Welcome back to my weekly letter and thanks in advance for sharing my content with your friends, colleagues and social media followers, it really does mean a lot.

I’ll start this week by saying that I laid out my detailed market thesis in depth at the weekend via my YouTube channel, so if you missed that, it’s embedded below with around 20 top notch trade ideas.

But in this weeks letter I’ve kept it simple and laid out some of my favourite charts and a few trade ideas for your watch lists.

The May Outlook For US Stocks

If you subscribe beyond the paywall, you can expect some great charts and actionable trade ideas for your watchlists.

After the bottom call I made on China 3-4 months ago, I’m receiving a lot of requests from our clients asking if there are more legs left in the rally.

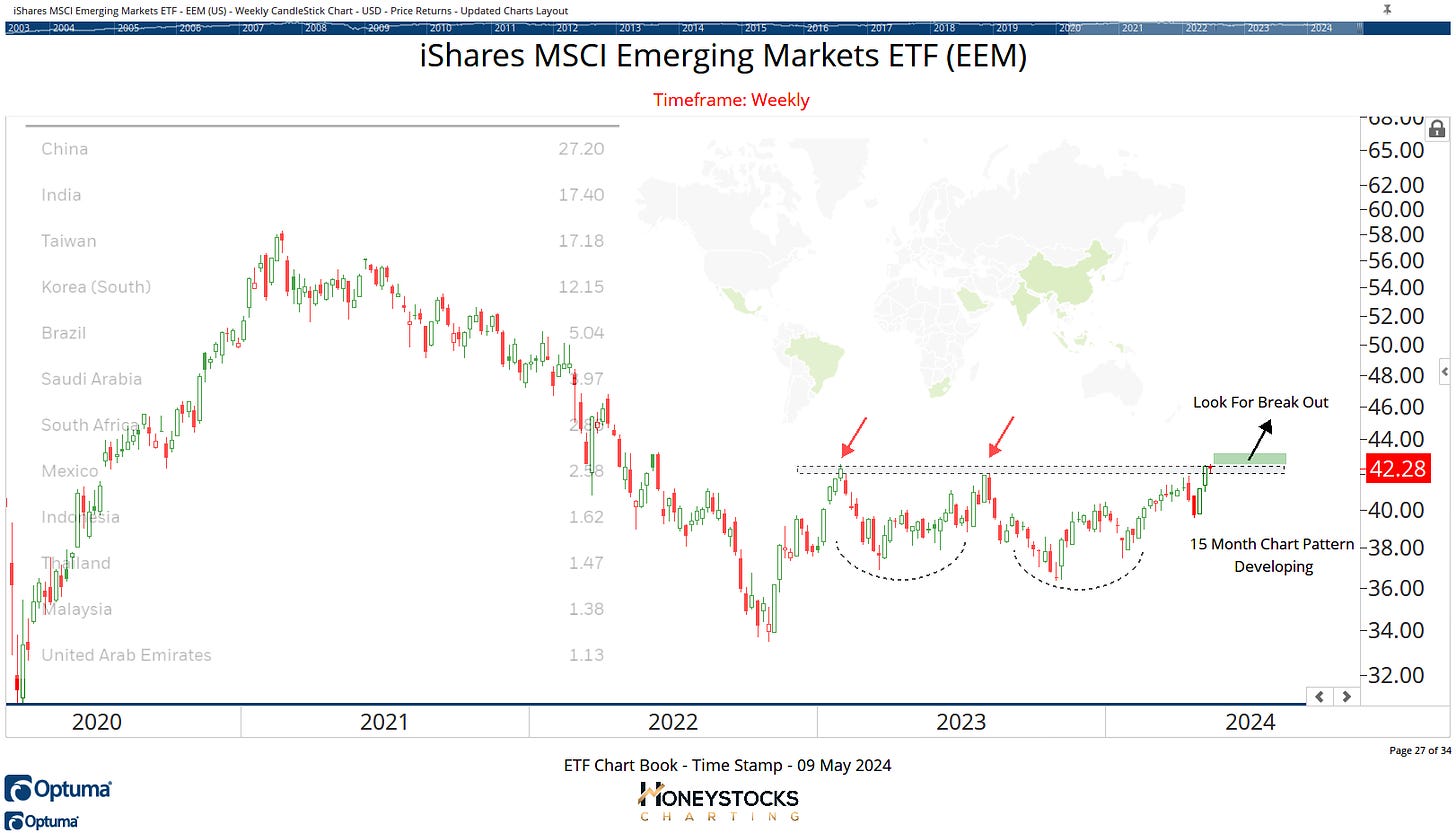

For me, the chart for Emerging Markets is going to drive a lot.

Emerging Markets ETF (EEM)

With anything that has exposure to China, and in this case 27%, there’s obviously a bunch of shenanigans to side step, but if we break out of the 15 month base, and the break out sticks the landing, is the chart just getting warmed up?

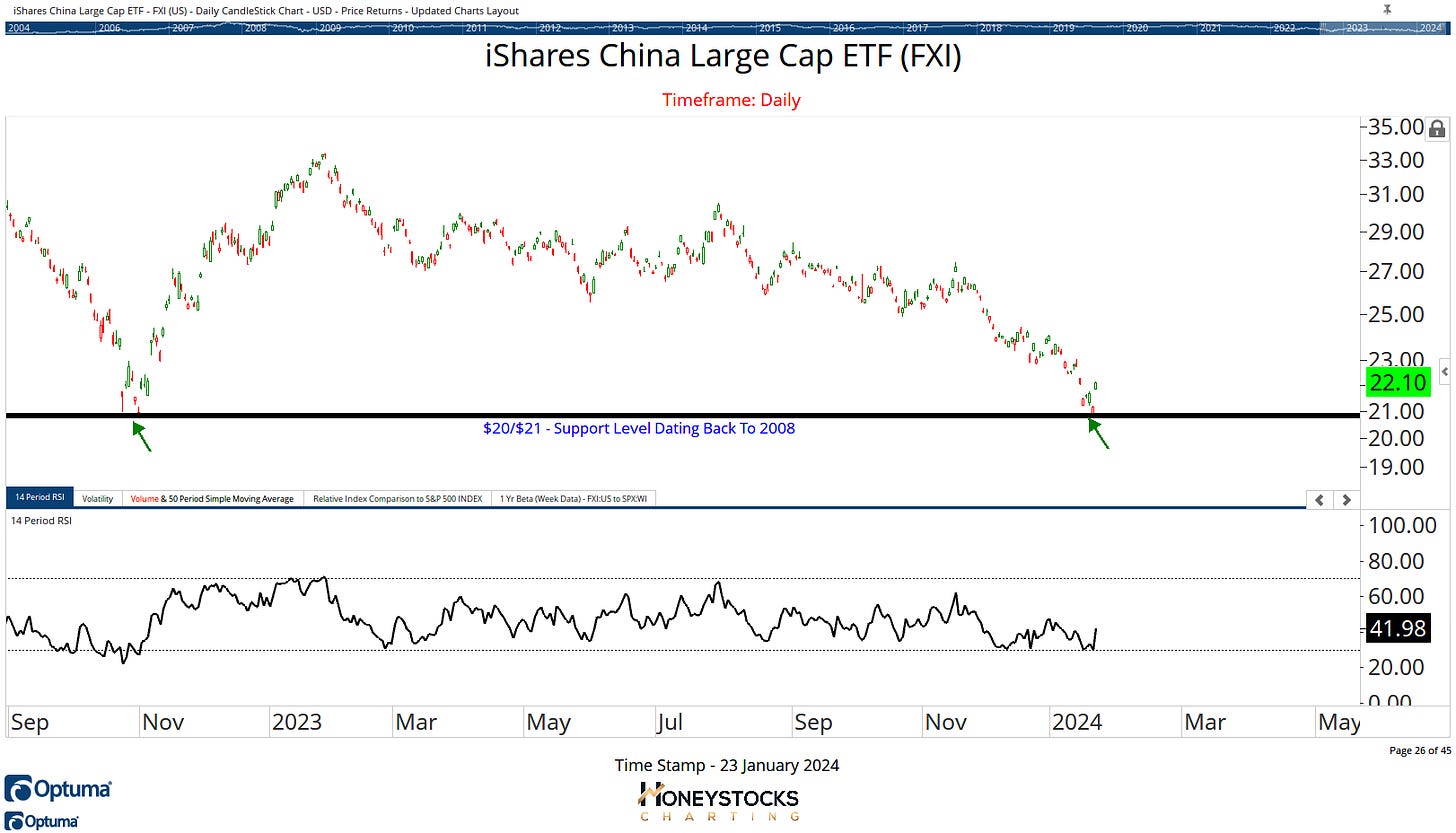

To be super clear though, I called the exact bottom in China back in January with the below chart, so our clients / members who wanted China exposure, got in a long time ago.

China Large Cap (FXI) - 23rd January Time Stamp

Micro Caps ETF (IWC)

If you follow my work closely, you’ll already know I’m waiting VERY patiently and watching for a risk on signal for the riskiest stocks in the US markets.

The micro caps are still trapped below those AVWAP levels from the Covid lows, with a solid out-performance so far in May, a break out above $120 would be a good risk on signal in my technical world.

Invesco QQQ Trust (QQQ)

With the NYSE Composite Index providing the tradeable bottom - I covered that on the 23rd April Letter - Is The Bottom In? and now that the Triple Q’s have rebounded, we’re now trading at the upper levels of the defined risk range.

With buy low : sell high charts, it’s natural to see some profit taking at these levels.

If we break out and confirm a break out above 450ish however (I’m sure we’d all prefer that), I think we’ve probably got another 10% upside.

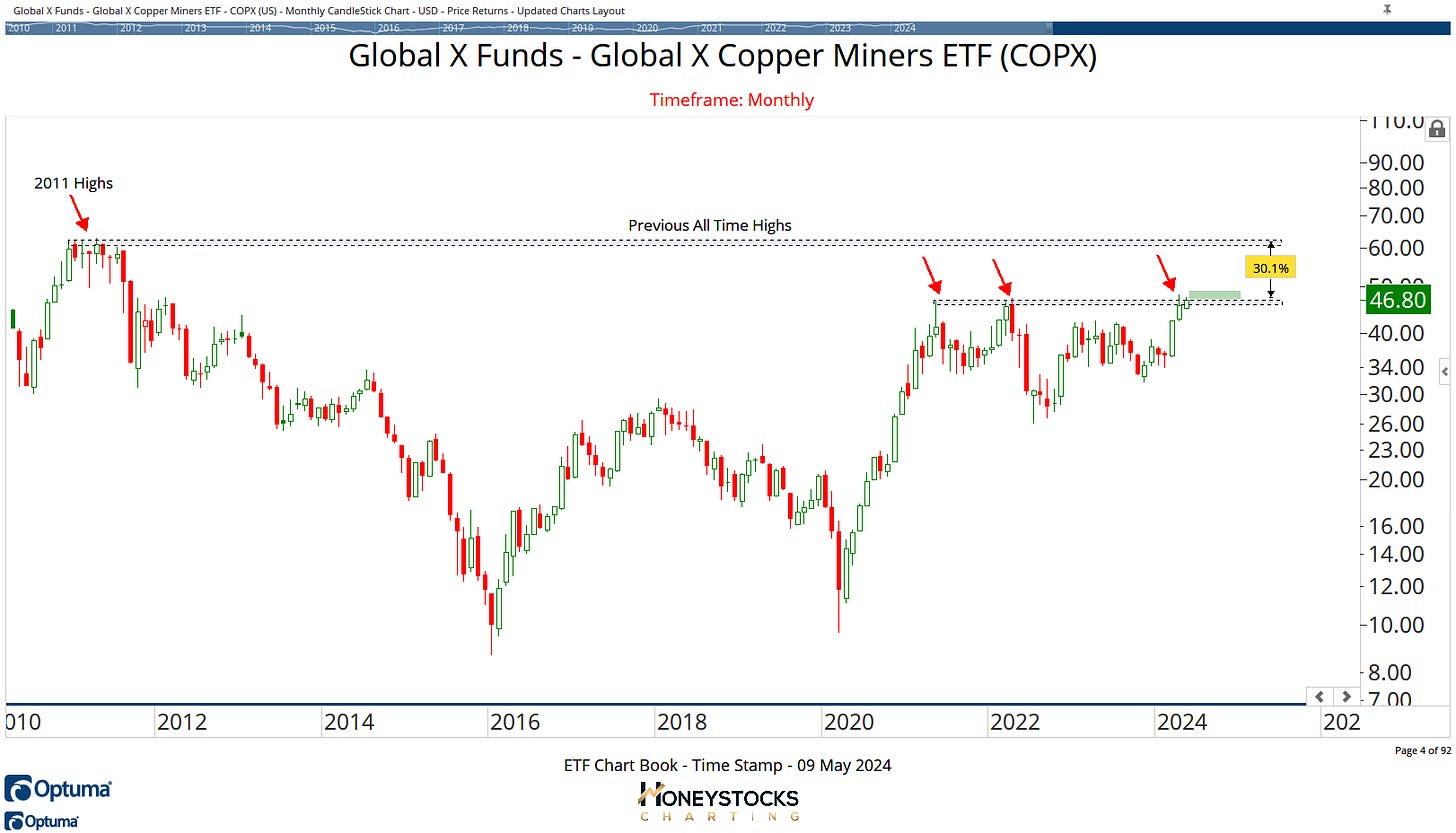

Copper Miners (COPX)

If you did well on the recent moves in Copper and specifically Southern Copper (SCCO), then I’m sure you’ll be watching this chart for a potential break out developing in the copper miners.

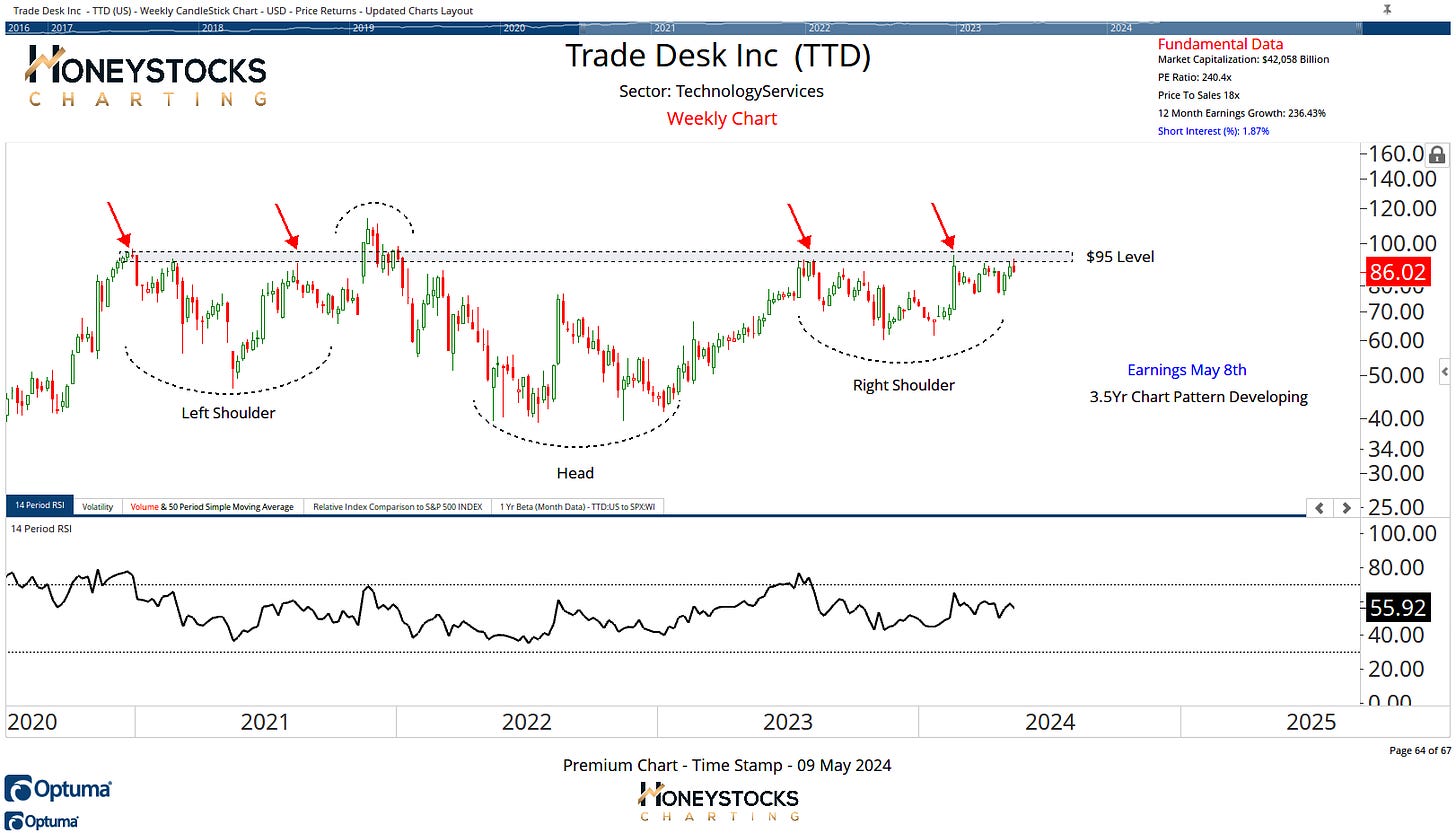

Trade Desk Inc (TTD)

Trade Desk reported earnings last night with some solid beats across most major metrics.

Obviously I’ve no clue how the price reaction will be today, but I think the chart is worth adding to your watchlists as per the technical chart setup.

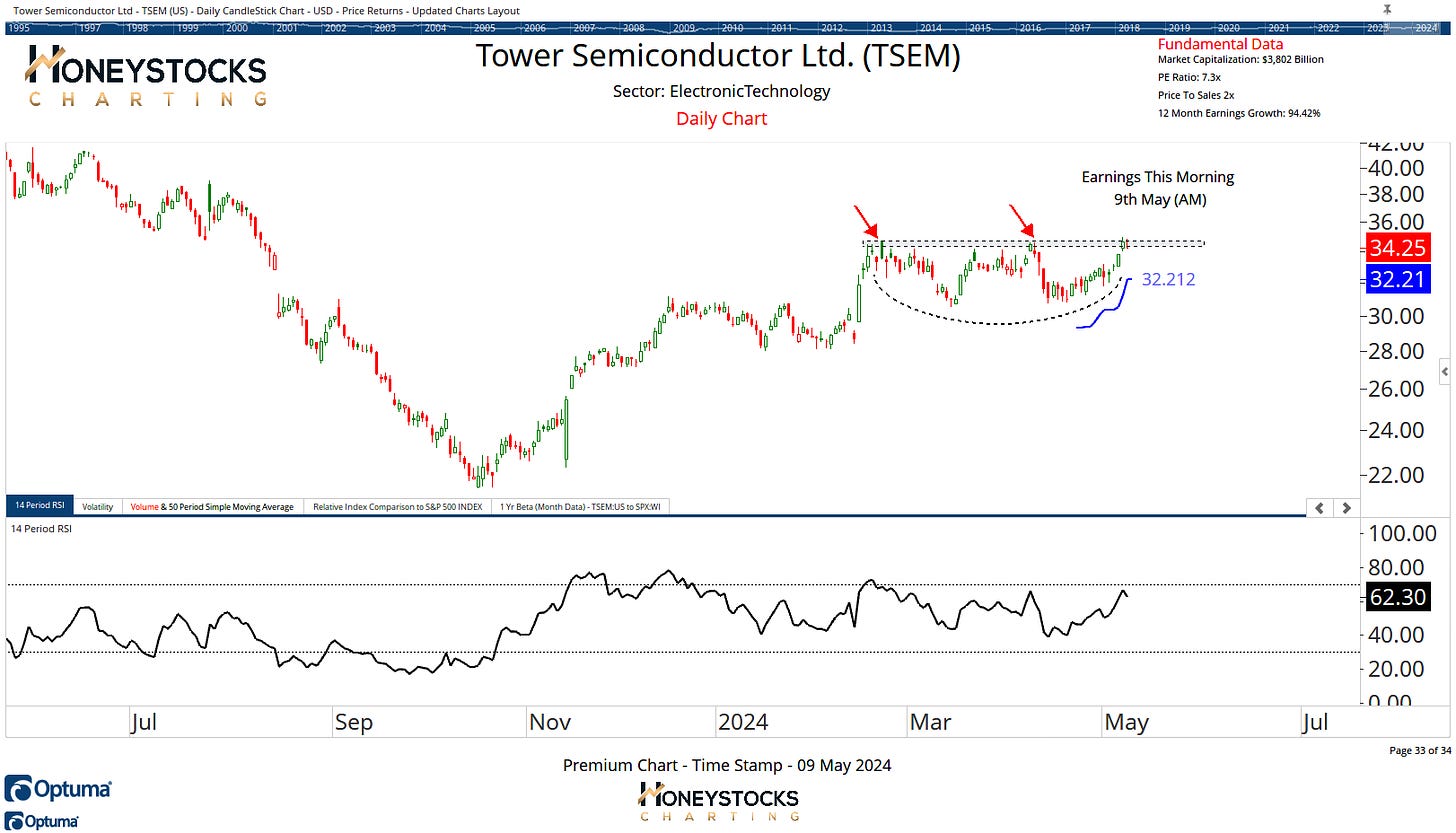

Tower Semiconductor (TSEM)

TSEM was 1 of the 6 premium trade ideas prepped yesterday for our members midweek half time analysis and it’s another chart I’ve added to our trade ideas chart book.

If you’d like to access those charts and all our chart books, as well as daily access to me, there’s a link below for you.

In the meantime, have a wonderful weekend and I’ll see you next week.

Access Our Premium Content & Chart Books