Let me get it out there straight off the bat so there’s no confusion.

This weeks letter isn’t a prediction, I don’t even think it’ll happen, but in the interests of preparing for the worst case scenario, I have some charts I think everyone can pay close attention to “just in case”.

If you missed our previous letter at the weekend where I talked about it being a stock pickers market, you can catch that here, my views haven’t really changed - A Stock Pickers Market

But lets not mess about, lets just get into the charts.

For disclosure, I’m providing bullish AND bearish charts to our clients / members just now.

I have no interest in doom-mongering or perma-bulling, both are equally as bad.

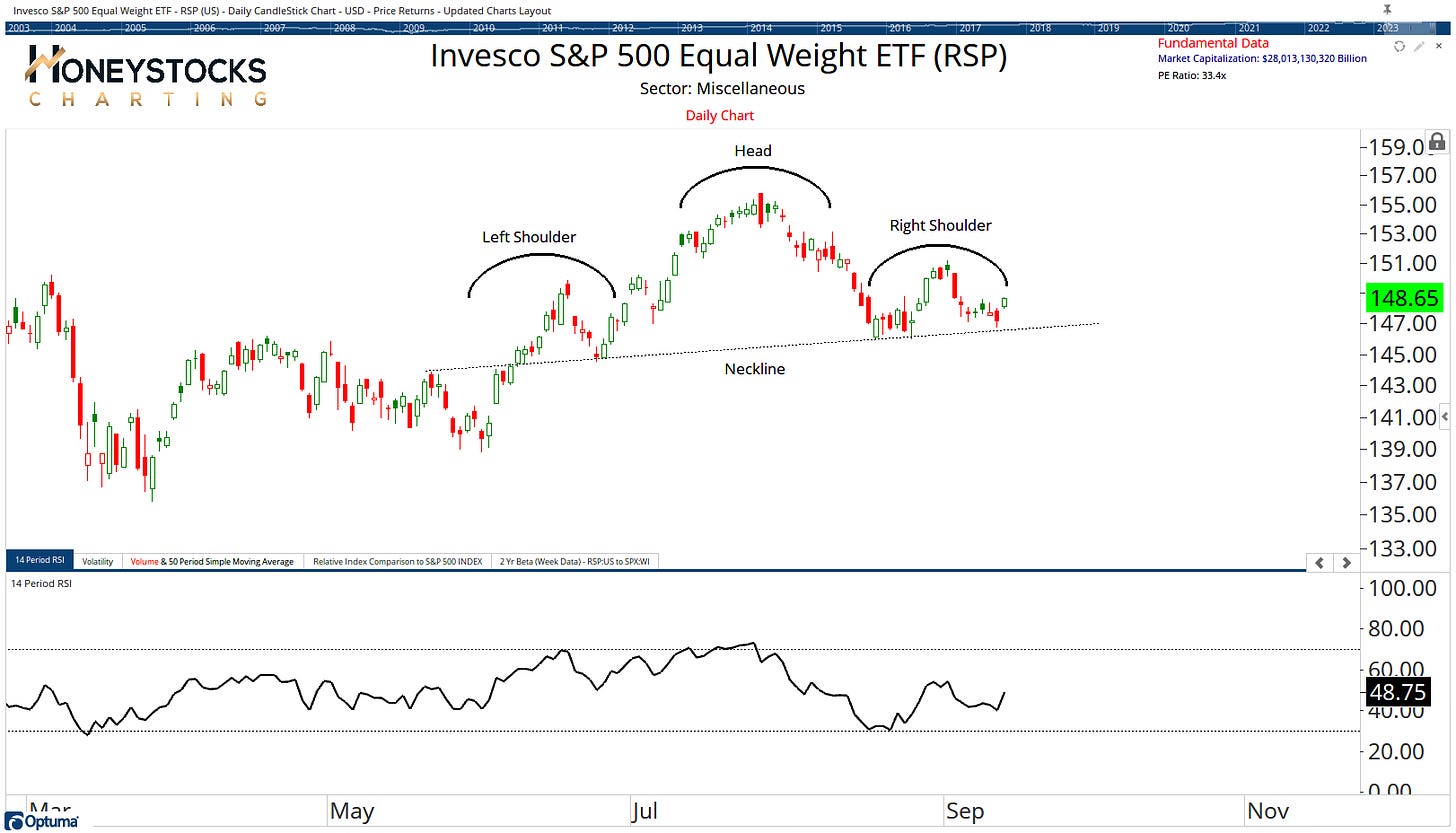

Equal Weight S&P500 (RSP)

If you’re looking for a decent picture of the market just now, equal weight S&P500 is a good snapshot.

Whether chart patterns are your jam or not, the basic point the chart is making is “look out” if the RSP chart resolves below the highlighted neckline.

I should probably add that I never advocate front running chart patterns, because they often about turn in double quick time and resolve higher.

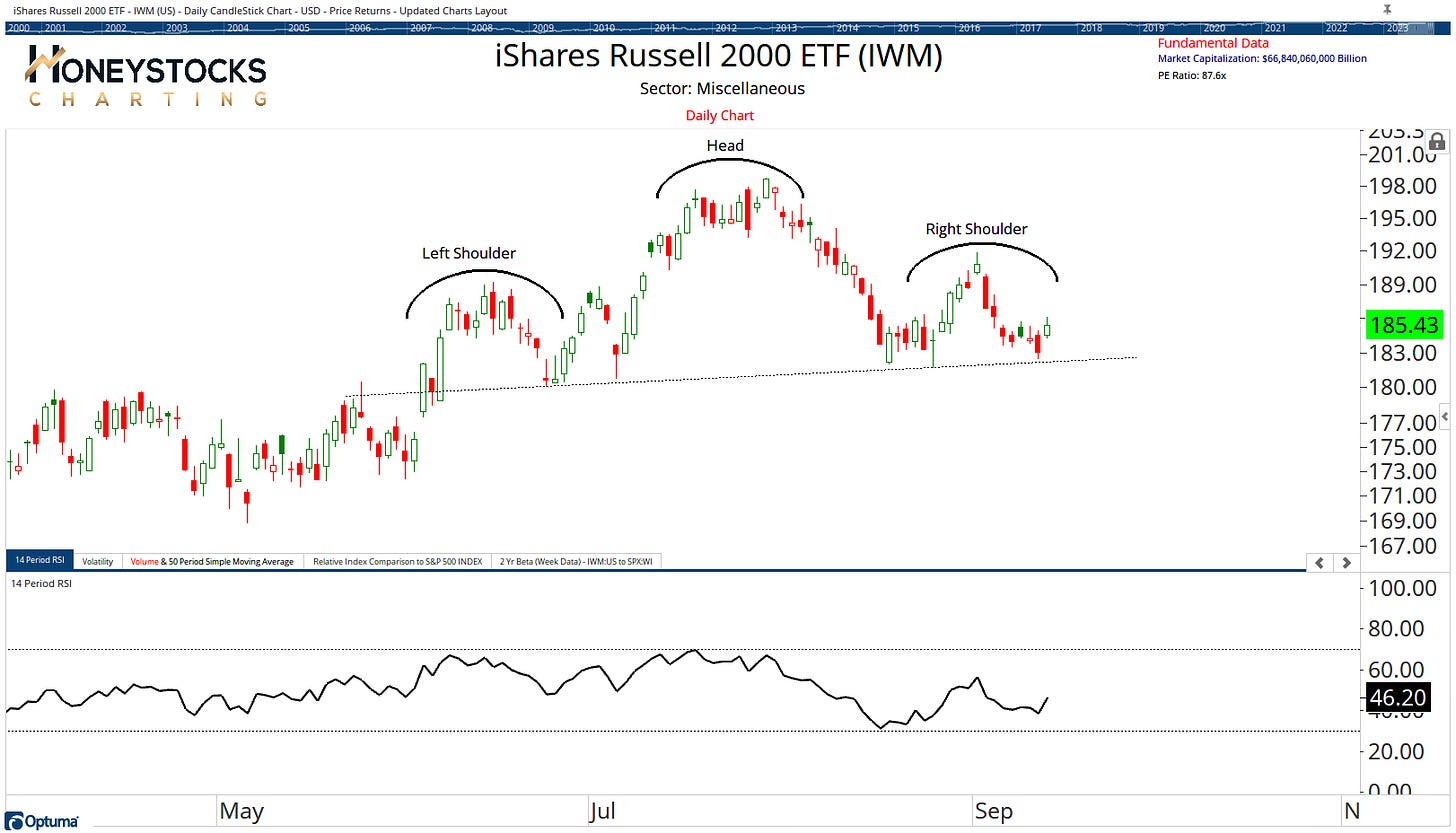

Russell 2000 (IWM)

It’s the exact same look for the small caps and essentially the same message.

If you want to remain confidently bullish, you just want to see things hold up at these levels.

Apple Inc (AAPL)

Apple has obviously had a lot of airtime over the last week and it’s front and centre for many given that it has implications for the cap weighted indexes.

You can complain about lack of Apple innovation if you like, but I personally prefer to keep an eye on the big price levels

You probably want to see these August 2022 prices hold up.

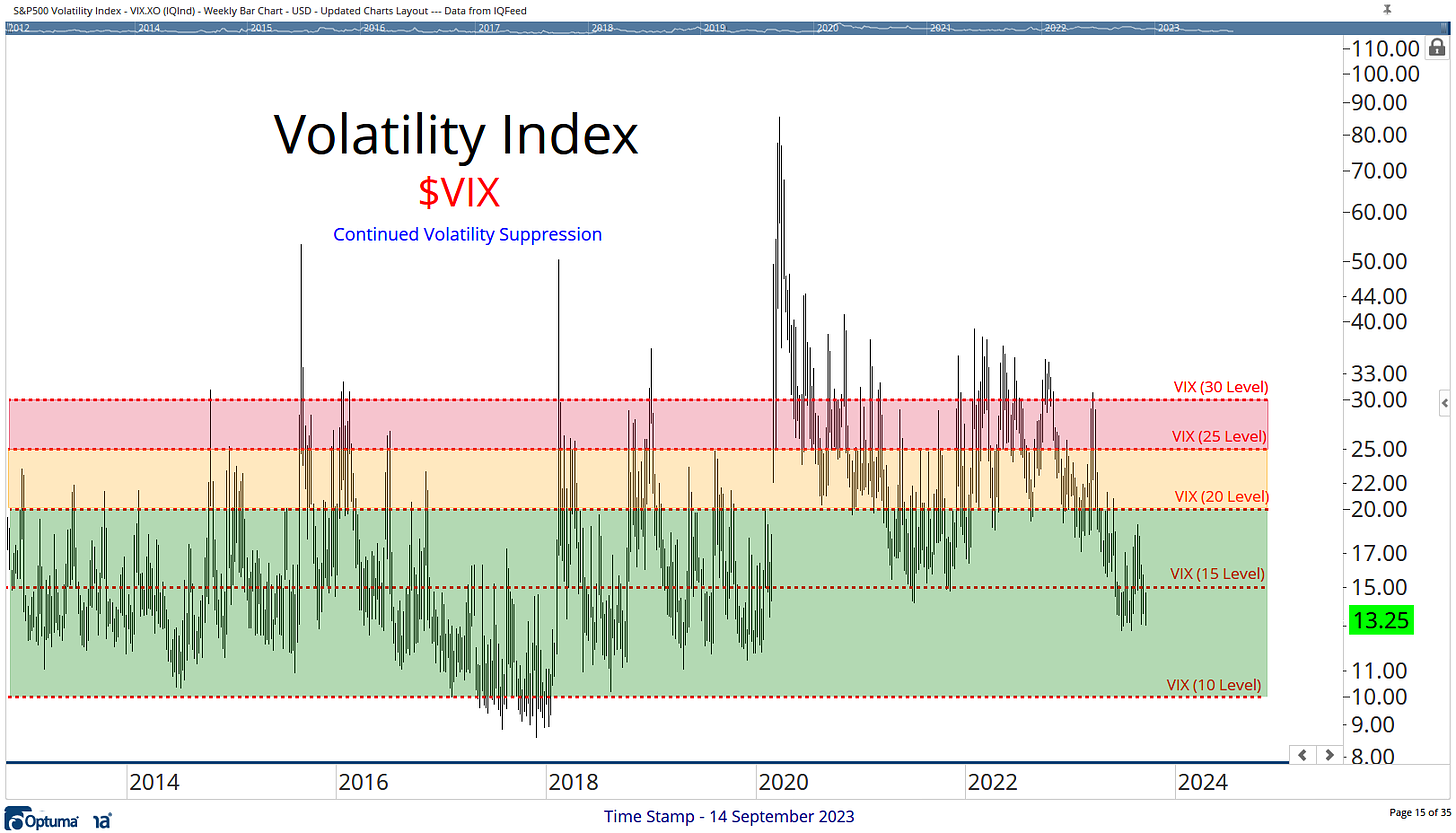

Volatility Index (VIX)

Volatility continues to be suppressed, which for me is actually very constructive.

At the index level, I think we can all agree it remains choppy, but despite all the negative sentiment there continues to be plenty of stocks doing well and plenty of dips in many stocks are perfectly buyable.

Energy markets are the obvious area of strength and if you follow my work closely you’ll already know I’ve been banging the drum on oil markets for 2 months already.

Not just Oil, the uranium stocks have been ripping too.

Cameco Corp (CCJ)

Cameco has been our play on the rip higher in Uranium stocks over the last month.

It’s been great. We have a target of $44, but it is near term over bought so a pull back is likely to kick in soon, the pull back may offer opportunity depending on how deep it goes.

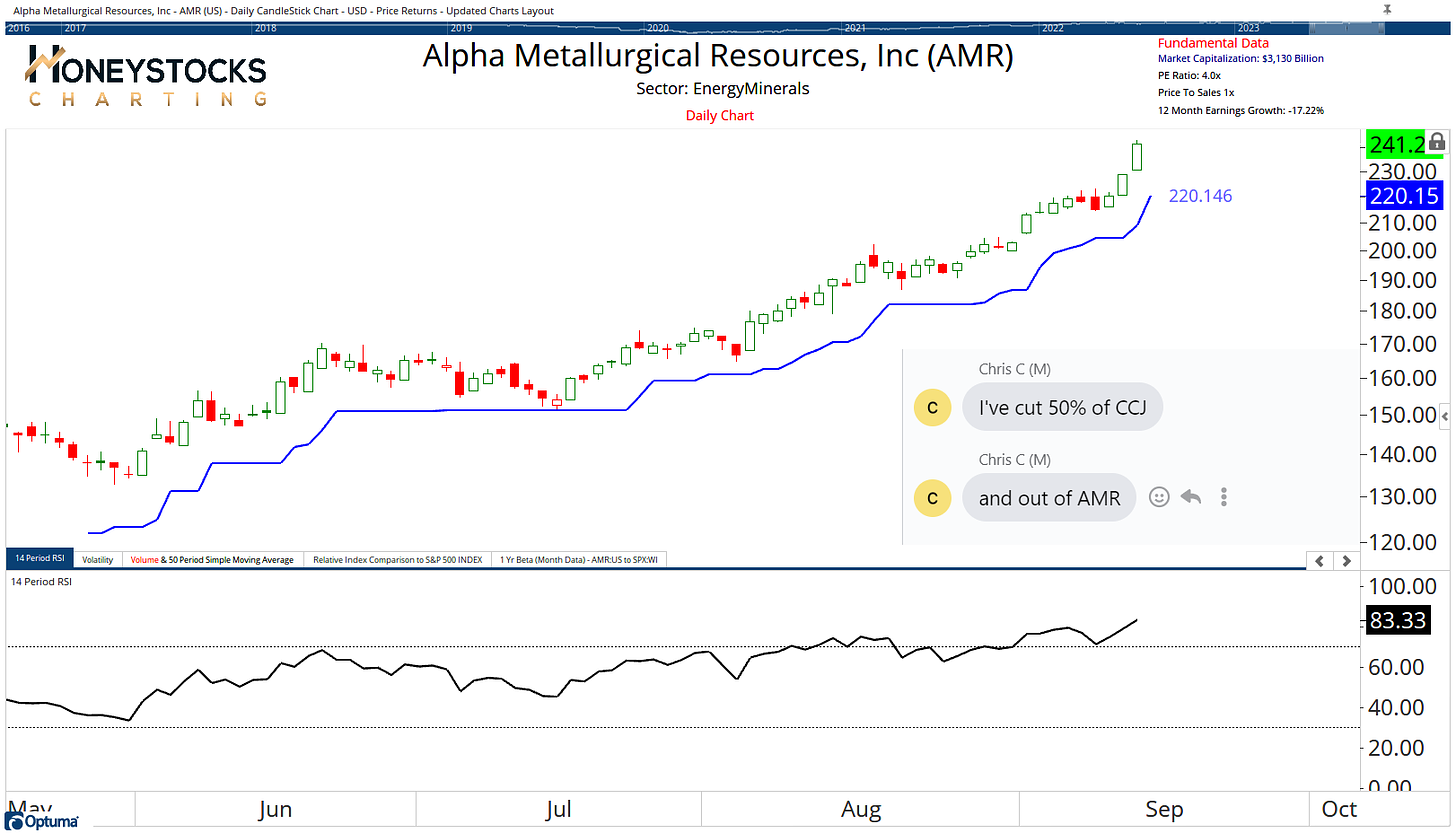

Alpha Meta Resources (AMR)

AMR has also been great.

The myth stocks aren’t going up just isn’t true and as September’s been running true to form so far, I believe the most unexpected thing the market can do from here is go up.

It’ll monumentally piss everyone off, which is why I think it’s also the most likely outcome, but if the market does sell off, I’m perfectly ok with that also, because I’m prepared for it.

A Side Note

A curious thing happened this week.

1 of my social media followers told me they were shocked to learn I don’t pay much attention to individual candlesticks within my work because apparently all the Chartered Market Technician’s (CMT’s) do.

30mins ago, another follower presented market breadth data on Twitter showing the market is currently being killed.

If you’re quite new to my work, it’s really geared towards removing ALL of the noise from all the conflicting data points and focussing purely on systematic investment process and logical price targets/levels.

I move through thousands of charts every week to identify the stocks going up for possible stocks to buy, and also the stocks going down for stocks to sell and I couldn’t care much for 2nd guessing what comes tomorrow after every Doji or Engulfing candlestick. I’d neve sleep if I worried about individual candles.

And I couldn’t care much for market breadth during/after a corrective phase.

If you pay too much attention to breadth and “healthy” markets, you’ll miss the best risk : reward propositions when it comes time to go long.

Last year, everyone told me I was an idiot when I started recommending TSLA, NVDA, META, AMZN, AAPL and every other juggernaut Tech name that ripped higher off their lows with the collapse of the US Dollar.

This tiny little letter called it to perfection last October - US Dollar Bullish Market Analysis

The relative strength CMT’s were telling everyone the market wasn’t healthy enough and the Economic doom-mongers scared everyone into oblivion.

There’s not a single analyst on planet earth I pay close attention to for this very reason.

I don’t believe anyone can offer me a “hot take” because I’m 1 of the very few who rips through the thousands of charts every week and I also happen to time stamp ALL of my work.

It’s the best (and only) way to do it and to do anything less isn’t going to cut the mustard in the market we currently find ourselves in.

Have a wonderful week everyone, stay safe out there because it’s not easy just now.

See you next week.