I’m sure we’ve all heard the old saying, be fearful when others are greedy and greedy when others are fearful…

That’s all good and well if you’re a long term investor who doesn’t manage risk, but if you’re someone who uses basic risk management process… how about this instead…

“Be greedy when others are greedy, and be greedy when others are fearful too”

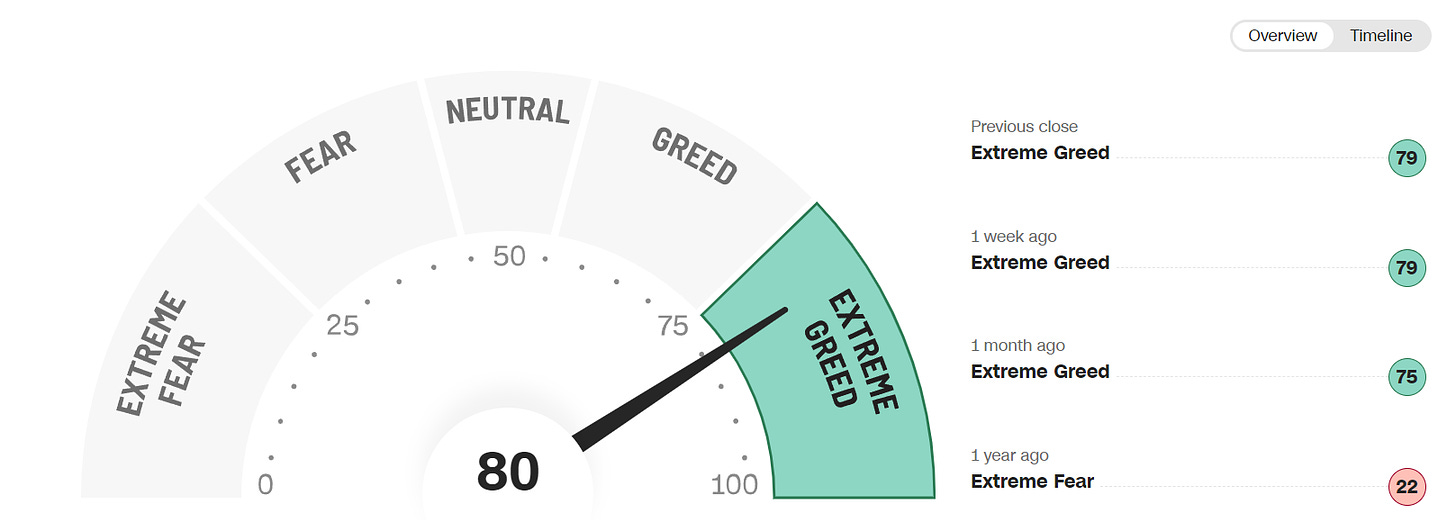

The Fear and Greed Index gets a lot more airtime that it probably should, but lets take a quick glance at it.

Fear and Greed Index

We’ve been sitting at extreme greed for a good few weeks now, so congrats to everyone else who’s been buying stocks since October last year, we’re now seeing everything ramp up and it seems like the market FOMO is kicking in.

It’s worth saying that I know the VIX will spike at some point, it always does, the question is, how high will it go when it does?

If you follow my work closely, you’ll already know over the last couple of weeks I’ve been working on the theme of rotation and I put some ETF’s and the Bitcoin chart to you last week.

This week, I’ll keep it brief/simple and share a few of our best charts from our subscribers ETF Chartbook.

Industrials (XLI)

I’m still being told (almost daily) it’s just 5 tech stocks leading the market, meanwhile Industrials are pushing against all time highs.

Is $110 the level here?

ARKK Innovation ETF (ARKK)

Aunty Cathie’s coming back into favour again and while the ARKK chart has been 1 of our buy low:sell high charts and it’s been great, very similar to last weeks ARKF analysis, I’m watching this closely for a break out on both an absolute and a relative basis.

It’s not there yet, but I’m watching.

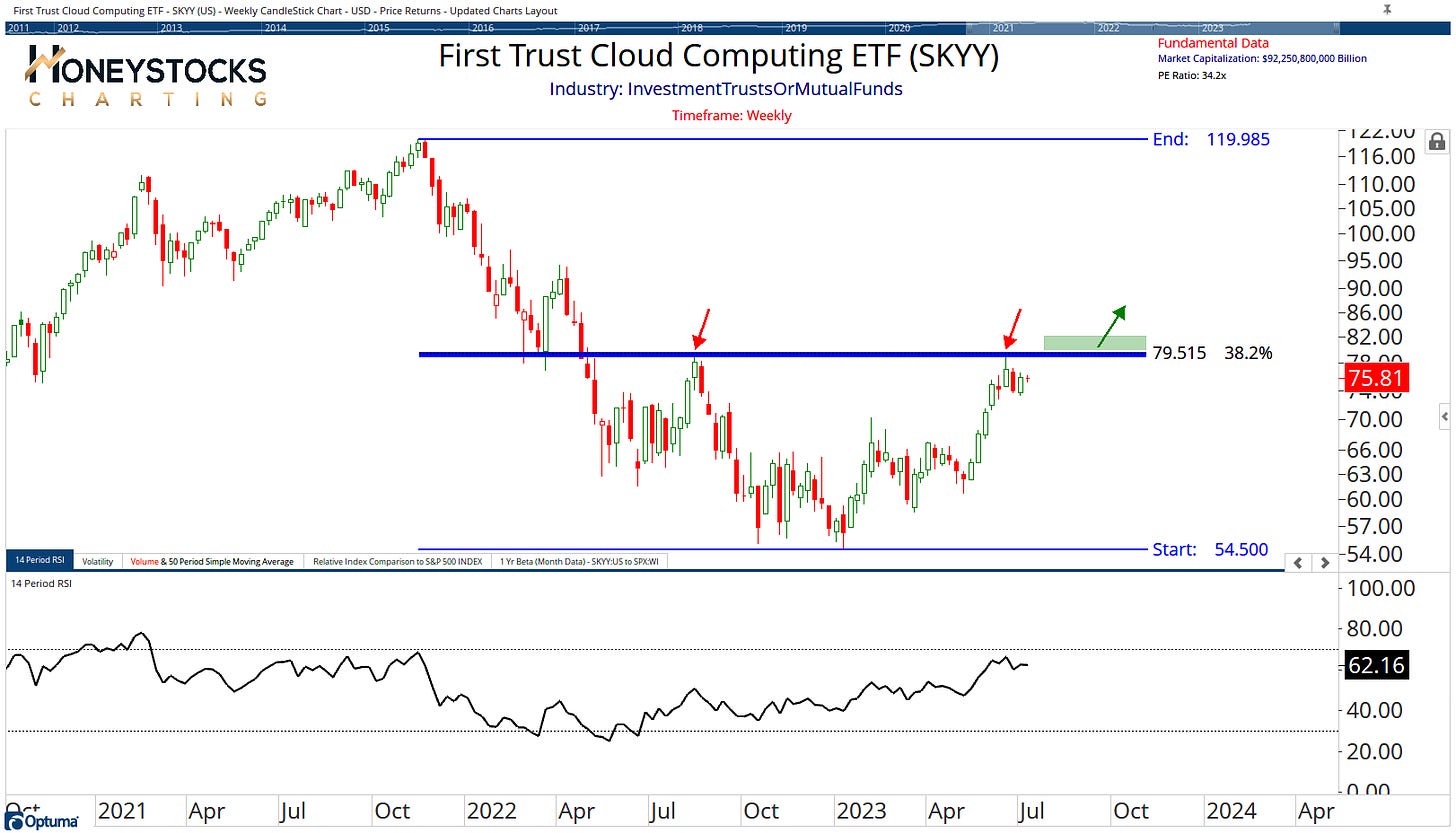

Cloud Computing ETF (SKYY)

Funny how Fibonacci works… above $80, what’s not to like?

I also laid out a BUNCH more charts in via our YouTube Channel at the weekend.

In Conclusion

Sentiment data I always take with a pinch of salt.

Whether we go up, down, sideways, to the moon or to the pits of Mordor is really immaterial to me because I firmly believe in the concept of risk management.

The biggest headaches I’ve seen over the years for investors all across the world, always occur when there’s no plan of action for dealing with a corrective phase.

Always have a plan.

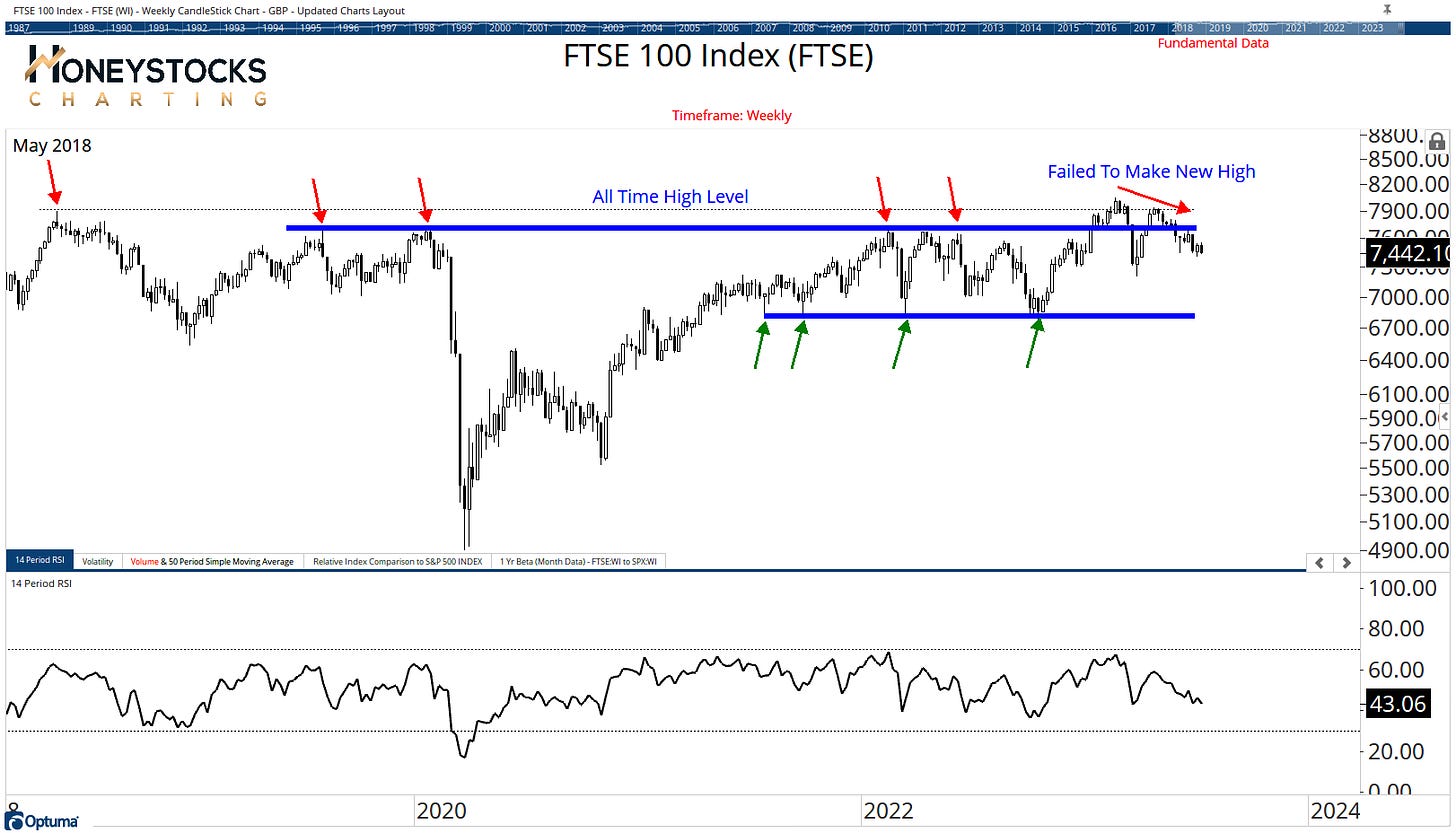

I always remain open to all outcomes and this time is no different, I know the market could switch on 30secs notice, I see some cracks in Europe,

FTSE 100 Index (UK)

Although the UK is on the decline, I’m not currently seeing that filter into the US Markets (yet), so I’m still looking for the best charts and the best stocks to buy, and that includes MANY beaten up names that I hope to see catch a bid over the coming weeks.

Have a great weekend everyone.

Our 4th July Flash Sale still had a couple of days left, so feel free to check that out at link below.

If you find value from my work, please consider forwarding to your friends and subscribing.

Click Below to get all of our best charts and alerts in real-time.