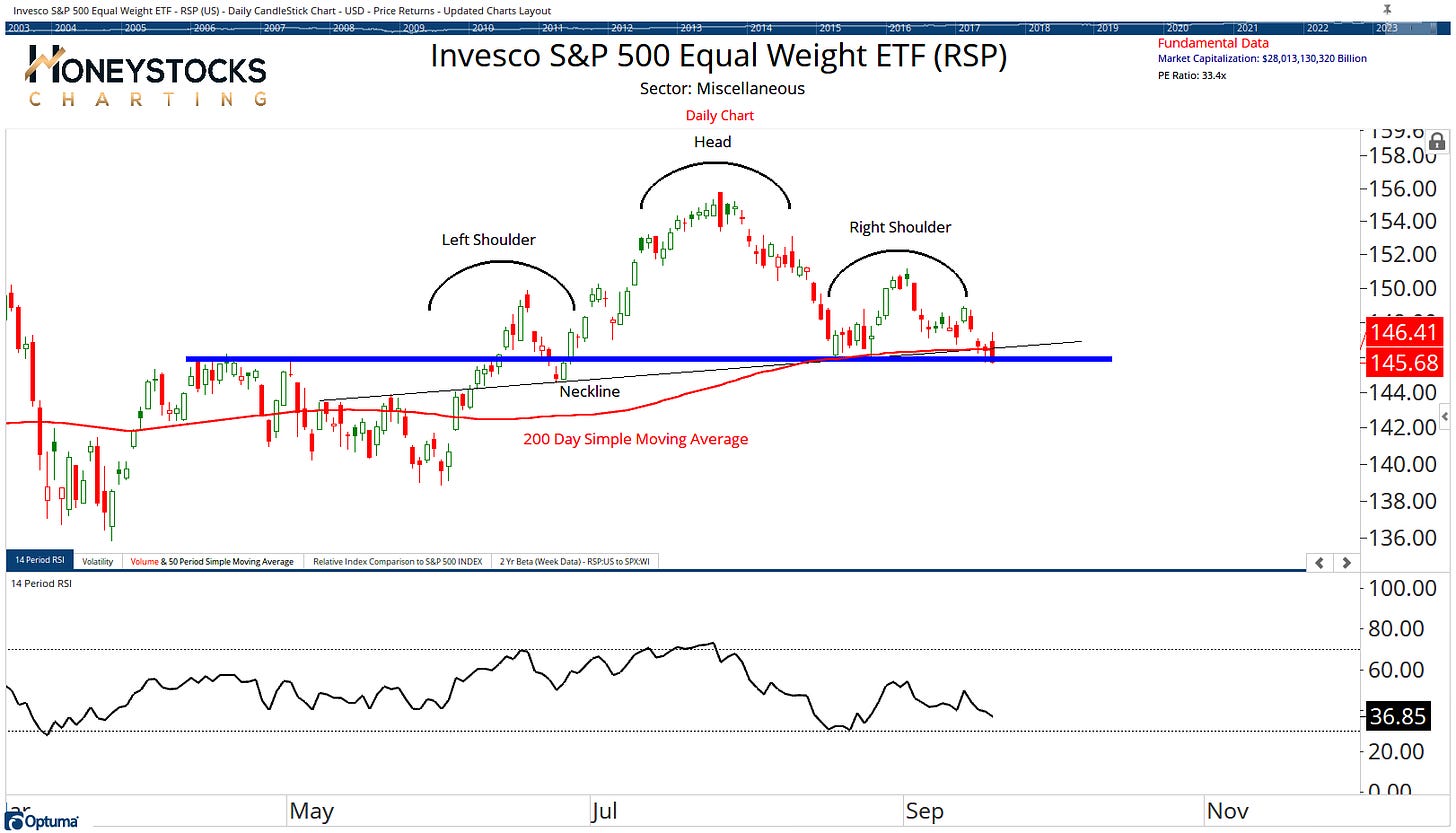

Equal Weight S&P500 (RSP)

Same look / setup is developing in the equal weight S&P500.

Again, it’s not a fantastic look for a very important chart, and it’s probably another of those data points that says “be very careful”.

Oil Markets

Lets keep it real.

Energy has been 1 of the only (and best) games in town over the last few months and I said a couple of weeks ago it was worrying me that all the relative strength analysts were now jumping onto the energy bandwagon.

Low and behold, Oil has now stopped going up at logical levels and this is now translating into energy stocks stuttering and stalling along with the rest of the market.

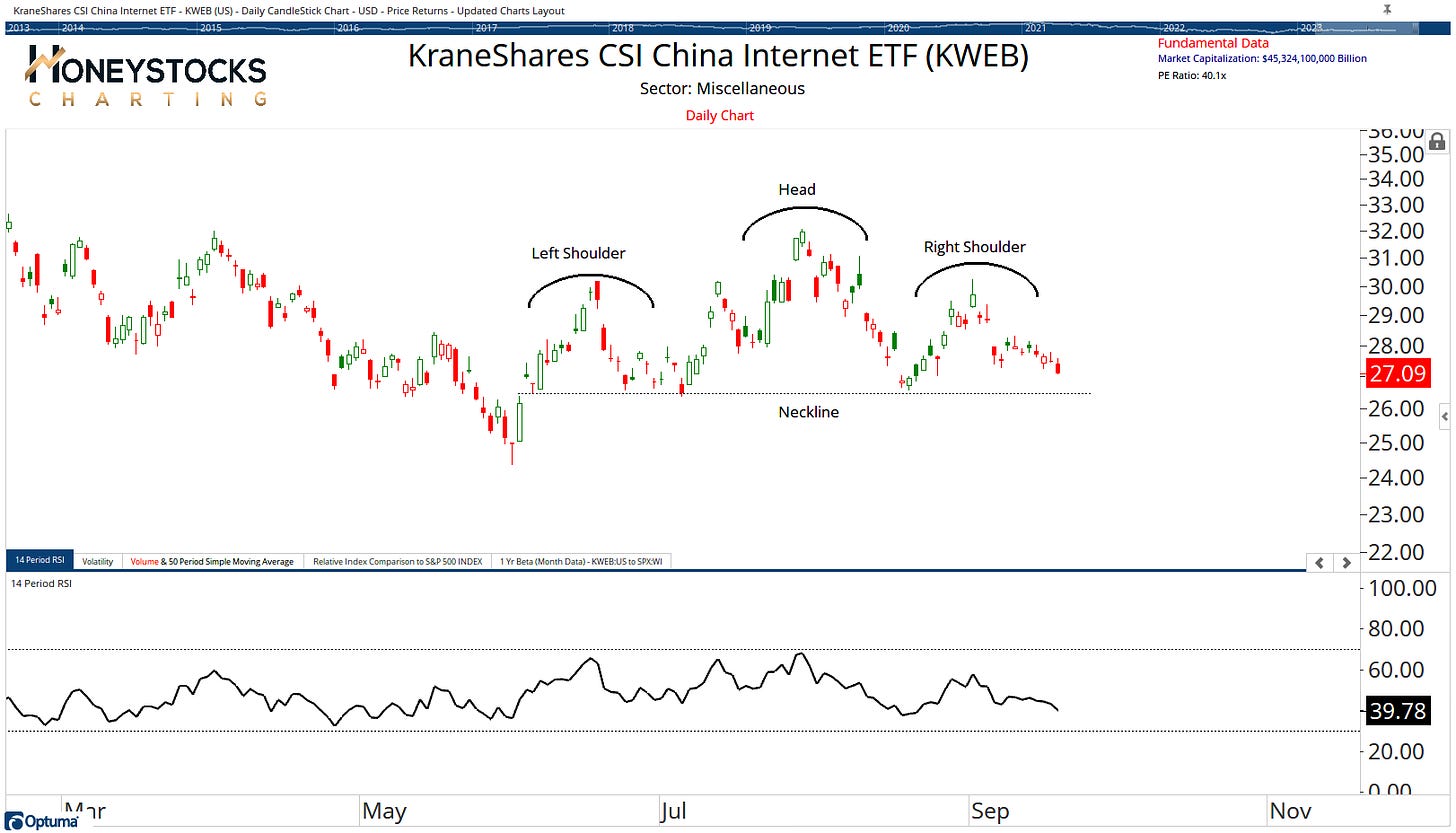

China (KWEB)

1 of the bearish charts from out ETF chart book (we cover 120 of the most liquid ETF’s from around the world) has the same look.

China has been under pressure for a long time.

It’s a choppy area of the market, very back and forth depending on the news of the week, but the chart is now looking very problematic for Chinese equities.

I have a heap of bearish charts (like the ones above) already prepared for participation on possible market down side for our subscribers.

You can access those below.

In Conclusion

Risk management is the only thing you have control of.

Over the coming days, you’re probably going to see a lot of fear inducing headlines and a lot of doom mongering coming at you from all corners but I’d encourage you to not lose sight of the opportunity that lies ahead.

Many of the risky small / micro caps have already corrected/crashed, and while those names could get a whole lot worse, my attention has already turned to identifying the buying levels for those stocks and the levels to buy into the best Technology stocks that’ve been beaten up these last few months.

For me, preparation is better than panic.

It also wouldn’t surprise me in the slightest to see the market close the month in the green.

I’ll be watching the charts rather than the headlines. How about you?

Stay safe out there, see you next week.

Access Our Real-Time Analysis And Charts