I keep hearing the market’s on life support, but with a few days left in June, it’s looking like another really terrific month that’s rewarded investors yet again for buying stocks.

I hope everyone’s done well.

With June almost in the books, I’m continuing to keep a close eye on many of the possible rotations (and possible rebound levels) developing out there so in this weeks letter, whilst I know many would like me to cover Tech again, I don’t see the point in going over old ground.

If you’re interested in my thoughts on Technology stocks - please do check out my letters over the last 2 weeks.

I laid it all out before the fact - 15th June Letter - “Nearing Big Tech Exhaustion”

In this weeks letter, I’m just going to get into some areas of the market I currently find interesting, so lets just get into it.

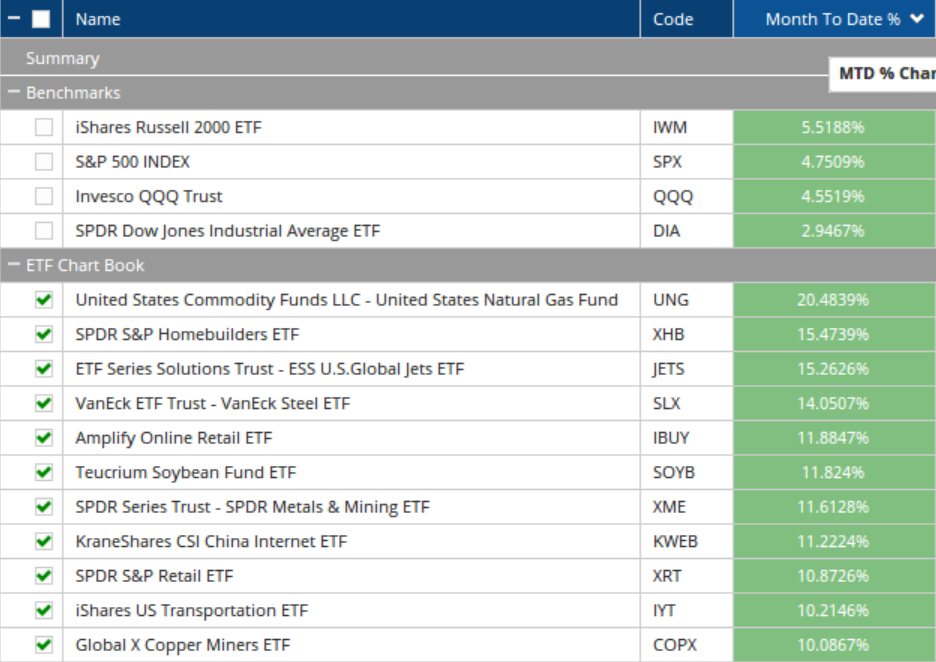

June - Month to Date

Something I tend to notice much more than most, is when the market decides to move out of 1 area and into another.

From the 10 ETF’s above, do you also notice less growth and more value?

When 1 area goes down, another area tends to go up, I don’t make up the rules, that’s just how investor behaviour (price) works.

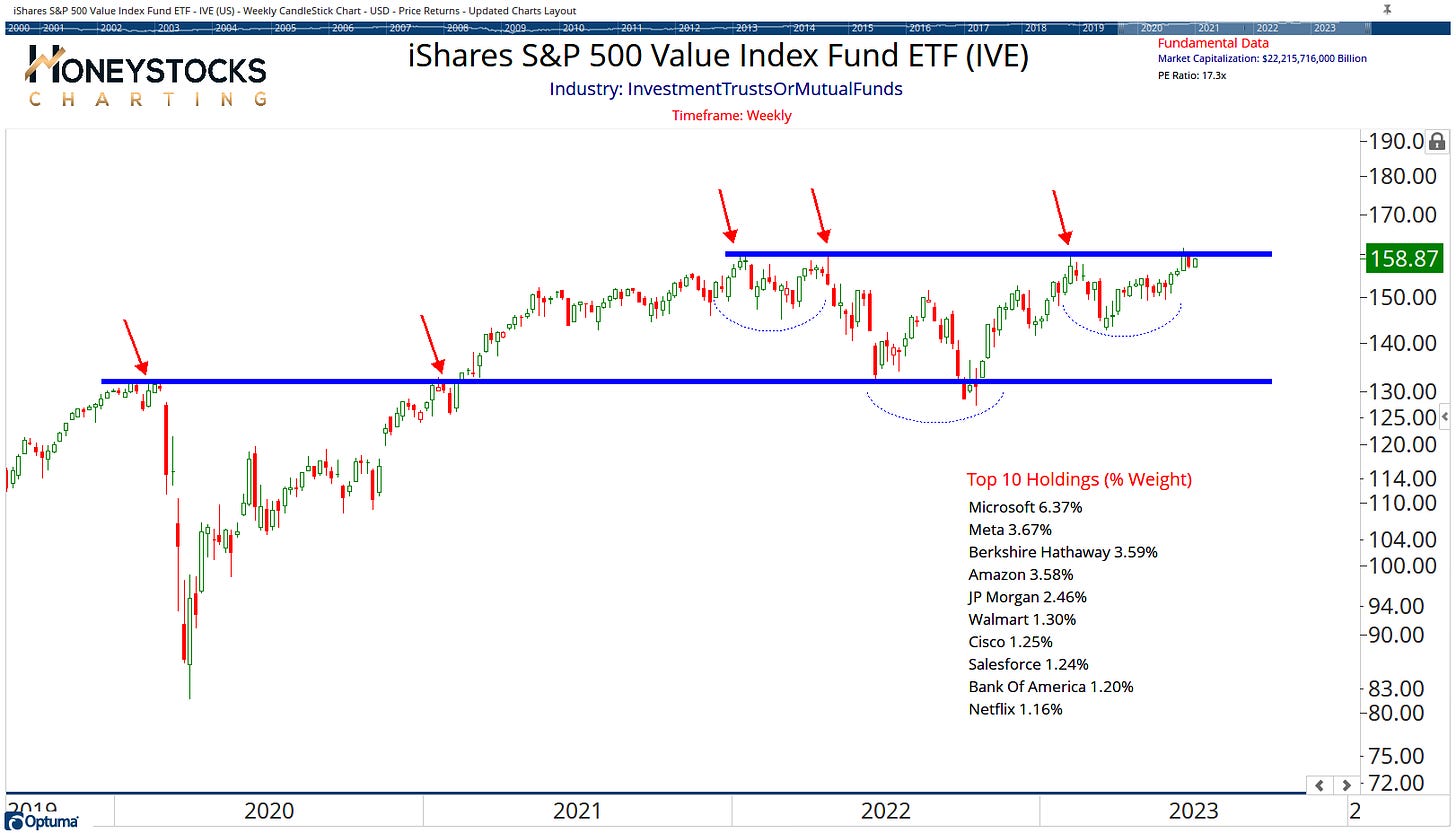

S&P500 Value ETF (IVE)

The S&P500 Value ETF, which as you can see has a fair amount of technology exposure, is on the cusp of breaking out to new all time highs, and this is information I want to pay attention to.

ARK Fintech Innovation ETF (ARKF)

Or how about Auntie Cathie and her Fintech ETF?

She’s taken a lot of flak over the last couple of years, but with the out-performance in growth over value this year, there’s probably a comeback story in there somewhere.

A break out on both an absolute and a relative basis, what’s not to like?

Social Media (SOCL)

We’re seeing charts like this setting up absolutely everywhere just now.

If Social Media is above $39 and breaking out on a relative basis, again, what’s not to like?

Bitcoin

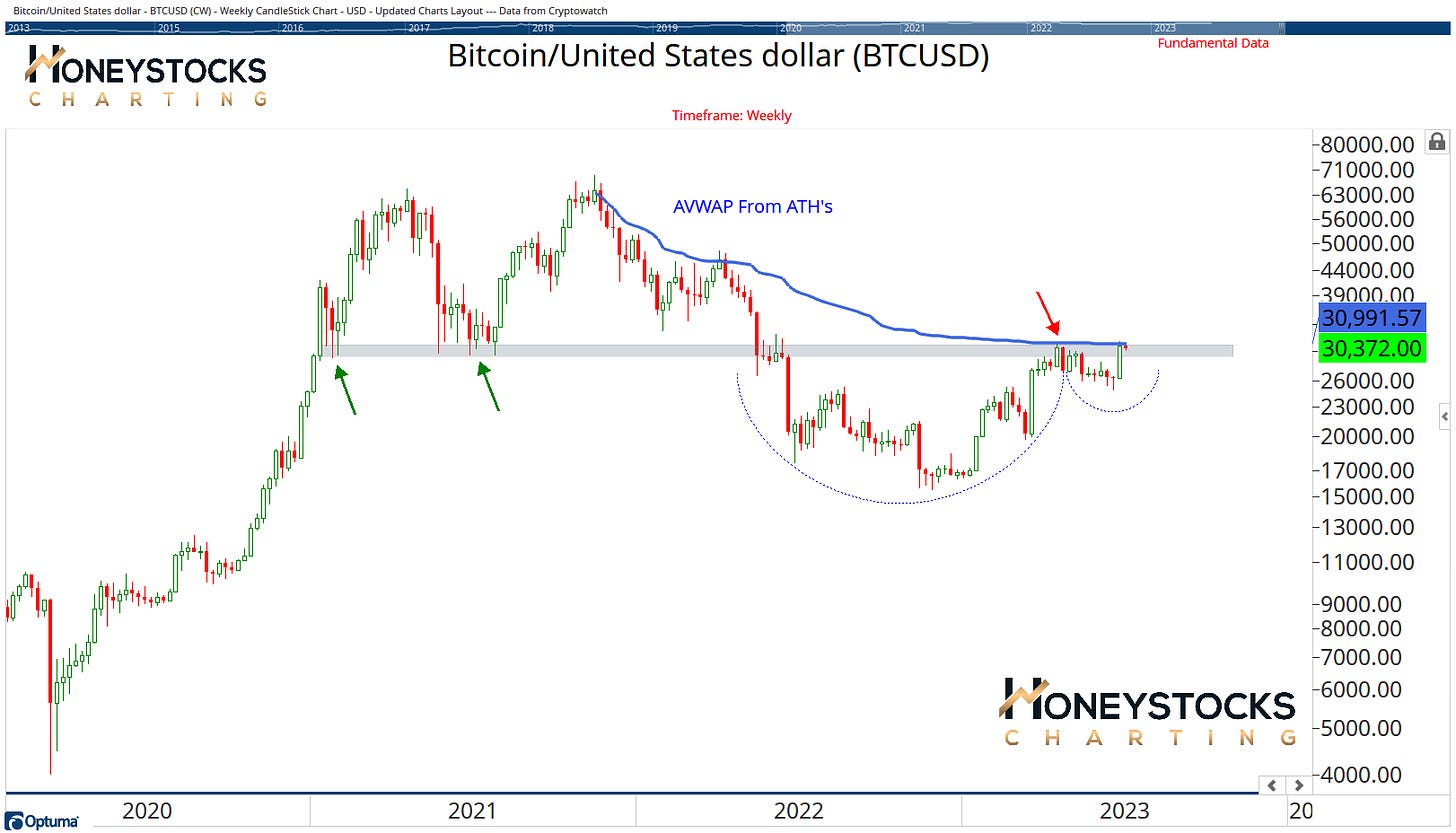

Let me be clear about my thoughts on Bitcoin and crypto in general.

I don’t buy it and I don’t like it and I couldn’t care less if Blackrock are getting involved.

I much prefer sleeping soundly at night.

That said, I do of course have many professional clients and members who want my thoughts on Bitcoin on a weekly basis, and this is the chart I’m working with just now.

Maybe that $31k-32k level offers something?

In Conclusion

I keep hearing it’s just 5 stocks driving the market performance this year, and if you’re hearing it too, you should pay close attention to who you’re listening to.

These folks continue to be downright lazy and just aren’t putting in the hard yards.

It take a special kind of economic analyst to tell everyone else they’re wrong, and to continually push out confirmation biased narratives when stocks have offered the returns of a lifetime this year.

Thankfully I like to pay attention to price, because it’s the only data that matters.

If the market crashes / corrects tomorrow, next week, next month or next year, it’s not a problem, that’s why we manage risk around here.

I’ll be laying out a playbook in our midweek Half Time Analysis this evening for our clients and members so feel free to check our membership options below if you’d like to access that.

Have a great week.

If you find value from my work, please consider forwarding to your friends and subscribing.

Click Below to get all of our best charts and alerts in real-time.